‘Manageable’ event for carriers

Piles of debris from Hurricane Milton line the streets of Venice, Florida, October 17, 2024

While Florida residents braced themselves for a wild 2024 storm season, the Florida Hurricane Catastrophe Fund and insurance companies statewide prepared for the worst. In total, the Cat Fund is expected to pay out $4.6 billion ($4.5 billion from Milton and $100 million from Helene) to help cover insurance companies’ losses, which they say are manageable. “While two major hurricanes hit Floridian shores within a two-week period, preliminary gross and net loss estimates for homeowners’ carriers indicate that full-year earnings will be significantly reduced but are expected to remain positive, with no appreciable erosion in capital and continued near-term ratings stability,” KBRA said in a report published in late October. They continued, stating “Some insurers anticipate Hurricane Helene to be a full-retention event while others anticipate limited insured losses … most insurers expect Hurricane Milton will be a full-retention event.” The losses won’t trigger a policyholder surcharge, according to KBRA and the Cat Fund’s advisory council.

An insurance village in Bradenton, Florida handling Hurricane Milton and Helene claims, October 16, 2024

Even with the looming severity of both storms, damage and payouts “are unlikely to threaten any (re)insurers’ solvency and business plans moving forward into 2025 remain largely intact,” according to a report from Gallagher Re. Claim payouts from Milton and Helene were indeed high enough to be covered by reinsurance, with the global reinsurance broker reporting that reinsurers remain bullish on the Florida insurance market.

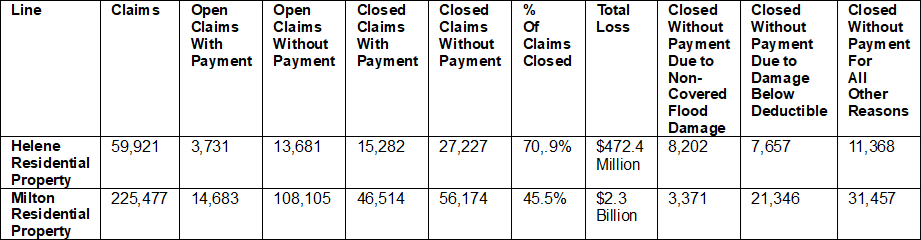

As of this past Friday, November 8, Hurricane Helene has generated 133,099 claims with estimated insured losses of $1.7 billion. A large portion of those claims are split pretty evenly between residential property lines and automobile. Although 71% of the residential claims are closed, just more than a third (36%) were closed with payment. The Florida Office of Insurance Regulation is now providing more granular data on the reason why – and verifies what we’ve said in these pages for the last several editions: Many of those unpaid claims were flood damage not covered under a homeowners policy or the damage was below the deductible (in fact, more than half were – see chart below)

Hurricane Milton to date has generated 283,298 claims with estimated insured losses now topping $3 billion. About 80% of those are residential property lines claims. Just over 45% of those claims have been closed, with 45% closed with payment. Many didn’t meet their deductible. (See chart below)

Those whose claims were denied due to uncovered flooding can provide that written denial to FEMA in order to qualify for a FEMA emergency grant for repairs. As for federal flood insurance under FEMA’s National Flood Insurance Program (NFIP), so far there have been over 72,000 NFIP policyholders in all states with damage from Debby, Helene, and Milton with $894 million paid-out to date. Because of the hurricanes, FEMA has extended the renewal period for flood insurance policies to December 10, a significant move from the usual 30-day grace period. Let’s hope we don’t have to keep learning the same lesson – if your address says Florida, you need flood insurance.

St. Petersburg’s Tropicana Field had its fiberglass roof shredded by Milton’s winds

Finally, a bit of unfortunate irony to share at a time when homeowners and businesses have been tempted to reduce their insurance coverages due to rising costs. Earlier this year, the city of St. Petersburg decided to reduce its policy limits on Tropicana Field from $100 million to $25 million. That, along with a $22 million deductible, saved the city about $275,000 in annual premiums. Hurricane Milton defied the computer modeling enlisted by the city and blew most of the roof off of the stadium (and figuratively the city’s estimates and potential savings), causing total damage of more than $47 million.

LMA Newsletter of 11-12-24