A push for greater protection

FEMA’s new Flood Insurance Rate Maps that have been premiering in South Florida over the past couple of months have a new feature for some coastal residents. It’s a special designation that some Florida Keys residents fear will increase their insurance rates and lead to costly renovations.

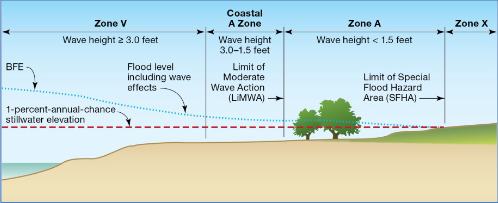

It’s called a Limit of Moderate Wave Action (LiMWA) line. It’s not formally defined in federal flood regulations or mapped as a flood zone on the maps; rather, it essentially creates a new subset within FEMA’s existing Zone AE. According to FEMA, the line denotes how far inland a 1.5 foot or greater breaking wave can go in a 1 in 100 year flood event.

FEMA says its post-storm field visits and lab tests have consistently confirmed that wave heights as low as 1.5 feet can cause significant damage to structures that are built far enough inland that they don’t consider coastal hazards. The new LiMWA line is meant as a wake-up call.

Schematic of Coastal Flood Zones, from FEMA

The chart at right shows FEMA’s National Flood Insurance Program’s existing Zone VE, where the flood elevation includes wave heights equal to or greater than 3 feet; and Zone AE, where wave heights would be less than 3 feet. For those new FEMA maps with a LiMWA line (and not all new coastal maps have them), Zone AE is now split at the 1.5 foot wave height mark, creating a “Coastal A Zone.” According to FEMA, in the Coastal A Zone:

- International Codes® require Zone VE construction standards

- Structures should be built with piling or column foundations

- Structural fill should not be used

- Enclosure under elevated structures should be limited to 299 square feet or less

- Elevation of the lowest horizontal structural member of the lowest floor should be at or above the base flood elevation (BFE)

Communities that adopt Zone VE standards in the Coastal A Zone and reference the LiMWA area receive Community Rating System (CRS) credits, which can lower flood insurance premiums.

Reaction is predictable in the Florida Keys, which just had a series of FEMA Open House events to view the proposed new maps. Some residents and local officials are concerned the LiMWA line could raise insurance rates and make more homes and businesses subject to costly repairs or rebuilding as nonconforming structures.

“A major downside of being moved into one of these VE zones is if your home happens to get significantly damaged in a storm, then you have to become compliant to the new building code,” Steve Russ, vice president of Fair Insurance Rates in Monroe (FIRM), told the Free Press. “Bringing homes into compliance – new windows, new roof – and you end up talking $500 a square foot for renovation. That’s tough.”

Homes within the LiMWA area may be deemed nonconforming, even if newly built, unless they were built above elevation. Both FIRM and Monroe County have hired flood consultants to help them analyze and respond to the proposed flood maps during the next 12 month FEMA review process.

FEMA is trying to better predict risk but the cost of more accurate risk prediction and making homeowners aware of it is a pocketbook issue and sea level rise means a great deal of pocketbook issues.

LMA Newsletter of 2-24-20