Citizens to drop rates in 2026

Hurricane Milton claims continue to rise, Citizens Property Insurance’s policy count reaches a new low as it prepares to file its first rate decrease in 10 years, plus the role ongoing depopulation is playing in Florida’s insurer of last resort. It’s all in this week’s Property Insurance News.

Hurricane Milton claims continue to rise, Citizens Property Insurance’s policy count reaches a new low as it prepares to file its first rate decrease in 10 years, plus the role ongoing depopulation is playing in Florida’s insurer of last resort. It’s all in this week’s Property Insurance News.

Cars stranded in flood waters along Tampa’s Fowler Avenue after Hurricane Milton, October 10, 2024

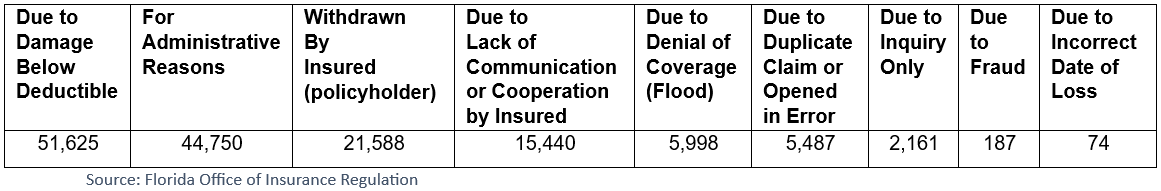

Milton Claims: The Florida Office of Insurance Regulation (OIR) has released updated claims data for Hurricane Milton, the Category 3 storm that made landfall in early October 2024 on Sarasota County’s Siesta Key and moved swiftly across the state, causing some serious flooding. As of December 9, 2025, total estimated insurance losses for Milton were $5.6 billion on 385,146 claims, up from the $4.75 billion in losses on 364,507 claims from the previous data call last June. 92% of claims have been closed, with 62% closed with payment. The remaining 38% that were closed without payment were mostly from damage below the deductible (51,625 claims), “administrative reasons” (44,750), and the policyholder withdrawing the claim (21,588). Interestingly, another 15,440 weren’t paid “due to lack of communication or cooperation by insured,” per the posted data. OIR audits and examines insurance carriers’ claims payments following every catastrophe to ensure claims are properly handled in compliance with Florida law and the terms of the policy. The full breakdown of closed claims without payment is shown in the below graphic. OIR has not updated Hurricane Helene claims.

Citizens Policies & Rates: The Citizens Board of Governors met on December 10, 2025 and approved a proposed overall rate decrease for 2026, the first decrease in 10 years. Citizens personal lines policies would drop by 2.6%, with the most popular component, HO-3 Multi-peril Homeowners policies dropping 4.1%. Commercial policies overall would increase 10.4%. The overall rate decrease is 0.8%. It now goes to regulators for review ahead of the slated effective date of June 1.

Citizens Policies & Rates: The Citizens Board of Governors met on December 10, 2025 and approved a proposed overall rate decrease for 2026, the first decrease in 10 years. Citizens personal lines policies would drop by 2.6%, with the most popular component, HO-3 Multi-peril Homeowners policies dropping 4.1%. Commercial policies overall would increase 10.4%. The overall rate decrease is 0.8%. It now goes to regulators for review ahead of the slated effective date of June 1.

“The reforms championed by Governor DeSantis have done what they were supposed to do. They have stabilized the Florida market and they are providing rate relief to policyholders,” said Citizens President & CEO Tim Cerio. He said 46.2% of Citizens policy holders with primary (homestead) property are going to get a decrease, amounting to around 11.2%.

Chief Actuary Brian Donovan called it “really, really quite remarkable” that Citizens uncapped rate indication for its two most popular policy types has gone from 91.5% in 2023 to minus 1.3%, especially in shedding the policies it has. Cerio said each of those years represented about $500 million less in premiums needed. “So you can see where litigation costs drive up rates for Citizens and the private sector. You get a handle on litigation, rates come down.” Cerio said 2026 rates could go even lower, depending on reinsurance costs and other factors and there’s nothing preventing a resulting mid-year 2026 rate adjustment.

Depopulation of policies to the private market has played a role, with a 2025 year-end policy count of 395,144, the lowest in Citizens’ history. From January 1 through December 9, 2025, 546,091 Citizens policies had been removed by the private market, with an associated $220.1 billion in related exposure removed. Depopulation efforts continue into this new year, with takeouts scheduled for February, March, April, and June. You can read more in our full LMA report here,