Doing nothing not an option

Senator Jim Boyd. Courtesy, The Florida Channel

The Florida Legislature was in Tallahassee over the past two weeks to begin a staggered six-week series of legislative committee meetings in preparation for the start of the 2024 session on January 9. But it appears further property insurance reform is not going to be on the agenda. Senate Banking and Insurance Committee Chairman Jim Boyd (R-Bradenton) commented that this past spring’s legislative session accomplished a lot and that he doesn’t see “any additional big-deal things that we can do” in the upcoming 2024 session.

Appearing before Senator Boyd’s committee and its House subcommittee counterpart was Florida Insurance Commissioner Mike Yaworsky. He said that without the past reforms, “I think it would’ve been absolutely devastating for Florida’s insurance market.” The big question everyone was asking was “When are homeowners insurance rates going to go down?”

Florida Insurance Commissioner Michael Yaworsky. Courtesy, The Florida Channel

Yaworsky stressed that it will take time for the reforms to have a measurable impact on premiums. He said one reason is that claims dispute litigation that was already “in the system” prior to the reforms is governed by the previous laws, including one-way attorney fees. Therefore, those claims can be viewed as artificially skewing the effectiveness of the changes to be anticipated under the new laws. There is also an inherent delay because some policyholders will have to wait for policy renewal to have the new laws impact their premiums. He credited the reforms for bringing a more moderate 27% increase in reinsurance costs by the private market this past summer versus the anticipated 50% to 60% increases.

Commissioner Yaworsky also said that if not for inflation, rates would be lower. One Senator asked him why he can’t just cap rate increases at an arbitrary number. Yaworsky said doing so would cause carriers to leave the state. He reminded legislators that the rate setting process is intended to ensure each carrier is actuarially sound, and rate caps make that impossible.

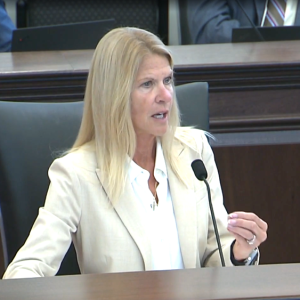

Senator Debbie Mayfield. Courtesy, The Florida Channel

Senator Debbie Mayfield (R-Melbourne) cited property insurance and concerns about it as the number one constituent issue in her district. That’s the same sentiment we’ve heard in our conversations with several legislators, so it is very puzzling that Chairman Boyd would say we’re not going to do anything more. We are hopeful that that was a misunderstanding in his conversation with the news media. In our opinion, doing nothing is not an option. While we don’t have all the answers in my firm, I have been on a listening tour with many stakeholders. First of all, we know that rates are not going to come down because of inflation, weather, litigation, and reinsurance costs. We disagree with recent news coverage. Some refuse to recognize the documented truth that excessive litigation has been and will continue to be – until the excess of Hurricane Irma and Ian claims are resolved – a huge cost driver. They don’t truly understand the market and do a disservice to insurance consumers who must pay the price through higher premiums.

So the goal is to slow rate increases. The commissioner has done an incredible job trying to calm the market and consumers. We all need to collectively put our heads together to come up with some ideas on how to temper rate increases because many Floridians that I talk to are concerned that they’re going to either lose their mortgaged home or worse, will have to leave Florida. We welcome your ideas and hope you share this newsletter with others. Please let us know your thoughts.

LMA Newsletter of 10-23-23