Help in solving higher property insurance costs

New York State Senator Brian Kavanagh. Courtesy, NY Senate

We at LMA like to keep our readership completely up to date on all insurance happenings in the beautiful Sunshine State, but occasionally making a foray out into another state can help us gain some much-needed perspective. The New York State Senate recently held a public hearing regarding the cost and affordability of homeowners insurance, which included 11 separate panels with experts from a range of fields, to help better understand the reasons behind rising insurance costs for New Yorkers.

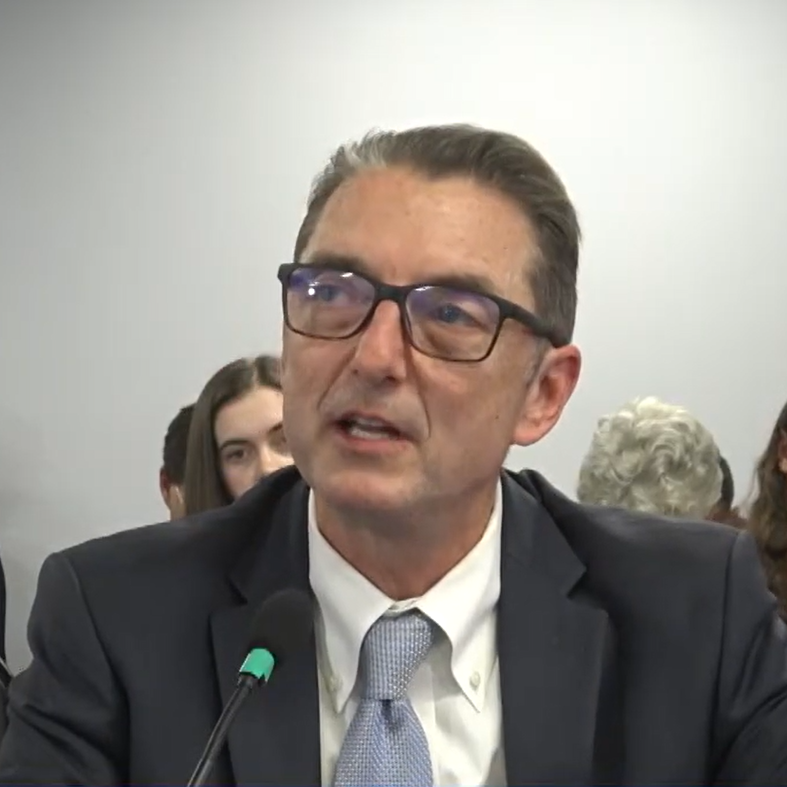

Former Triple-I president Robert Hartwig

The almost nine-hour hearing saw lots of the usual insurance talking points we’re used to, with senators on the committee questioning insurance profits and duty to the policyholder. That included the role of insurance litigation in costs. State Senator Brian Kavanagh (D) said several times over that, “one person’s nuclear verdict is another person’s justice served.” Former Insurance Information Institute president Robert Hartwig addressed these points in his testimony, noting the eventuality of large-scale catastrophes in coastal states like Florida and at large, and how this redefines traditional profits. “We are talking about events that don’t necessarily occur on a decade-by-decade time scale. I can pull out points in history where it looks like the state of Florida’s homeowners insurance market is wildly profitable. Same thing in Louisiana. But even in those states, you can go a decade, 15 years without a major loss and then you have it, okay? And then it occurs. So, it’s not a matter of if, it’s just a matter of when.” And when catastrophes happen, our insurers need to have enough in the coffers to pay out in the billions to their policyholders – a fact that often goes unmentioned in discussions of insurance profits.

APCIA Senior Vice President Robert Gordon

While much of the usual insurance-critical rhetoric and questioning was present, so were insurance industry specialists with an outside perspective (for us Floridians): many pointed to Florida as the standard for how to reform an insurance market at scale. While state Senators Jamaal Bailey (D), James Skoufis (D), and Kavanagh (D) led the charge grilling panelists about California and Florida facing market exits and rising rates in recent years, many insurance specialists were quick to set the record straight. “I would suggest starting … as Florida has done,” opined Erin Collins from the National Association of Mutual Insurance Companies when asked for specific legislation recommendations. “Joint strategies between industry and regulation to bend the loss curve down … the strongest step forward would be to address some of the litigation changes.” This sentiment was echoed by others from the insurance industry, such as Robert Gordon, Senior Vice President of The American Property Casualty Insurance Association (APCIA), who offered his own opinions on how to lower the cost of Empire State insurance. First, he suggested making staged accidents a felony statewide; and second, enacting litigation reform like Florida did in 2022 and 2023. Specifically, Gordon refers to Assignment of Benefits reform and one-way attorney fees that clogged up the system with excessive litigation – what Governor DeSantis and others have called ‘billboard lawyers.’ “(Florida) homeowners rates this last year have been the lowest increase in the nation. They’ve been only 1%, which is post-inflation a real drop. So, we know that reforms can help.”

And the data from OIR is reflecting this correction to the insurance landscape. Just in the past year, Citizens Property Insurance has offloaded more than half a million policies, dropping to its lowest level since 2019, and Florida has seen 17 private property insurance companies enter the market since the reforms. While our Florida market has certainly seen some turbulence in recent years, it can be relieving to know that other big states like New York are looking way down south to find their North Star.