While Governor proposes cuts to taxes and regulation

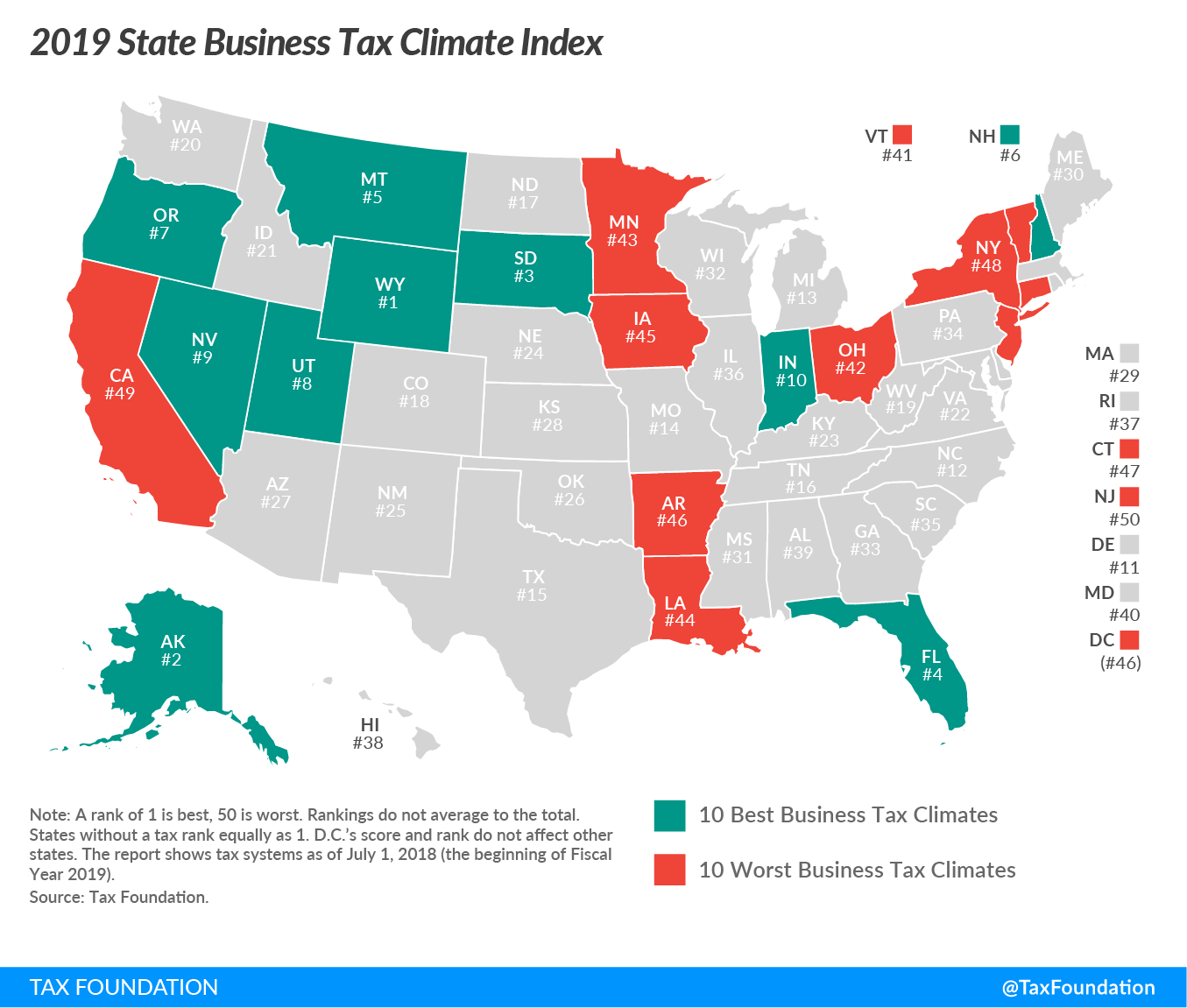

Florida has the fourth best business tax climate in the nation according to the latest annual report from the Tax Foundation. The State Business Tax Climate Index compares each of the 50 states based on how well their tax system works.

The Index looks at more than 100 variables within the primary methods of taxation: corporate taxes, individual income taxes, sales taxes, property taxes, and unemployment insurance taxes.

Florida trailed behind Wyoming (1), Alaska (2), and South Dakota (3). Montana, New Hampshire, Oregon, Utah, Nevada, and Indiana respectively rounded-out the Top 10 states. The Index is designed to show how well states structure their tax systems and provides a road map for improvement.

Florida ranked #1 for individual income tax (we have none), #2 for unemployment insurance tax, #6 for corporate tax, #11 for property tax, and #22 for sales tax.

The 10 lowest-ranked, or worst states in this year’s Index include New York (48), California (49), and New Jersey (50).

Governor DeSantis, in his proposed $91.3 billion state budget for fiscal year 2019/2020 released this past Friday, calls for a $335 million tax cut. It includes a $290 million reduction in the “Required Local Effort” – the amount of tax revenue the state mandates that local governments raise each year to contribute to public education funding.

Governor DeSantis, in his proposed $91.3 billion state budget for fiscal year 2019/2020 released this past Friday, calls for a $335 million tax cut. It includes a $290 million reduction in the “Required Local Effort” – the amount of tax revenue the state mandates that local governments raise each year to contribute to public education funding.

Governor DeSantis is also tackling the other nemesis of commerce: regulation. He and some of his top lieutenants held a one-day “Deregathon” in Orlando with the state’s 23 professional licensing boards to identify harmful regulation. The Governor called for “bold and appropriate deregulation” that protects consumers but doesn’t put up unnecessary roadblocks for people, especially those running small businesses, to succeed.

The licensing boards are tasked with reviewing currents rules and regulations for their particular industry and identifying proposed changes.