Plaintiff attorney glib

Florida’s property insurance market turmoil has seen homeowners suffering big rate increases, with some losing their coverage, while a growing number of insurance companies are going insolvent or reducing or eliminating their policy-writing in the state. The reaction by some of the bad actors responsible for this? A Miami plaintiff lawyer who has filed the most claims lawsuits in the state so far this year was glib when confronted by a reporter (and we have the video). It’s part of this week’s Property Insurance News digest.

Insolvency Update: A Louisiana judge on April 28 formally liquidated Tampa-based Lighthouse Property Insurance Company and sister Lighthouse Excalibur. Lighthouse stopped writing in Florida in February but had 27,000 policies at the time of its insolvency. The Florida Insurance Guaranty Association is still assessing outstanding claims liabilities and what assessment on Florida policyholders of other companies may be needed to pay remaining claims. Lighthouse is the third insolvency among Florida property insurance writers this year, following St. Johns Property Insurance and Avatar Property & Casualty Insurance, and the seventh insolvency since 2019.

Insolvency Update: A Louisiana judge on April 28 formally liquidated Tampa-based Lighthouse Property Insurance Company and sister Lighthouse Excalibur. Lighthouse stopped writing in Florida in February but had 27,000 policies at the time of its insolvency. The Florida Insurance Guaranty Association is still assessing outstanding claims liabilities and what assessment on Florida policyholders of other companies may be needed to pay remaining claims. Lighthouse is the third insolvency among Florida property insurance writers this year, following St. Johns Property Insurance and Avatar Property & Casualty Insurance, and the seventh insolvency since 2019.

Senator Jeff Brandes

Homeowners Impact: WBUR-FM, the powerhouse NPR station for the greater Boston area, aired an hour-long program Inside Florida’s property insurance crisis last week. Why a Boston station? Because there are residents in New England with homes in Florida or who are thinking of moving to Florida. It’s another reason we need to fix this problem now before it cooks our golden goose of real estate even more. The program includes a story featuring Cape Coral resident Mandy Wells, who has suffered through more than two years of legal battles with Marlin Construction Group and her insurance company. Wells is finally going to get her roof fixed, but in the meantime, her insurance premium has gone up from $800 in 2017 to $2,700 this year. LMA served as a resource to the reporter on this story, which also features an in-depth interview with Florida state Senator Jeff Brandes.

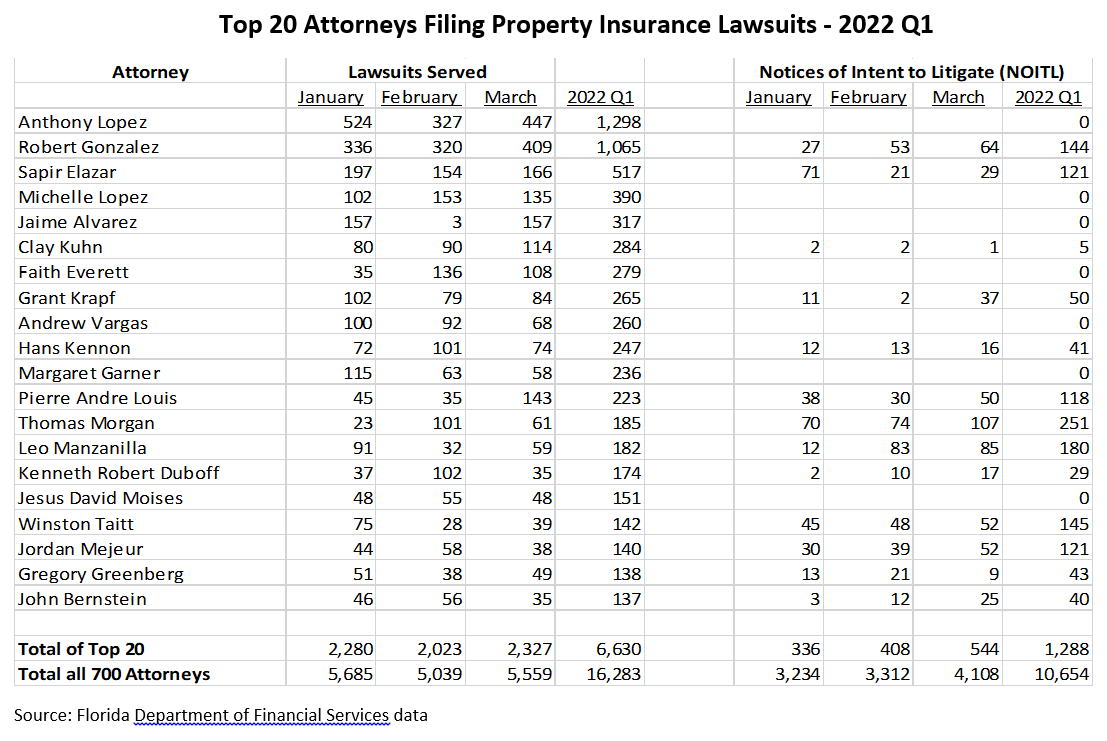

Media Exposing the Truth: Part of LMA’s role is to bring awareness of our property insurance dilemma to Florida media and help make often complex insurance issues understandable. We highlight two of the more than a dozen stories from the past two weeks. WPLG-TV Local 10 News in Miami in their story, interviewed attorney Anthony Lopez. He’s filed the most property insurance lawsuits in the state so far this year (see chart below). Reporter Glenna Milberg asked him “You filed like 1,300 cases just this year so far?” to which Lopez, responds, “That’s it?” In Tampa, WFLA-TV reporter Mahsa Saeidi interviewed insurance defense attorney Michael Monteverde of the Zinober Diana & Monteverde firm. Her 8-on-your-side story revealed the unscrupulous tactics used by contractors, public adjusters, and their attorneys and the problem it has created for insurance companies and consumers.

House Speaker Chris Sprowls

Meanwhile, House Speaker Chris Sprowls (R- Palm Harbor), an attorney by trade who chose not to hear any of the meaningful insurance bills passed by the Senate during the final week of the regular session, was non-committal following the Governor’s special session call. “We look forward to working with our partners to evaluate whether there is more we can do to address the availability and affordability of property insurance,” he said in a released statement.

![]() Save the Date: Demotech, the ratings agency for many of Florida’s domestic insurance companies, will hold a webinar recapping action taken during the May 23-27 special session. You can register for the June 2 webinar here, whose panel participants will include yours truly!

Save the Date: Demotech, the ratings agency for many of Florida’s domestic insurance companies, will hold a webinar recapping action taken during the May 23-27 special session. You can register for the June 2 webinar here, whose panel participants will include yours truly!

LMA Newsletter of 5-9-22