Plus, new rules and ideas for change

Florida homeowners insurance rate hikes are outpacing any in the nation, how actual cash value roof policies could lower premiums, the new insurer accountability act is now law, regulators release the new catastrophe reporting form, plus a claims adjuster is arrested for fraud. It’s all in this week’s Property Insurance News.

Florida homeowners insurance rate hikes are outpacing any in the nation, how actual cash value roof policies could lower premiums, the new insurer accountability act is now law, regulators release the new catastrophe reporting form, plus a claims adjuster is arrested for fraud. It’s all in this week’s Property Insurance News.

Homeowners Insurance: Not only do we have the highest average premiums of any state but Florida’s home insurance rates rising faster than any state, nearly triple U.S. average, reads the Miami Herald headline. LexisNexis Risk Solutions reports costs here have risen about 57% since 2015, nearly triple the national average of 21%. More hurricane damage, inflation in building materials and labor costs, higher interest rates, and of course, much higher insurance litigation and fraud costs are the factors driving this. The average wind damage claim cost to insurance companies since 2010 has doubled nationally, tripled here in Florida, and quadrupled in the Miami metro area, according to the report.

Homeowners Insurance: Not only do we have the highest average premiums of any state but Florida’s home insurance rates rising faster than any state, nearly triple U.S. average, reads the Miami Herald headline. LexisNexis Risk Solutions reports costs here have risen about 57% since 2015, nearly triple the national average of 21%. More hurricane damage, inflation in building materials and labor costs, higher interest rates, and of course, much higher insurance litigation and fraud costs are the factors driving this. The average wind damage claim cost to insurance companies since 2010 has doubled nationally, tripled here in Florida, and quadrupled in the Miami metro area, according to the report.

Cash Value for Roofs: One solution to drive down insurance costs and homeowners premiums, is to move from the current replacement cost value to actual cash value (ACV) for roof coverage in standard insurance policies. I argue in this recent Insurance Journal Viewpoint that doing so is a fairer and simpler way to pay roof claims as well. It’s a counterpoint to independent adjuster Ben Mandell who suggests that stated value endorsements of $5,000 or $10,000 is the way to go.

New Rules on Insurance Companies: Governor DeSantis has signed SB 7052, the Insurer Accountability Act into law, effective July 1, 2023. It’s intended to increase the accountability and transparency of insurance companies with regulators and consumers. The major provisions cover regulation, claims handling, insurance coverage, and rates. It followed sweeping civil remedies reform signed into law to reduce excessive litigation and claims costs on insurance companies.

New Rules on Insurance Companies: Governor DeSantis has signed SB 7052, the Insurer Accountability Act into law, effective July 1, 2023. It’s intended to increase the accountability and transparency of insurance companies with regulators and consumers. The major provisions cover regulation, claims handling, insurance coverage, and rates. It followed sweeping civil remedies reform signed into law to reduce excessive litigation and claims costs on insurance companies.

New Cat Form: The Office of Insurance Regulation (OIR) has released the 2023 Catastrophe Reporting Form for insurance companies as part of required data call reporting after hurricanes and other major events. It has also included this list of Frequently Asked Questions. Companies upload the requested information via the Insurance Regulation Filing System (IRFS) at specified time intervals as determined by OIR.

New Cat Form: The Office of Insurance Regulation (OIR) has released the 2023 Catastrophe Reporting Form for insurance companies as part of required data call reporting after hurricanes and other major events. It has also included this list of Frequently Asked Questions. Companies upload the requested information via the Insurance Regulation Filing System (IRFS) at specified time intervals as determined by OIR.

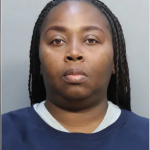

Kiyuana Pasley mugshot. Courtesy, Miami-Dade County

Adjuster Busted: A former automobile claims adjuster for Progressive Insurance was arrested in late May for submitting 11 bogus Personal Injury Protection (PIP) claims on behalf of policyholders and pocketing nearly $24,000 in claim payouts for herself. The Department of Financial Services (DFS) reports Kiyuana Pasley of Homestead “added false information to the claims regarding bodily injury, deductibles, and wage loss payments, before diverting the claim funds to her personal bank accounts,” without the knowledge of the policyholders. The two-year employee resigned from Progressive after the company discovered the scheme and tipped-off DFS. Pasley is charged with 11 counts of insurance fraud, 11 counts of grand theft, and one count of organized fraud.

LMA Newsletter of 6-12-23