Florida’s insurance crisis deepens

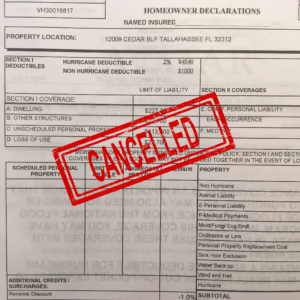

Another week has brought more property insurance companies announcing they’ll stop writing new homeowners policies in Florida and/or stop renewing existing ones. Claims creep from the 2020 hurricane season and higher litigation and reinsurance costs are combining to make Florida an increasingly inhospitable market for property insurance companies.

Another week has brought more property insurance companies announcing they’ll stop writing new homeowners policies in Florida and/or stop renewing existing ones. Claims creep from the 2020 hurricane season and higher litigation and reinsurance costs are combining to make Florida an increasingly inhospitable market for property insurance companies.

Among the companies is Progressive Insurance, which announced it will not renew HO-3 and DP-3 policies for homes with shingle roofs 16 years old or older, amounting to a reported 56,000 policies. These announcements follow the news the previous week that Farm Bureau Insurance and TypTap Insurance are no longer writing in Florida. An S&P Global Market Intelligence report published Thursday said Farmers has recorded net losses for seven straight quarters from 2019 through part of 2021. Despite writing more direct premiums, Farmers has lost almost $50 million in that period, part of the sea of red ink of net underwriting losses that most carriers are experiencing.

Word on the street is that we will see more companies do likewise between now and the start of hurricane season on June 1, as some simply won’t be able to place their reinsurance coverage. Companies have to either cut costs, including reducing exposure by reducing policy count, or raise rates. At least 12 companies so far have either suspended new or renewal business or limited the types of homes they cover. Many carriers, including some who have stopped writing and/or renewing, have been filing double-digit rate increases with regulators as we’ve chronicled in these pages. Speaking of reinsurance, Moody’s is reporting it expects prices will rise further this year, in part due to catastrophe exposure and secondary perils, but also from other factors, including rising litigation costs.

Trying to quantify the litigation part of the problem further, the Office of Insurance Regulation has announced it will hold a workshop on February 24 as part of its rule development for the SB 76 data call coming up next year. The data call is required under last year’s SB-76 reforms and will require carriers issuing personal lines or commercial lines residential property insurance policies to report claims litigation data annually. You can read more about the workshop here.

LMA Newsletter of 2-14-22