Lisa with former state Senator Jeff Brandes addressing the Independent Insurance Agents of Central Florida luncheon, October 25, 2023. Courtesy, IIACF

Former Senator Jeff Brandes and I shared a meal and chat with the Independent Insurance Agents of Central Florida at their October 2023 luncheon. As I prepared my remarks, I reflected on the many calls I receive from agents on a daily basis. You see, much of my telephone time is spent listening to insurance agents tell me their stories of their worries about the next shoe to drop in Florida’s property and casualty insurance market. Thinking about those calls and discussions, it’s no wonder, since auto, homeowners and commercial insurance premiums are at an all-time high. Floridians are being crushed at the level of the increased costs.

At the luncheon, Senator Brandes and I batted around ideas to slow the rate increases. Most in the audience recognized that rates will most likely not go down because of inflation and the weather, which we have no way to control. What they didn’t realize was that our legislature can and should control the cost of reinsurance that accounts for 35 cents of every premium dollar.

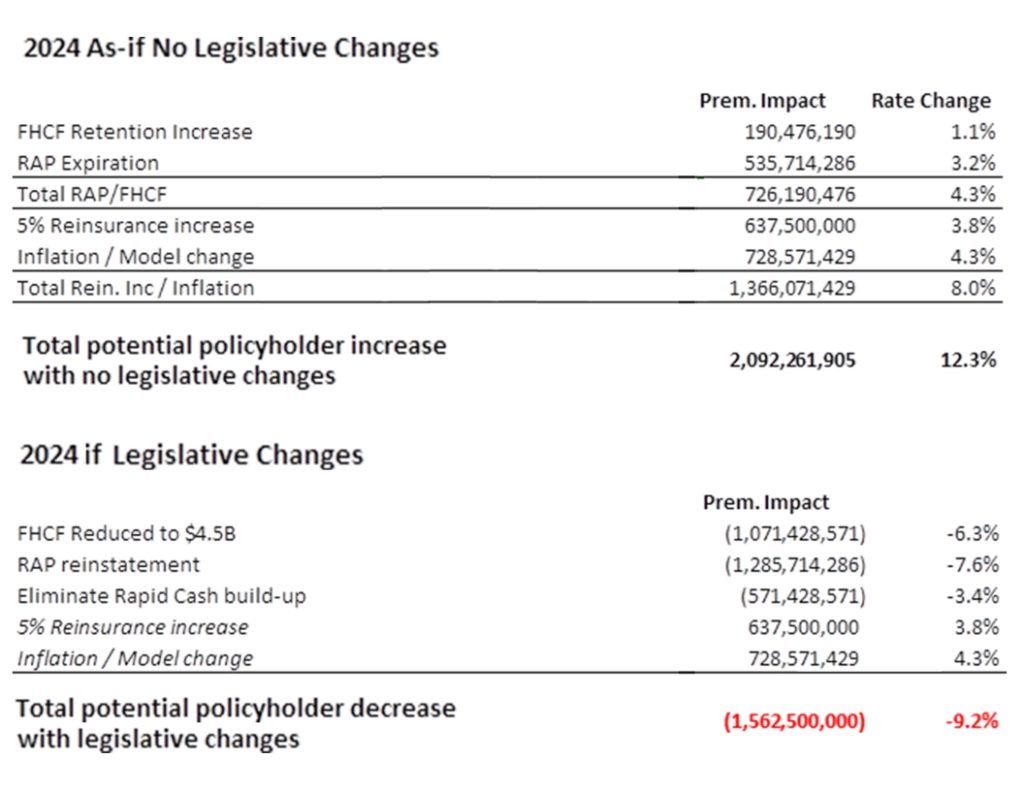

Here’s how the math adds up on rate without and with further reinsurance relief. The chart below was created by one long-time insurance executive with access to the bigger picture numbers of Florida’s property insurance industry:

If the legislature does nothing to stem the cost of reinsurance and change the way the Florida Hurricane Catastrophe Fund (Cat Fund) operates, our homeowners rates will go up about 12% in 2024. Yes that’s right…another increase. But if the Cat Fund structure were to change, it would slow rate increases by about 9% in 2024. The bottom line: rates will continue to rise because we can’t control the weather or inflation. What we can control is the cost of reinsurance and this chart demonstrates this. If we do nothing, 2023 rates will rise 12% in 2024 but if we change some of the Cat Fund’s parameters, we could see almost no rate change from 2023.

It was an honor to be with, and I was enlightened by, the good questions asked by this agent group who can be a force behind 2024 legislative changes. We asked the agents for other ideas to slow down the soaring cost of insurance. Do you have any? We would love to hear them!