Help for policyholders

An aerial view over a Lee County neighborhood damaged from Hurricane Ian, September 2022

Governor DeSantis announced over the weekend that the Florida Housing Finance Corporation is providing $5 million to local housing partners to help homeowners impacted by Hurricane Ian pay their insurance deductibles. The help is available to qualified homeowners in Charlotte, Collier, DeSoto, Hardee, Lee, and Sarasota counties. The confirmed death toll from the high-end Category 4 storm is up to 114, with nearly half of them in Lee County, and most (70) from drowning. Today, 26 days later, it could still be another week before flood waters from the St. Johns River finish receding from some Central Florida communities. At latest count going into this past weekend:

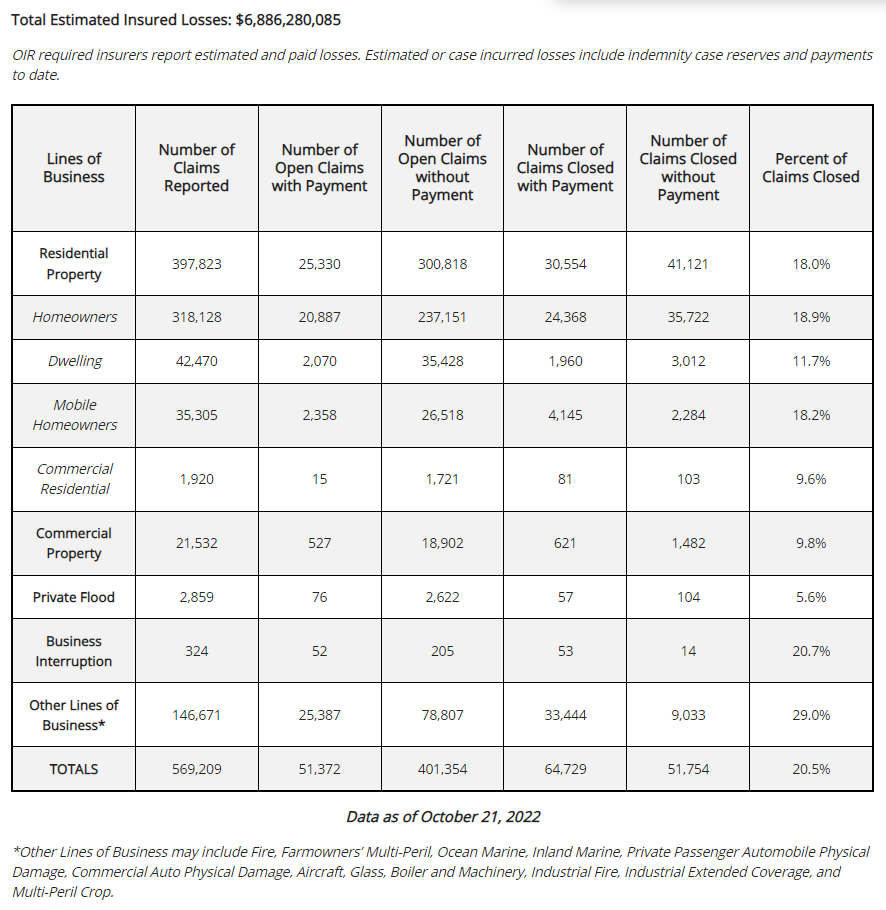

- Florida insurance regulators reported $6.88 billion in estimated insured losses on 569,209 claims. Hard-hit Lee, Charlotte and Sarasota counties accounted for nearly 62% of insurance claims. 5% of claims are closed, with a 6:5 ratio of paid to unpaid closed claims. Total estimated claims are expected to number between 850,000 to 1 million (see chart below). There is a significant number of automobile and marine losses. OIR has extended daily claims reporting through this Friday (October 28);

- Citizens Property Insurance, the state-backed insurer of last resort and now the state’s largest carrier with 1.1 million policyholders, received a little more than 50,000 claims as of the beginning of last week. It has scaled back its claims projection to 100,000 claims (down from 225,000) but hasn’t updated its earlier projection of paying $2.3 billion to $2.6 billion in losses.

- Florida’s private insurance companies aren’t seeing initial claims come in at the speed they expected either and some have adjusted their estimates downward, too. Whether this is because more damage appears to be from flooding (and not covered under a homeowners policy) remains to be seen. By law, policyholders have up to two years to file initial claims.

- FEMA’s National Flood Insurance Program (NFIP) reported 42,000 claims and paid more than $147 million to policyholders, including $103 million in advance payments. The NFIP has extended the Proof of Loss requirement for policyholders in Ian from 60 to 365 days. It has also authorized its Write-Your-Own insurance company partners and the NFIP Direct to pay claims based on the adjuster’s report without requiring policyholders to sign a proof of loss. Policyholders can submit a signed proof of loss later if they need to request an additional payment or if they disagree with the adjuster’s report; and

- FEMA has paid out $595 million in Individual Assistance to residents in 26 counties for help with home repair, replacing personal belongings, rental, and temporary lodging. Another $322 million has gone to the state for emergency response, while the U.S. Small Business Administration has provided $211 million in disaster loans.

From Florida Office of Insurance Regulation

Updated industry-wide claims estimates keep rolling in. Moody’s estimates total damages from Ian could run as high as $84 billion, counting both private insurance and NFIP flood claims. That would make it the most expensive hurricane to hit Florida, per the News-Press of Ft. Myers, which ranks our other past storms. Legal costs could add $10 billion to $20 billion to Ian insured losses, per Triple-I, especially in cases where coverage leakage of water losses onto wind-only policies is possible. Demotech’s Joe Petrelli told Artemis that as of October 13, “based upon catastrophe modeling results and the early reporting of claims associated with Ian, each carrier reviewed and rated by Demotech is within their vertical reinsurance tower,” and will be able to contain their losses accordingly.

Public access was restored to the Sanibel Causeway in 15 days, 10 days ahead of schedule on October 19, 2022. Courtesy, Florida DOT

A new estimate by the University of Florida shows the state’s agricultural losses to be $786.6 million to $1.56 billion, with the largest losses for growers of vegetables and melons, citrus and horticultural crops. Nearly 5 million acres of growing lands were affected by Ian’s big winds of up to 155 mph and heavy rains of up to 21 inches.

The Florida Disaster Fund has raised nearly $50 million to date, with $4 million awarded so far to help Southwest Florida residents. If you haven’t already, please consider making a tax deductible contribution by visiting www.FloridaDisasterFund.org or texting DISASTER to 20222. As a reminder, FloridaStormRelief.com serves as a one-stop-shop for all available public assistance.

LMA Newsletter of 10-24-22