Florida’s property insurance market remains in the red

The first emergency assessment on Florida’s property insurance policyholders since Hurricane Andrew is on the way, as three more carriers file rate increases of 14%, 45%, 62% and even 103%. There’s also new data out that shows Florida’s domestic market has a combined negative net income and underwriting loss of $2.7 billion.

Rate Hikes: The Florida Office of Insurance Regulation (OIR) last week held public rate hearings for two property insurance companies. First Community Insurance, a subsidiary of Bankers, submitted a use-and-file rate increase of nearly 45% that it implemented last November on about 25,500 homeowners policies. Those policies have since been non-renewed as the company withdraws its homeowners business from five Southern states. If approved by OIR, it would be the carrier’s fourth rate increase in three years. The company cited large litigation costs in Florida, reinsurance rates that increased 83% in 2022 following a 45% increase in 2021, and net underwriting losses of more than $50 million since 2020.

Rate Hikes: The Florida Office of Insurance Regulation (OIR) last week held public rate hearings for two property insurance companies. First Community Insurance, a subsidiary of Bankers, submitted a use-and-file rate increase of nearly 45% that it implemented last November on about 25,500 homeowners policies. Those policies have since been non-renewed as the company withdraws its homeowners business from five Southern states. If approved by OIR, it would be the carrier’s fourth rate increase in three years. The company cited large litigation costs in Florida, reinsurance rates that increased 83% in 2022 following a 45% increase in 2021, and net underwriting losses of more than $50 million since 2020.

Kin Interinsurance Network is a reciprocal exchange insurance company owned by policyholders. It came before OIR asking approval for rate hikes of 61.5% for homeowners, 84.3% for dwelling, and 103.2% for condominium policies, impacting about 27,000 policyholders in total. Again, rapidly rising reinsurance costs and the need to maintain surplus levels were cited in the rate need.

Meanwhile, the state-backed Citizens Property Insurance Corporation announced last week it will file with OIR an average statewide increase in Personal Lines policies of 14.2% and Commercial Lines policies of 12.3% beginning this fall for a total increase of 14.1% across all lines. Non-primary residences face increases of up to 50% due to the SB 2-A December 2022 reforms passed by the Florida Legislature. Citizens’ Chief Actuary Brian Donovan notes that the uncapped indication across all lines (meaning the amount of rate to be actuarially-sound) is 57.9% and reflects anticipated savings from the SB 2-A reforms. But under the statutory glide path, no individual policyholder may experience a rate increase over 12% in 2023, or 13% in 2024.

Not surprisingly, Citizens’ policy count grew by 51% (386,506 policies) in 2022 and is now 1.22 million, growing by 13,000 in one recent week alone. It’s projected to reach 1.54 million policies by year-end. Its analysis of homeowners multiperil rates conducted in November 2022 found Citizens’ statewide average premium was 44% below the premiums charged by nine private companies representing 24% of the market. (More below)

Emergency Assessment: The United Property & Casualty (UPC) insolvency in February pushed the Florida Insurance Guaranty Association’s (FIGA) previous 9,100 pending claims count to more than 24,500 and has added an estimated $550 million to $650 million liability on FIGA. This will require FIGA to float bonds to fund those claims payouts. Because the insolvency was created by Hurricane Ian, the board on Friday authorized a 1% emergency assessment on all FIGA-member insurance companies that will begin October 1 of 2023 and continue for a year, with automatic renewals after that until the bonds are paid off, which is expected to occur in 2025. This assessment will be a pass-through to policyholders and is pending approval of the OIR.

Emergency Assessment: The United Property & Casualty (UPC) insolvency in February pushed the Florida Insurance Guaranty Association’s (FIGA) previous 9,100 pending claims count to more than 24,500 and has added an estimated $550 million to $650 million liability on FIGA. This will require FIGA to float bonds to fund those claims payouts. Because the insolvency was created by Hurricane Ian, the board on Friday authorized a 1% emergency assessment on all FIGA-member insurance companies that will begin October 1 of 2023 and continue for a year, with automatic renewals after that until the bonds are paid off, which is expected to occur in 2025. This assessment will be a pass-through to policyholders and is pending approval of the OIR.

The 2% normal assessments that FIGA is currently collecting will go down to 0.7% on July 1 and remain at that level until/unless future events require additional assessments. It’s worth noting that FIGA, as many insurance companies are, says it is getting hundreds of new legal cases a day. Some of this is the result of the recent tort reform signed into law, where plaintiff attorneys have been filing suits to get in under the wire with the changes in the law related to attorney fees.

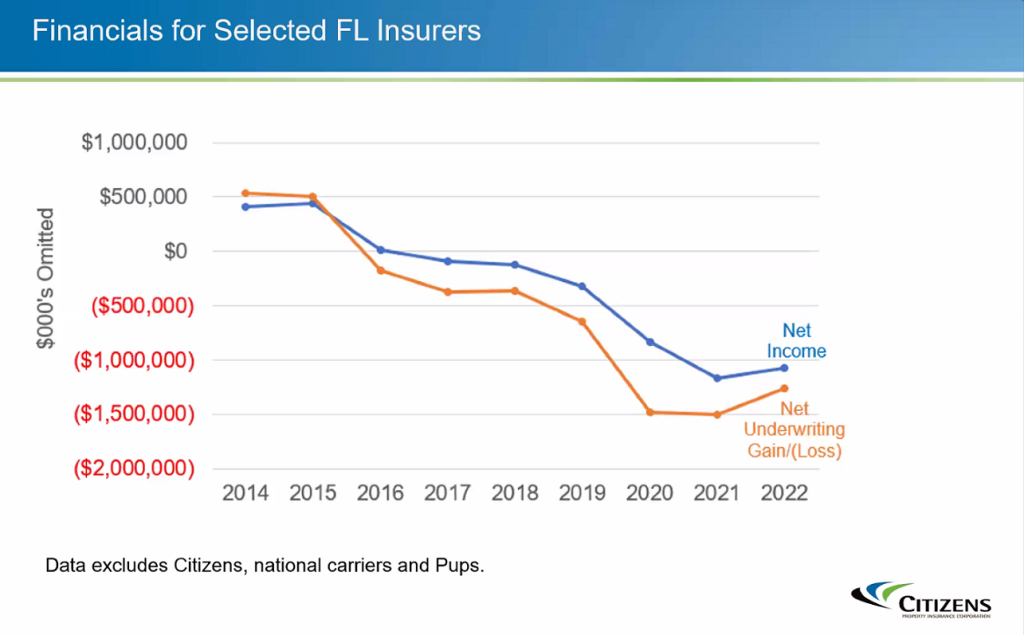

Florida’s Broader Market: During the Citizens Property Insurance Board of Governors meeting last week, Citizens President Tim Cerio committed to depopulating Citizens, attaining actuarially-sound rates “as soon as possible” so as not to compete with the private domestic market, and explained how Citizens is trying to bring private investors and insurance companies to Florida. He also shared the chart below on net income and net underwriting losses for the greater Florida market.

Source: Citizens Property Insurance Corporation 3-29-23

Cerio said that Florida domestics are still in the red, with a negative net income of about $1.2 billion and an underwriting loss of $1.5 billion in 2021. “There is a slight uptick in 2022. We believe it’s about an 8% uptick. We think that’s attributable to rate increases, as well as some more restrictive underwriting strategies but the industry of course is still in the red in Florida,” he told the Board.

Cerio said Citizens has a strong support model for investors and carriers interested in depopulation and “we’re going to work hard to depopulate.” Many policies within Citizens portfolio should be attractive for take-out. As an example, he said 46% of its policies’ roofs are less than 10 years old.

LMA Newsletter of 4-3-23