New insights on claims

A series of homes destroyed on Ft. Myers Beach during Hurricane Ian, November 6, 2022. Courtesy, Kevin Miller

Hurricane Ian, the more expensive of the two Florida hurricanes in terms of both human life and property, continues to grow more so and is now expected to have broader impacts on both the environment and on the surplus lines insurance market – the ultimate market of last resort to Florida’s troubled standard property insurance market.

Ian’s death toll grew from 134 to 137 this past week as certified by medical examiners, with Lee County where the storm made landfall, accounting for 61 deaths. Estimated insured losses have been growing at a pace of $600 million a week as more insurance claims are filed. At latest count going into this past weekend:

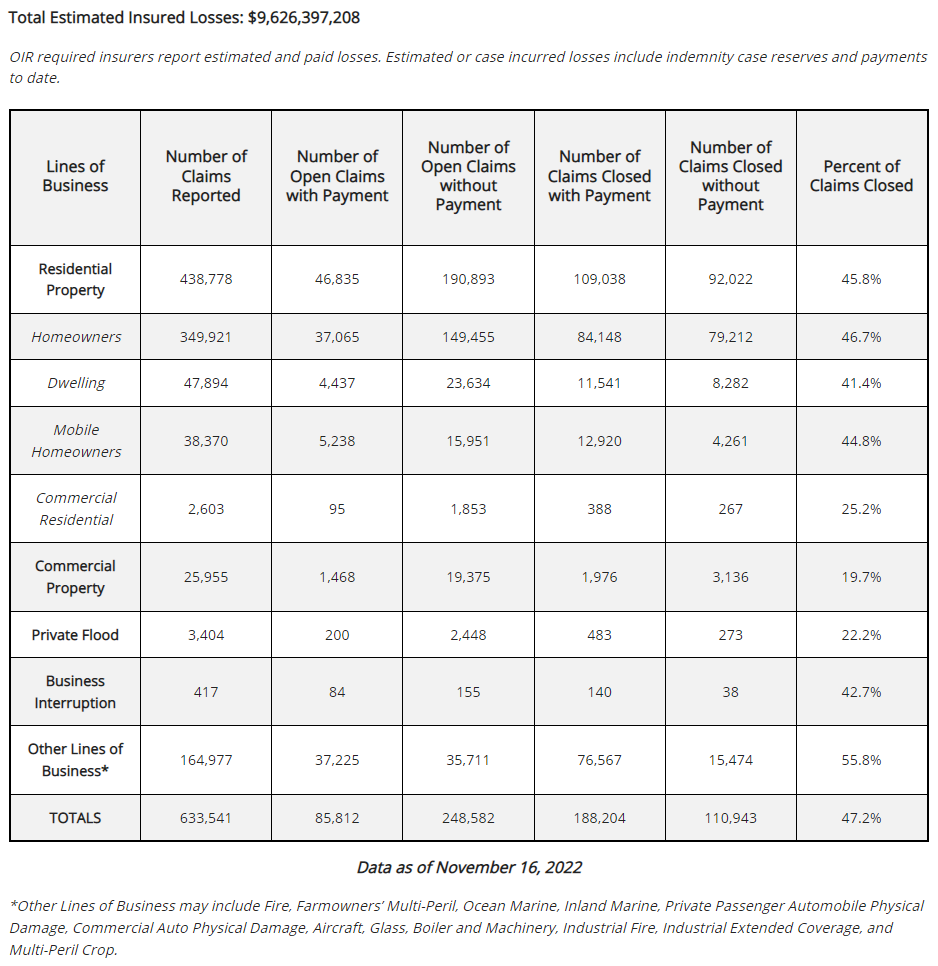

- Florida insurance regulators reported $9.6 billion in estimated insured losses on 633,541 claims. The percentage of closed claims has grown significantly to 47%, with 63% of those closed with payment (see chart below). OIR has revised the remaining data reporting deadlines for November to tomorrow (November 22) by noon and next Wednesday, November 30 at noon.

- State-backed Citizens Property Insurance has significantly increased its previous estimated costs of the storm of $2.3-$2.6 billion to now $3.8 billion. It is still holding on its 100,000 claims estimate and had received about 56,000 claims by mid-week last week.

- FEMA’s National Flood Insurance Program (NFIP) last Monday reported it had received 44,100 claims and has paid $509 million in claims. FEMA said its initial estimate of NFIP flood insurance losses is between $3.5 billion and $5.3 billion, including loss adjustment expenses. The losses include flood insurance claims received from five states, with the majority coming from Florida. FEMA said in a release that its annual traditional reinsurance program is triggered at $4 billion.

From Florida Office of Insurance Regulation

Hurricane Ian’s powerful 155 mph peak winds destroyed the inside of this 7-11 store on Ft. Myers Beach, November 6, 2022. Courtesy, Kevin Miller

The Citizens Property Insurance Claims Committee last week discussed the company’s experience to date in handling Ian claims. The majority of its response has come from its 1,829 independent adjusters with internal oversight. It’s costing Citizens another $136 million to cover the adjusters needed. They activated five additional contracted call centers to handle first notice of loss and reported receiving 125,000 calls. Claims Chief Jay Adams noted “the most astounding thing here is the average wait time for those customers was 18 seconds,” Citizens, as some private insurance companies do, also utilized outbound calling to proactively reach out to policyholders they hadn’t heard from, but data showed should have suffered storm damage. It also partnered with GIC on a new tool that compares pre-event imagery and post-event imagery and uses artificial intelligence to produce a damage assessment percentage. Those properties with the highest percentage were assigned to a specialized large loss team.

Reinsurance News reports that Hurricane Ian is expected to have an “immediate and substantial” impact on the excess and surplus (E&S) lines property market, according to the latest edition of the REDY Index by CRC Group. Restricted capacity, resulting in shared and layered placements including inland as well as coastal risks, further pressure on rates, and increased retentions, are all possible, CRC warns. This story underscores that the backstop to our admitted or regulated market is not immune to the severe weather (and the excessive insurance litigation) that plagues Florida.

Ian is also negatively impacting the coastal environment. Scientists say runoff from its rain and flooding have made the existing red tide worse on Florida’s Gulf coast. The Fort Myers News-Press reports toxic algae levels now stretch from Sarasota south to Marco Island.

LMA Newsletter of 11-21-22