More flood insurance required

A new report shows federal flood maps are misleading property owners into believing they don’t need flood insurance, FEMA is making historic levels of funding available for community resilience projects, and NOAA is sharing its latest storm forecasting tools with the insurance and reinsurance industry. It’s all in this week’s Flood Digest.

A new report shows federal flood maps are misleading property owners into believing they don’t need flood insurance, FEMA is making historic levels of funding available for community resilience projects, and NOAA is sharing its latest storm forecasting tools with the insurance and reinsurance industry. It’s all in this week’s Flood Digest.

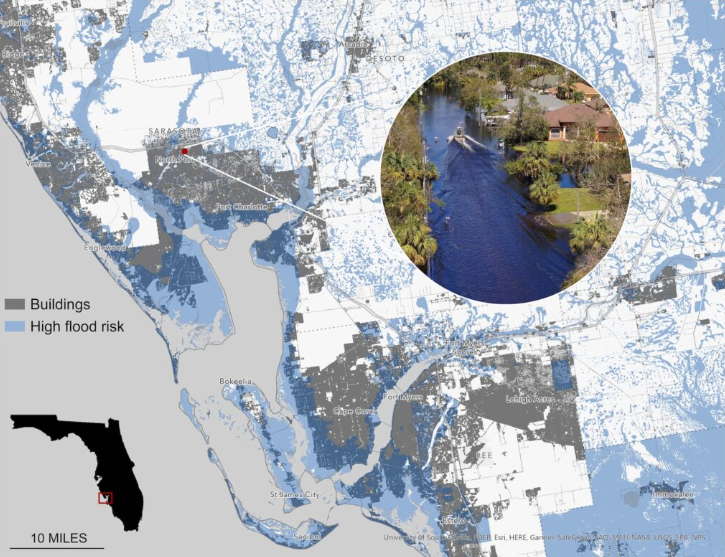

Faulty Flood Maps: A new study by North Carolina State University says only about 4% of homeowners nationwide have flood insurance, a problem that can be largely attributed to the flood maps created by FEMA. The maps’ Special Flood Hazard Areas where 1-100 year flood events can occur are out of touch with the reality of actual and predictive flooding, according to the study. Researchers compared their information with 2020 FEMA flood maps and found that more than two-thirds of the damage came from outside of the maps’ high-risk zones. It also notes that more than 80% of homes that were under evacuation orders in Hurricane Ian didn’t have flood insurance.

Hurricane Ian destroyed thousands of buildings throughout southwestern Florida. This map illustrates the proximity of those buildings (gray) to high-risk flood zones (blue). Map by Georgina Sanchez, N.C. State University

We know that those residents who had mortgages and lived in a flood zone were required to have flood insurance, but many of the rest of Ian’s victims likely didn’t. In Lee County, only 31% of residential structures had National Flood Insurance Program (NFIP) policies, and statewide only 15%. Standard homeowners policies do not cover flooding. As about 25% of the NFIP’s claims come from outside high-risk zones, all property owners should consider purchasing flood insurance.

More Resilience: The application period is open for a record $3 billion of funding for two annual mitigation grant programs to help communities enhance resiliency to natural hazards. The two programs are the FEMA Building Resilient Infrastructure and Communities (BRIC) and Flood Mitigation Assistance (FMA) for fiscal year 2022 grant programs. The funding was bolstered by nearly $900 million from the Infrastructure Investment and Jobs Act of 2021, which provided $200 million for BRIC and $700 million for Flood Mitigation Assistance. The funding notices for both programs are available at Grants.gov. Eligible applicants must apply for funding using FEMA Grants Outcomes, the agency’s grants management system by the Jan. 27, 2023 deadline.

Weather & Insurance: NOAA is continuing its engagement with the insurance industry to deliver authoritative climate data and services. Next Tuesday it will host the third webinar in a series of dialogues with the industry, this one focused on severe convective storms. Experts will share current NOAA resources and research data, tools, and trends relevant to the industry. NOAA says the event will also provide another opportunity to discuss, identify and address gaps in NOAA’s delivery of data and services to stakeholders in the insurance industry. To register for the November 15, 1pm webinar, visit: https://attendee.gotowebinar.com/register/2369332534863525390.

LMA Newsletter of 11-7-22