While Congress considers NFIP Reauthorization

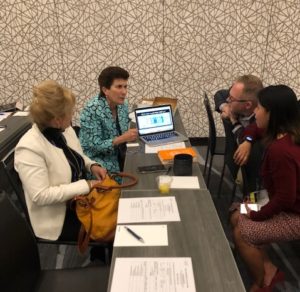

Lisa attends the NCOIL Spring Meeting with Greg Raab, VP of Adjusters International, March 15, 2019

The National Conference of Insurance Legislators (NCOIL) convened the first meeting of its Special Committee on Natural Disaster Recovery this past weekend in Nashville. Item one on the agenda was to consider creating a model private flood insurance law, like Florida’s, to help states encourage their own vibrant private flood market.

My presentation to NCOIL stressed how well Florida’s model laws, SB 1094 and SB 542, have worked here to date. In just 3 years, almost 30 companies are now offering better coverage at a cheaper price. It proves that when state government encourages it, a vibrant, competitive environment emerges.

The amendments currently offered for consideration to the existing NCOIL State Flood Disaster and Mitigation Relief Model Act are those we first presented last July and based on Florida Statute 627.715, enacted in 2014, that aim to encourage a robust private flood insurance market to provide consumer choices to the existing National Flood Insurance Program (NFIP). Closing the insurance gap in this country is vital to ensuring that states can properly and efficiently recover from a natural disaster.

Lisa Miller testifying on model flood insurance legislation at the NCOIL Spring Meeting in Nashville, TN, March 15, 2019

The committee also heard from David Maurstad, the NFIP’s Chief Executive. Maurstad stressed the aspirational changes that the NFIP is pursuing – the “moonshot” trajectory that former FEMA Director Brock Long spoke of so often where NFIP and private insurers each write the policies they can to reduce the coverage gap that exists across America.

Our testimony occurred during the same week that the US House of Representatives Financial Services Committee held a hearing on reauthorization of the NFIP, currently set to expire May 31 when its seventh short-term extension ends. That coverage gap was referred to eloquently by Florida Congressman Bill Posey (R-FL 8th) who noted that “this isn’t rocket science.” “The national participation rate as we heard earlier is 31% and so you have 31% of the people paying for 100% of the losses. Do the math. If it’s good actuarial, you take it in the shorts every single year. And that’s what we’ve been doing with NFIP,” Posey said, referring to the federal program’s ongoing debt. You can watch his comments here.

Lisa explaining to a group of NCOIL listeners why it makes sense for state legislatures to establish guidelines to launch a private flood insurance market. March 15, 2019

It was our goal to have an NCOIL model flood law on the books so that those of us working on teams in Washington for the NFIP reauthorization who know that Congress is going to again kick the can down the road could have used this model to let Washington know that “we got this”. My NFIP colleagues are working tirelessly to launch Risk Rating 2.0, set to be implemented in 2020. In essence, if two homes are in a flood zone and one is closer to the water and one isn’t, the premiums will differ based on the actual risk…just like in property insurance. This rate modernization will actually help push the private industry’s emergence on this journey.

The NCOIL committee’s discussions will continue with various parties to work together to bring a vibrant flood insurance market to all of our fifty states. For more on this effort, visit our Lisa Miller & Associates Private Flood Insurance & Resilience webpage and I look forward to talking with you or your company on ways to participate in our ongoing efforts.