‘Elevate Florida’ to ease homeowners cost burden

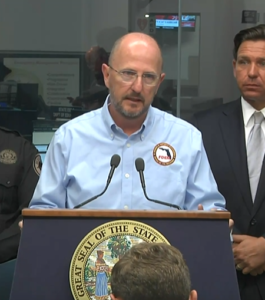

Florida Emergency Management Director Kevin Guthrie

The Florida Division of Emergency Management (FDEM) recently launched its much anticipated Elevate Florida program, the first residential mitigation program of its kind in the Sunshine State. FDEM Director Kevin Guthrie alluded to the relief program late last year, assuring homeowners it would help lower their insurance rates and National Flood Insurance premiums, however, not many details were shared at the time. Now we have a much better picture of the program and how it will enhance community resilience – incentivizing Floridians to prepare for the next big storm, through mitigation reconstruction and the titular process of structural elevation.

A home in Ortley Beach, N.J. is elevated to mitigate and adapt to growing flood risk from storm surge after Hurricane Sandy, April 13, 2013. Courtesy, Sharon Karr/FEMA

To start, homeowners need to apply through the Elevate Florida application portal. So long as a property owner can put up to 25% of the project’s total cost, including initial inspections, the program can cover a whopping 75-100% of flood mitigation costs depending on some other factors, including history of loss. Eligible projects include physically elevating existing structures, mitigation reconstruction for homes that cannot be elevated, wind mitigation, and acquisition with demolition to create open space. A list of qualifications and eligible construction projects can be found here. While federal and state grants are already available to elevate homes, many Floridians cannot afford to put up the required 25%. Guthrie said in December that he worked with FEMA to allow homeowners to apply for federal Small Business Administration (SBA) loans of up to $500,000 (previously only available to Florida businesses) to pay their up to 25% share to get the project underway. The SBA loans have a low interest rate of about 2.8%.

Elevate Florida program process and timeline. Source: FDEM

The timing of the program couldn’t be better, as some homeowners who suffered damage in last year’s hurricanes are facing a rebuilding conundrum. Many didn’t have flood insurance. Then there’s FEMA’s 50% Rule, which requires homes in flood zones that suffer damage of at least 50% of their market value (not including the land) be brought up to current building codes – often involving more costly rebuild and elevation – rather than simple repair. Kevin Guthrie’s visionary leadership in launching Elevate Florida has set a national standard for flood resilience. By leveraging existing federal grant funding, this one-of-a-kind program empowers homeowners to protect their properties through home elevation, reducing future flood risks. Multi-family real estate such as duplexes, condos, townhomes, semi-detached homes, apartments and manufactured homes may also be eligible. “Homeowners do not need to have experienced prior flooding or damage to be eligible. However, applications may be prioritized based on a history of loss,” according to the Elevate Florida website.

In other disaster relief news, the Tampa City Council last week approved a $3.2 million hurricane relief fund to help residents still struggling in the wake of Hurricane Milton. Homeowners will soon be able to apply for money or reimbursements for home repairs and insurance deductible payments. The two largest counties in the Tampa Bay area – Hillsborough and Pinellas – have finished their assessment of damage to businesses and homes, which comes to nearly $5 billion. That’s more than the entire estimated cost of Hurricane Idalia across Florida, Georgia and the Carolinas. You can read more on Tampa Bay’s billions in damages here.