New bill filed

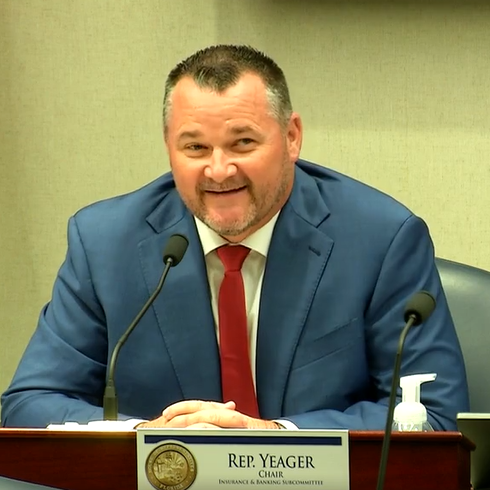

Rep. Brad Yeager (R-New Port Richey) presides as Chair of the House Insurance & Banking Subcommittee at its October 7, 2025 meeting. Courtesy, The Florida Channel

The Florida House Subcommittee on Insurance & Banking met October 7, 2025, to examine how insurance companies are using artificial intelligence (AI) in their operations. A panel of insurance and technology experts representing CFO Ingoglia’s office, NAMIC, APCIA, FIC and Insurtech told lawmakers that insurers use AI sparingly and primarily for efficiency, accuracy, fraud detection, and faster claims handling—not to make final claims decisions. They emphasized that existing laws already hold insurers accountable for any AI-assisted decisions and that AI cannot replace human oversight.

Panelists identified the National Association of Insurance Commissioners’ bulletin on AI as the national framework guiding responsible use and suggested the Florida Office of Insurance Regulation − not the Legislature − remains best suited to regulate AI applications within insurance companies. Lawmakers revisited failed 2024 bills by Rep. Hillary Cassel and Senator Jennifer Bradley that would have prohibited insurers from denying claims solely through AI systems and required human review of all denials.

One panelist noted that larger insurance carriers are leading adoption, using AI to streamline back-office operations, improve underwriting precision, and develop new products like private flood insurance. While AI-driven efficiencies could eventually reduce operating costs − and potentially premiums − the lawmakers on the Committee said they intend to continue monitoring the evolving role of AI to ensure consumers remain protected.

A week later, on October 15, Senator Bradley (R-Fleming Island) filed SB 202 titled “Mandatory Human Reviews of Insurance Claim Denials.” It would require that an insurance company’s “decision to deny a claim or any portion of a claim must be made by a qualified human professional.” It would also require that an “algorithm, an artificial intelligence system or a machine learning system may not serve as the sole basis for determining whether to adjust or deny a claim.” It’s very similar to her bill last year that passed unanimously in its first hearing but never progressed to its two remaining committee hearings and whose House counterpart never received a hearing.