Plus $multi-million Medicare & auto fraud

Although it can (and does) happen anywhere, there’s a reason that authorities say most insurance fraud occurs in the South Florida counties of Miami-Dade and Broward. In just the past two weeks, three high-profile cases spanning various insurance lines have made the news – all despicable, hurtful to the victims, and a big reason insurance costs are unnaturally high. It’s all in this week’s Fraud News.

Medicare Fraud: A federal jury in Miami last week convicted a South Florida couple for their roles in a conspiracy to defraud Medicare by billing over $93 million for home health therapy services that were never rendered. The government said Karel Felipe, 42, of Miami Shores, and Tamara Quicutis, 54, of Hialeah, conspired with others to submit false bills to Medicare for three home health companies located in Michigan. Their co-conspirators recruited individuals from Cuba to sign Medicare enrollment documents and appear as the owners of the home health agencies to conceal the identities of Felipe, Quicutis, and others involved in the scheme. The group then used these home health companies to submit claims for services that were not rendered using lists of stolen patient identities, some of whom had died. Hundreds of shell companies and bank accounts were used to launder the Medicare fraud proceeds and convert the proceeds into cash at Miami-area ATMs and check cashing stores. A third defendant, Jesus Trujillo, 52, of Miami, pleaded guilty to conspiracy charges. All three face multiple 20-year prison sentences later this year.

Medicare Fraud: A federal jury in Miami last week convicted a South Florida couple for their roles in a conspiracy to defraud Medicare by billing over $93 million for home health therapy services that were never rendered. The government said Karel Felipe, 42, of Miami Shores, and Tamara Quicutis, 54, of Hialeah, conspired with others to submit false bills to Medicare for three home health companies located in Michigan. Their co-conspirators recruited individuals from Cuba to sign Medicare enrollment documents and appear as the owners of the home health agencies to conceal the identities of Felipe, Quicutis, and others involved in the scheme. The group then used these home health companies to submit claims for services that were not rendered using lists of stolen patient identities, some of whom had died. Hundreds of shell companies and bank accounts were used to launder the Medicare fraud proceeds and convert the proceeds into cash at Miami-area ATMs and check cashing stores. A third defendant, Jesus Trujillo, 52, of Miami, pleaded guilty to conspiracy charges. All three face multiple 20-year prison sentences later this year.

Angela Augustine mugshot. Courtesy, Broward County Sheriff’s Office

Auto Insurance Fraud: The Department of Financial Services (DFS) has made the first of what is expected to be multiple arrests in busting an $11.6 million automobile insurance fraud ring operating in Broward County. DFS investigators say that Angela Augustine, a Coral Springs insurance claims adjuster, allegedly re-opened numerous previously closed or settled auto insurance cases, then fabricated claims by creating fictitious claimants and documented fictitious scenarios, along with fake photos and repair estimates to issue liability claim payments. Augustine would then allegedly adjust reserves to support the false documentation and make matching payments on the claim. All total, she’s accused of making about 1,255 fraudulent payments to approximately 326 co-conspirators for more than $11.6 million. DFS didn’t say which carriers Augustine worked for. She faces up to 55 years in prison if convicted on all charges.

Courtesy, WPLG-TV Local 10 News

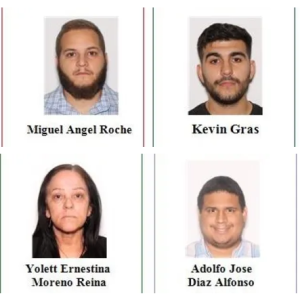

Homeowners Insurance Fraud: It was the familiar offer of a free home inspection that proved to be anything but for a 94 year-old Miami Gardens woman. The group of four visitors – two public adjusters, a posing public adjuster, and a mold remediation company owner – are accused of forging her signature on “multiple fraudulent homeowner claims, assignment of benefits documents, public adjuster contracts and a service repair agreement,” according to DFS. Investigators said the four worked in concert to fabricate mold and water damage to the woman’s air conditioner and kitchen and then submit $57,000 in fraudulent claims to Citizens Property Insurance.

Arrested were southwest Miami-Dade County public adjusters Miguel Angel Roche and Kevin Gras, Unlicensed Public Adjuster Adolfo Jose Diaz Alfonso of Premier Consultant Group of Miami Gardens, and Yolett Ernestina Moreno-Reina, owner of Never Mold, LLC of southwest Miami-Dade County. You can watch the busts in action in this WPLG-TV Local 10 Miami story. It’s the latest in a series of public adjuster fraud arrests.

If you or someone you know is suspicious of fraud, please report it immediately at FraudFreeFlorida.com. You could be eligible for up to $25,000 in rewards.

LMA Newsletter of 10-9-23