How to lower reinsurance costs xx

© Can Stock Photo / radiantskies

So what impacts will an above normal Atlantic hurricane season have on Florida’s recovering property insurance market? Will homeowners insurance rates go up? Will reinsurance prices at this week’s June 1 renewal rise? What can be done to ease premiums? And how can homeowners be proactive in protecting their properties and lowering their premiums?

Property Insurance Rates: The NOAA hurricane season forecast with its highest-ever number of named storms can cause understandable fear from Florida residents that their property insurance is going to get even more expensive. But as I’ve been explaining to news media around the state this past week, that’s not the case. There is no direct link between forecasts and costs. Hurricane and other risks are already part of a homeowner’s current premium. Future premiums though could be another story. As I told WPTV-TV in West Palm Beach for their story, “It will have an effect if some of these predictions materialize. It could reverse some of the strides we’re making with leveling off of rate increases.”

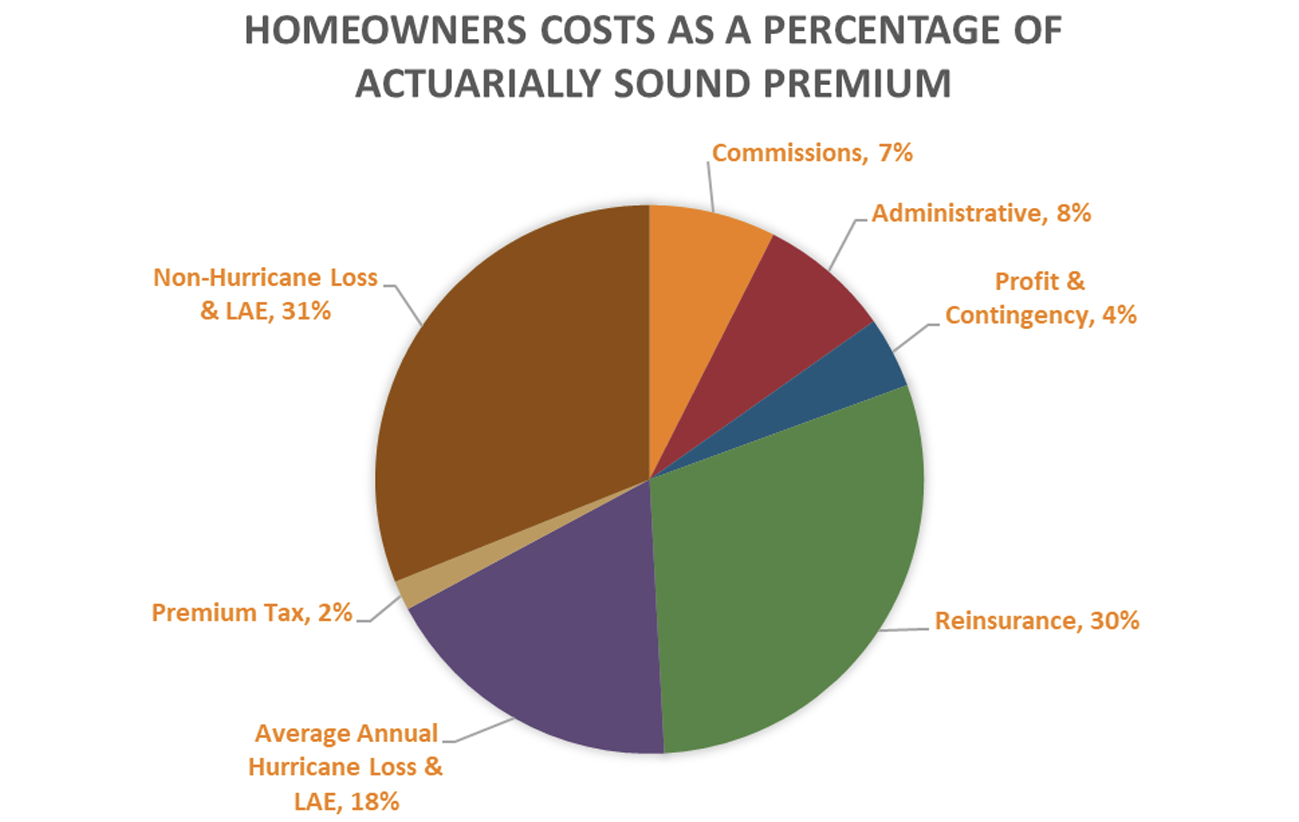

Impact on Reinsurance Prices: Likewise, while reinsurers may want to price hurricane risk they charge to insurance companies based on the potential for a high-strike season at the June 1 contract renewals, that’s not going to happen for a number of reasons. The Wall Street Journal this past Friday reported pricing is expected to remain level or lower, due to new capital coming into the reinsurance market, which we’ve been reporting on in these pages. As I’m quoted in the story, “Consumers are still feeling the rate increases because there’s a lag time. A lot of time, the reinsurance pricing from last year is still rolling into renewals. But the 2024 reinsurance costs are going to be better, with a capital B.” The chart below, presented by Florida Insurance Commissioner Michael Yaworsky at a legislative briefing last fall, shows that on average, 30 cents of every homeowners premium dollar goes to reinsurance costs.

Source: Florida Office of Insurance Regulation, October 2023

How to Ease Premiums: Lowering those reinsurance costs to our insurance companies will help lower a homeowners premiums. A few changes in the law governing the Florida Hurricane Catastrophe Fund (Cat Fund), which has more than $10 billion in reserves, would allow insurance companies to buy cheaper reinsurance from the Cat Fund, as I told Fox 13 in Tampa. HB 1293 and SB 1668, filed this past spring in the Florida Legislature but unfortunately never got a hearing, support the fact that the Legislature can create more state-backed reinsurance at about 10-15 cents of every premium dollar we pay versus private reinsurance at 30 cents average (and upwards of 40 cents) of every dollar we pay. The catastrophe models for 2024 have been recalculated with recent hurricane losses and other factors, leading to higher rate indications. Some insiders are anticipating that reinsurers will likely seize on this in hiking their future pricing. So it’s more important than ever to let insurance companies and their policyholders have other avenues to cheaper reinsurance.

Homeowners Prepare: As the old saying goes, “An ounce of prevention is worth a pound of cure.” The Florida Division of Emergency Management has updated its guidance and provided excellent checklists for homes and business to use in preparing for hurricane season at this dedicated page at FloridaDisaster.org. The state’s popular My Safe Florida Home program will resume taking applications from homeowners on July 1 with some new rules and a $200 million infusion of funding. The program offers free home inspections and grants of up to $10,000 on a $2 to $1 match to incentivize homeowners to harden their homes from future hurricanes, resulting in lower premiums. Applicants will now be sorted by age and income, as explained by WPTV-TV. Meanwhile, the Department of Financial Services is encouraging Floridians to take advantage of the Florida Home Hardening Sales Tax Initiative before it ends on June 30, 2024. This initiative established a two-year sales tax exemption on the retail sales of items like impact-resistant windows, doors, and garage doors. The program overall has saved homeowners an estimated $462.6 million during the course of the exemption period.

LMA Newsletter of 5-28-24