Further signs of a deteriorating property insurance market

The Florida Legislature’s Organizational Session, November 22, 2022. Courtesy Rep. David Smith

Although no official proclamation had been issued as of last night, the new Florida Legislature is poised to meet a week from today (December 12) in a week-long special session to address economic relief for Hurricane Ian victims and ongoing problems in our state property insurance market.

The legislature met on November 22 in a one-day organizational session, where Rep. Paul Renner (R-Palm Coast) was installed as the new House Speaker and Sen. Kathleen Passidomo (R-Naples) as the new Senate President for the next two years. Passidomo, noting her family was personally impacted by Ian, said “One of our first challenges is our response to Hurricane Ian and Hurricane Nicole.” Renner formed a Select Committee on Hurricane Resiliency and Recovery to look at issues resulting from the hurricanes and “accelerate rebuilding and gather lessons learned, so that we are even better prepared for future storms,” said Renner. He appointed Rep. Michael Grant (R-Port Charlotte) as Chair and Rep. Adam Botana (R-Bonita Springs) as Vice Chair. Expect a report similar to a previous select committee’s 2018 report on Hurricanes Maria & Irma.

The economic relief will include providing property tax deferment for homes and businesses destroyed or made uninhabitable in the 26-county FEMA disaster declaration area from Ian. The session will occur during one of the seven committee weeks leading to the start of the regular 60-day session on March 7. There have been very few committee chairs named in the Senate, including the Banking and Insurance Committee. The House meanwhile has named Rep. Bob Rommel (R-Naples) as chair of the House Commerce Committee, and Rep. Wyman Duggan (R-Jacksonville) as Chair of its Insurance & Banking Subcommittee with Rep. Tom Fabricio (R-Miami Lakes) as the Vice Chair.

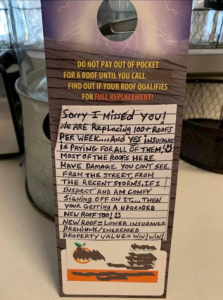

Unscrupulous roofing contractors with their offers of “free roofs” such as this during neighborhood solicitations are driving up the costs of homeowners insurance in Florida

In our previous newsletter we shared the four things the Florida Legislature can do in the special session to help Florida’s failing property insurance market: curb excessive litigation, refine roof coverage and solicitation, ease Cat Fund requirements, and depopulate Citizens Property Insurance. So far, no proposed bills have been made public. In this past May’s special session on property insurance, bills were unveiled less than 48 hours before session and were passed in three days with just technical changes.

The insurance industry’s focus in the special session is on at least eliminating the one-way attorney fees statute. Florida has 7% of the nation’s homeowners insurance claims yet 76% of the nation’s homeowners insurance lawsuits. Of the $15 billion spent on litigated claims from 2015-2020, only 8% was paid to policyholders. Plaintiff attorneys got 71% with the remaining 21% spent by insurance companies on defense attorneys. One recent example shared with us was a case where the judge awarded attorney fees that were 10 times the indemnity settlement. Another case saw fees that were more than four times the $55,000 jury verdict and included a contingency fee multiplier, another abusive element of the system. Incentivized litigation breeds excess and is one of the key drivers behind the six insurance company insolvencies this year, among the 11 since November 2019.

Runaway litigation costs over roof claims and other damage have eroded the stability of not only Florida’s insurance market, but also its real estate market. The Wall Street Journal reported last week that Florida Developers Are Holding Off on Big Projects as Insurance Costs Surge. Among the casualties: high-rise buildings and apartment complexes in South Florida, where more housing is desperately needed. AM Best recently reported that Florida’s litigation environment and storm-prone location is generating the most homeowners insurance premiums in the U.S., totaling $12.4 billion in 2021.

Even the Florida Insurance Guaranty Association (FIGA), which pays the claims of insolvent insurance companies through extra assessments on all our policies, is watching the special session closely. “We feel like we’ll have enough cash to last us through the whole of 2023 but we’re going to get to levels that make me and the rest of the team uncomfortable,” Executive Director Corey Neal told FIGA’s board last week. He said FIGA is spending about $30 million a month on claim payments and will determine in early 2023 whether yet another assessment may be needed. The Tampa Bay Times, in its editorial last week, wrote “The property insurance crisis isn’t going away, and the Legislature needs to deal with that reality.” We here at LMA are cautiously optimistic that further insurance consumer reforms will pass. If they don’t, how will the reinsurance market react, given that we have no Florida property insurance market without a confident reinsurance market?

Our team will be attending the special session next week and issuing a special LMA Bill Watch to our newsletter readers afterward with session results.

LMA Newsletter of 12-5-22