This is a special edition of our LMA Newsletter, devoted to the topic of the ongoing misrepresentation of Florida’s property insurance companies. It started in late February with the Tampa Bay Times story that Florida companies “diverted” billions of dollars to their Managing General Agents (MGAs), other affiliates, and shareholders from 2017-2019 while at the same time showing a net loss of $432 million from hurricane claims. The reporting was based on the newspaper’s read of a previously unreleased draft consultant’s report in 2022 done for the Florida Office of Insurance Regulation (OIR).

In this edition, we’re going to share with you the reaction by legislative leaders and the Governor, bring you an in-depth analysis on where the article is incorrect, incomplete, and misleading. Plus, highlights from my just-released episode of The Florida Insurance Roundup podcast. Veteran insurance agent Allen McGinniss (author of The truth about Florida’s insurance market − an agent’s perspective from our last newsletter) joined me to explain how an MGA functions, the expenses involved, and how consumers are safeguarded through a myriad of regulation.

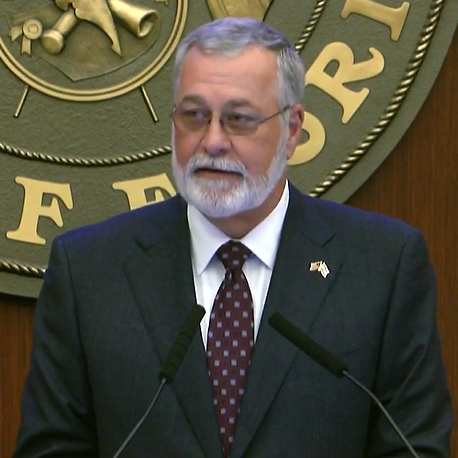

Senate President Ben Albritton on opening day of the Legislature. Courtesy, The Florida Channel

The Florida Legislature convened its 60-day legislative session last Tuesday with fiery remarks about property insurance companies by both legislature leaders, followed by pushback on those remarks by Governor DeSantis.

Senate President Ben Albritton (R-Bartow) told the 39 chamber members that “We’ll hold insurance companies accountable for the rates they charge and the services they provide when disaster strikes. They aren’t going to manipulate the system and neither is any other industry. Not on my watch.”

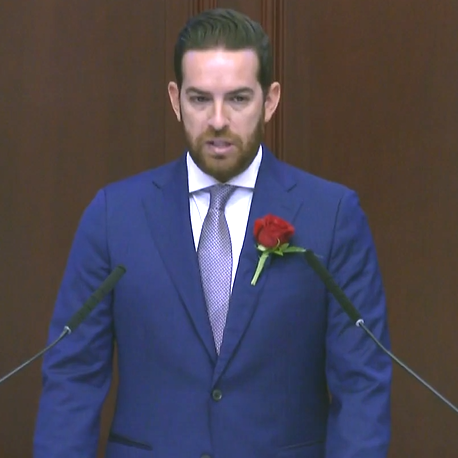

House Speaker Daniel Perez on opening day of the Legislature. Courtesy, The Florida Channel

House Speaker Daniel Perez (R-Miami), referencing the Tampa Bay Times story, told his 119 members the story “may suggest some insurance companies were using accounting tricks to hide substantial profits while telling us they were in a crisis. I have asked the Insurance & Banking Subcommittee to conduct hearings, and they will have access to the full range of tools, including issuing subpoenas, putting witnesses under oath and hiring outside experts.”

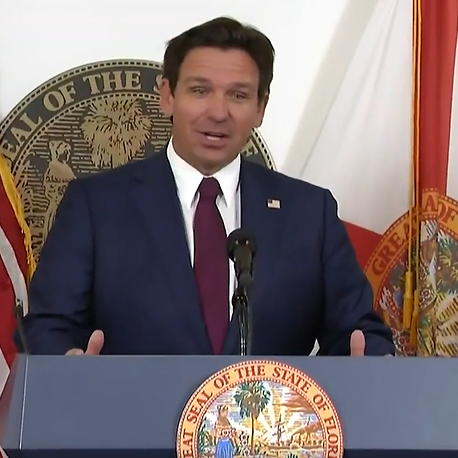

Governor DeSantis pushed back on Perez during a press availability afterward. He defended past insurance reforms, particularly litigation limits. “Our markets were being driven into the ground because of excessive litigation,” DeSantis said, noting that Florida had 78% of all U.S. litigation costs with just 8% of claims. Dade, Broward, and Palm Beach Counties were responsible for most of the litigation, despite not being hit by major hurricanes. The Governor also noted that auto insurance rates are dropping. “GEICO would not be reducing by 10.5% if you did not do the litigation reform.” He said property insurance rate filings have shown minimal increases (0.2% to 2%) rather than drastic spikes with some rate filing decreases, too. Most importantly, the Governor said he told legislative leaders he’s not budging on keeping those litigation reforms.

Governor Ron DeSantis news conference following his State of the State address on March 4, 2025. Courtesy, The Florida Channel

The Times story was published a week before the session, which includes several bills fronted by the trial bar that would undo the key insurance consumer reforms passed in 2022 and 2023. They include repealing the elimination of one-way attorney fees for plaintiffs in property insurance lawsuits that were so important in revitalizing the market recovery we’ve seen over the past 14 months.

A veteran insurance industry expert told me this past week that the flaw in the draft OIR report reported in the Times is that it only shows the outflows of money reported on Schedule Y of the annual financial statement of the insurance carrier. That’s the revenue of the subsidiaries and the affiliates but it doesn’t include the expenses of the subsidiaries and affiliates. So calling those funds “profits” is simply incorrect. The combined results of many in the insurance business that provide homeowners insurance to Floridians is publicly available. In fact, a third-party analysis of insurance company expense ratios is being updated now and should be available soon. I’m told that it will show that the expenses paid by Florida homeowners insurance companies to run their business are similar to homeowners insurance companies operating in other states.

There was no movement last week in any of the insurance and related bills we’re following since our last Bill Watch. The Senate Banking and Insurance Committee is meeting today (March 10) at 1:30pm and the House Insurance & Banking Subcommittee is expected to meet this week on the above issues.

We hope you enjoy this special edition and look forward to your feedback! You can reach me directly at [email protected].