“Long road to recovery”

A still image from Drone video shows one of seven oceanfront homes in Wilbur-by-the-Sea collapsing into the Atlantic Ocean. Courtesy Bridgepoint Global

Nearly everyone who had a house that didn’t collapse into the ocean or was declared structurally unsafe is back at home following Hurricane Nicole’s landfall November 10 just south of Vero Beach, after an initial landfall in The Bahamas. The sprawling late-season Category 1 storm was only the third hurricane in Florida history to make a November landfall. It travelled across the state as a tropical storm into the Gulf of Mexico, making a third landfall northwest of Cedar Key before becoming a depression and heading into Georgia.

Nicole was barely a hurricane, with its maximum winds of 75 mph, doing its damage instead with days of strong on-shore winds that created a big storm surge and beach erosion and widespread rainfall of up to 8 inches that caused coastal and inland flooding so soon after Hurricane Ian. At least five Floridians died in Nicole and a woman in inland Deland had to have her leg amputated when a tree fell on her.

The partial deck collapse of Pirates Cove Condominium in Daytona Shores, November 10, 2022

The worst damage was on the Volusia County coast, just south of Daytona Beach, where beachfront hotels, condos, and homes were damaged from the tremendous erosion, some crumbling into the Atlantic Ocean. Damage there is estimated at $522 million, more than the estimated $377 million in damage from the Category 4 Hurricane Ian on September 28-29. In Daytona Beach Shores and New Smyrna Beach, 24 condominium buildings were evacuated and declared structurally unsound. Another 7 were inspected with residents allowed to return. In Wilbur-by-the-Sea, 29 oceanfront homes were damaged with 17 declared unsafe. Volusia County Manager George Recktenwald called the structural damage “unprecedented,” adding “This is going to be a long road to recovery.”

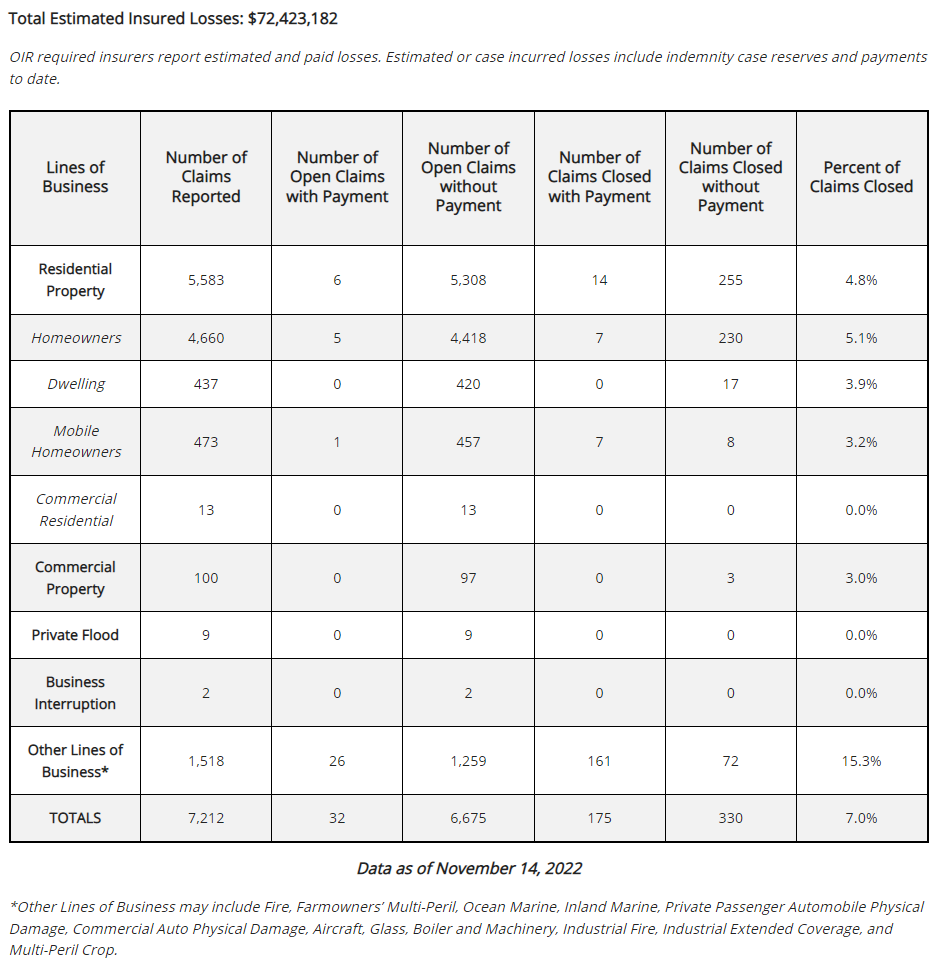

As of last Monday, Florida insurance regulators reported $72.4 million in estimated insured losses on 7,212 claims. The three counties north and northwest of landfall, Brevard (1,047), Orange (815), and Volusia (774) accounted for nearly 37% of those insurance claims. The percentage of closed claims was 7%, with 65% of those closed without payment (see chart below).

From Florida Office of Insurance Regulation

As we reported in our last Nicole Hurricane Update, the Florida Office of Insurance Regulation (OIR) issued an Emergency Order in response to the hurricane. It amends and supersedes Emergency Order 300997-22 that OIR issued during Ian. The amended order temporarily suspends for 90 days after repair, any planned policy cancellations or non-renewals by insurance companies on properties damaged by Nicole and/or Ian. The order now applies to Surplus Lines carriers as well.

Citizens Property Insurance said it expects about 5,000 claims and $62.5 million in losses from Nicole. As of last Wednesday, Citizens had received 1,679 claims. Early industry estimates of insured damage in Florida range from $750 million to $1.5 billion. National Flood Insurance Program (NFIP) losses are estimated to be under $300 million.

Hurricane Nicole provided another opportunity unfortunately to warn the public about the dangers of unscrupulous solicitors and contractors. I also reminded homeowners through various television interviews that in cases where damage was suffered in both Ian and Nicole, that an aggregate calendar year deductible applies covering both storms.

LMA Newsletter of 11-21-22