Plus, the fight against auto AOB fraud

A Pinellas County personal injury lawyer suspended from practice in December is now under arrest, accused of accepting and keeping for himself more than $850,000 in insurance settlement payments. Plus, Florida’s automobile insurance industry gets some welcome help in its fight against Assignment of Benefits (AOB) auto windshield fraud. It’s all in this week’s Fraud News.

A Pinellas County personal injury lawyer suspended from practice in December is now under arrest, accused of accepting and keeping for himself more than $850,000 in insurance settlement payments. Plus, Florida’s automobile insurance industry gets some welcome help in its fight against Assignment of Benefits (AOB) auto windshield fraud. It’s all in this week’s Fraud News.

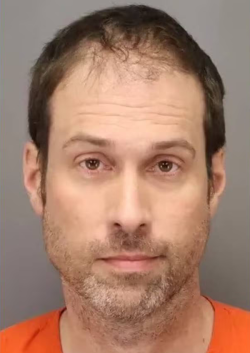

Christopher Michael Reynolds

Lawyer Downfall: The Florida Bar first got wind of something amiss with Attorney Christopher Michael Reynolds and his solo practice in Seminole last fall. By the time of his emergency suspension by the state Supreme Court in December 2022, the Bar had collected 11 complaints from his clients and medical providers, saying they hadn’t been paid proceeds from more than $200,000 in personal injury settlements. The Bar discovered Reynolds’ bank accounts were wiped out and the 44 year-old lawyer was nowhere to be found.

The Pinellas County Sheriff’s Department was first contacted last October by one of Reynold’s clients who had been referred by him for medical treatment using a Letter of Protection, to help pay for treatment pending a settlement or verdict. According to Sheriff Bob Gaultieri, Reynolds settled that suit for $100,000 but pocketed the money. So far, 16 clients have now filed complaints with the Sheriff, together representing $850,000 in insurance settlements that were never passed along to his clients or used to pay their medical expenses. Sheriff Gaultieri, in announcing Reynold’s arrest last week on multiple counts of money laundering and grand theft, said the lawyer has a drug problem. Much of the money, he said, was spent on drugs, travel, pornography, and on sex workers. As a result, his clients – the victims in the personal injury lawsuits he filed on their behalf – have been left with hundreds of thousands of dollars in medical bills.

Automobile AOB: This legislative session’s big tort reform momentum includes another attempt at reducing the decade-long fraud involved in automobile windshield insurance claims in Florida. The fraud is made possible by the state-mandated zero-deductible for glass claims and generous attorney fees made possible by the one-way attorney fee statute 627.428. The number of auto glass lawsuits grew from 591 in 2011 to 37,000 in 2022 – a whopping 4000% increase!

Automobile AOB: This legislative session’s big tort reform momentum includes another attempt at reducing the decade-long fraud involved in automobile windshield insurance claims in Florida. The fraud is made possible by the state-mandated zero-deductible for glass claims and generous attorney fees made possible by the one-way attorney fee statute 627.428. The number of auto glass lawsuits grew from 591 in 2011 to 37,000 in 2022 – a whopping 4000% increase!

Most Floridians are accustomed to “glass hawkers” approaching them at car washes and shopping centers. The scammers offer incentives such as gift cards to sign Assignment of Benefits (AOBs) giving them the right to make a claim for an allegedly “damaged” windshield. By the time the insurance company receives the claim, the glass is often already repaired and at an inflated cost – if it was broken at all.

This legislative session, HB 541 and SB 1002 would bar auto policyholders from entering into AOB contracts with repair shops on policies issued on or after July 1, 2023 (see our Bill Watch this newsletter). Last week the Coalition Against Insurance Fraud joined with allies, including the National Insurance Crime Bureau, in a statewide coalition called Fix the Cracks to support reforms in the state. We welcome their involvement!

LMA Newsletter of 3-6-23