Recovery steady with declining rates, say regulators

The Florida Office of Insurance Regulation (OIR) has gone from “optimistic” in January to “confident” today about the impact of the 2019-2023 property insurance reforms passed by the Florida legislature and the positive developments in the market. That’s the conclusion of OIR’s latest Property Insurance Stability Report, released last week. Among its reasons: a continued decline in insurance litigation and associated costs, declining rates, speedier claims resolution, a respite from rising reinsurance costs, new carriers entering the market, and a return to insurance companies’ profitability and stability.

The Florida Office of Insurance Regulation (OIR) has gone from “optimistic” in January to “confident” today about the impact of the 2019-2023 property insurance reforms passed by the Florida legislature and the positive developments in the market. That’s the conclusion of OIR’s latest Property Insurance Stability Report, released last week. Among its reasons: a continued decline in insurance litigation and associated costs, declining rates, speedier claims resolution, a respite from rising reinsurance costs, new carriers entering the market, and a return to insurance companies’ profitability and stability.

New since OIR’s January 2025 report:

- The average defense cost and containment expenses per claim decreased from $992.89 in 2022 to $817.64 in 2024 (see the detailed chart on page 4).

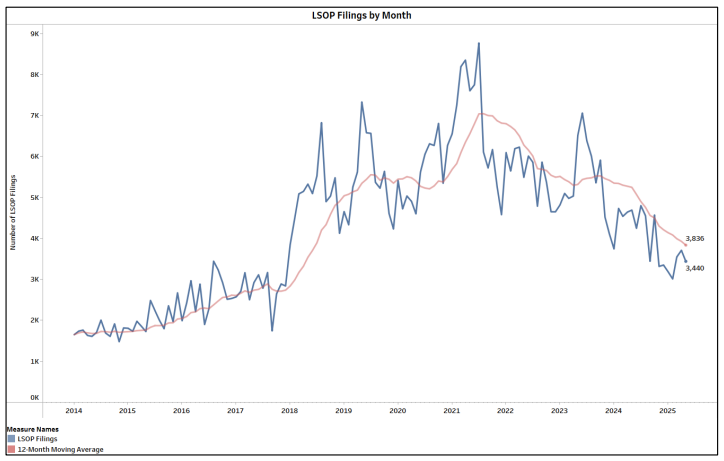

- The number of claims lawsuits, as represented by Personal Residential Legal Service of Process (LSOP) filings, continues to decline. It dropped 23% in 2024 from the year prior, and in the first six months of 2025 was down nearly 25% compared with the same period last year, with a 12-month moving average now of 3,836 filings. “We have been seeing consistent year-over-year decreases since the peak in 2021,” wrote OIR. The number of LSOP filings with Assignment of Benefits (AOB) agreements has now declined to below pre-2014 levels.

Source: Florida Office of Insurance Regulation, July 2025

- Notice of Intent to Litigate (NOITL) fillings likewise continue their decline in the 12-month moving average, despite a jump in the actual number of filings this past winter. The same applies to filings of Civil Remedy Notices.

- OIR’s Property Claims and Litigation Data Call, performed each January, is specific to Florida and tracks the entire life cycle of a claim. Collecting data related to the life cycle of a claim assists OIR in detecting and resolving any emerging issues in the claims experience process. There were 698,742 reported claims closed in 2024. That was about 40,000 more closed claims than in 2023, yet there were 4,000 fewer litigated claims. As a result, the percentage of claims going to litigation was 8.62%, down from 9.73% in 2023.

- The average number of days for insurance companies to close a claim improved in 2024 to 57 days (down from 77 days in 2023). The report contains detailed charts on the types of claims and the number of days to close them (pages 10-12).

- The total cost of indemnity paid for claims closed in 2024 was $15 billion (down from $15.3 billion in 2023). While the total loss adjustment expenses (LAE) paid for closed claims remained steady at $1.9 billion, the average LAE paid for litigated claims increased (from $10,543 in 2023 to 12,701 in 2024), while the average LAE paid for non-litigated claims fell (from $2,011 in 2023 to $1,778 in 2024).

- The state-created Citizens Property Insurance Corporation’s successful depopulation effort in 2024 into 2025 has made a difference in returning policies to the private market, with Citizens as of March now representing just 9% of the homeowners multi-peril policies (down from 16.7% last September) and 74.5% of the wind-only homeowners policies (down from nearly 80%).

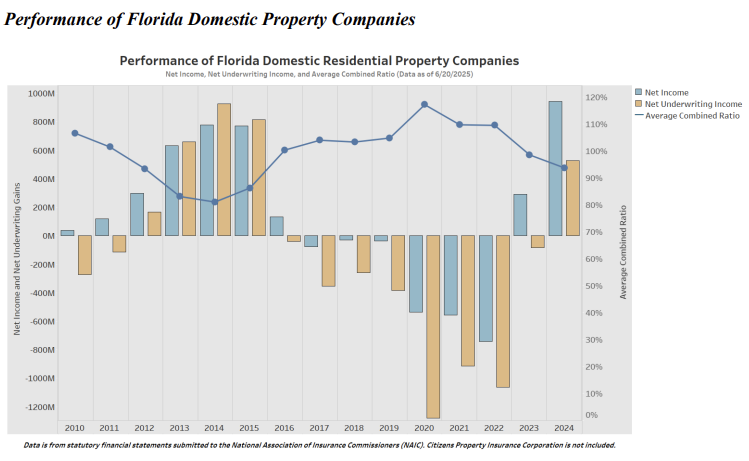

The report also tracks the financial performance of Florida’s domestic property insurers, including net underwriting gains (how much an insurance company has either made or lost from its operations), net income, and average combined ratio, per the chart below, which contains updated 2024 data.

Source: Florida Office of Insurance Regulation, July 2025

Property insurance rates are going down as a result. “Rate filings for 2024 showed a slight downward trend for the first time in years, indicating stabilization of the property insurance market,” according to the report. That downward rate trend has continued into 2025. For residential policies effective in 2024 or later, 27 companies have requested a rate decrease, and 41 companies have requested a 0% rate change. The report also includes (page 17) the average premiums charged for homeowners’ and condominium unit owners’ insurance in each of Florida’s 67 counties as of March 31, 2025.

Fourteen new companies have been approved to write residential policies since the reforms, offering greater consumer choice – with an additional company recapitalized and back in the market.

On its annual reinsurance data call, OIR noted that insurance companies writing Florida polices saw an average 1.7% decrease in risk-adjusted reinsurance costs in 2024 over 2023. “Preliminary 2025 data suggests price stabilization with anticipated flat risk adjusted reinsurance costs from 2024, on average. Initial data signifies a strengthening reinsurance market, despite multiple hurricanes making Florida landfall during the 2024 Atlantic hurricane season signifying confidence in the Florida property market post reforms,” writes OIR.

Between January 1 through June 19, 2025, OIR reports 16 insurance companies were referred to the Insurer Stability Unit for enhanced monitoring for various concerns, including exceeding writing ratio limitations and failing to file timely financial statements. Only one of those companies was deemed appropriate to actually add to the enhanced monitoring list of companies, which now number 17, down from the 20 on the list in the January report.