New OIR report shows deepening trouble

Reaction has been very favorable to the comprehensive property insurance market reforms passed by the Florida Legislature in its special session last month. Comments such as “profound” and “historic” and “will really unlock consumer choice,” and “will help to eventually lower rates,” have been made. We’ve created this Key Provisions of 2022 Insurance Consumer Protections & Market Reforms for your handy reference. Florida’s Consumer Insurance Advocate Tasha Carter has also provided this terrific Property Insurance Changes webpage as well. Yet as PEAK6 InsurTech’s Andy McGuire said about the Florida market during our most recent podcast, “This is not a little speedboat here that we can just turn. This is a big aircraft carrier and it’s going to take a little bit to get there, but we’re going to get there.” We’ll have more reaction, including Citizens’ Barry Gilway and Gallagher Re’s Adam Schwebach later in the newsletter.

Florida House Speaker Paul Renner speaking about the newly-passed reforms, December 14, 2022

So where do we go from here and what can we expect in this New Year? First, a new insurance commissioner, as Commissioner David Altmaier and both of his deputy commissioners have resigned (more on that later). Before he left, Altmaier warned that the private insurance market has a “pretty pivotal three or four months coming up to really get a handle on what the financial condition of some of these folks might be.” Florida House Speaker Paul Renner, after the reforms’ passage, said “I’m not suggesting that there won’t still be companies that go out of business after this bill because again, there’s nothing that anyone could do to change what’s happened in the past. And what’s coming next year, early next year, is in large part for the companies that are here, a function of what’s happened in the past that is beyond our control.”

Indeed, the market is not getting better immediately. Six insurance companies went insolvent in 2022 and a seventh (UPC Insurance) went into a regulated policy run-off in December, per this Consent Order from the Office of Insurance Regulation (OIR). This past week, OIR released its biannual Property Insurance Stability Report. New since the July 2022 inaugural report:

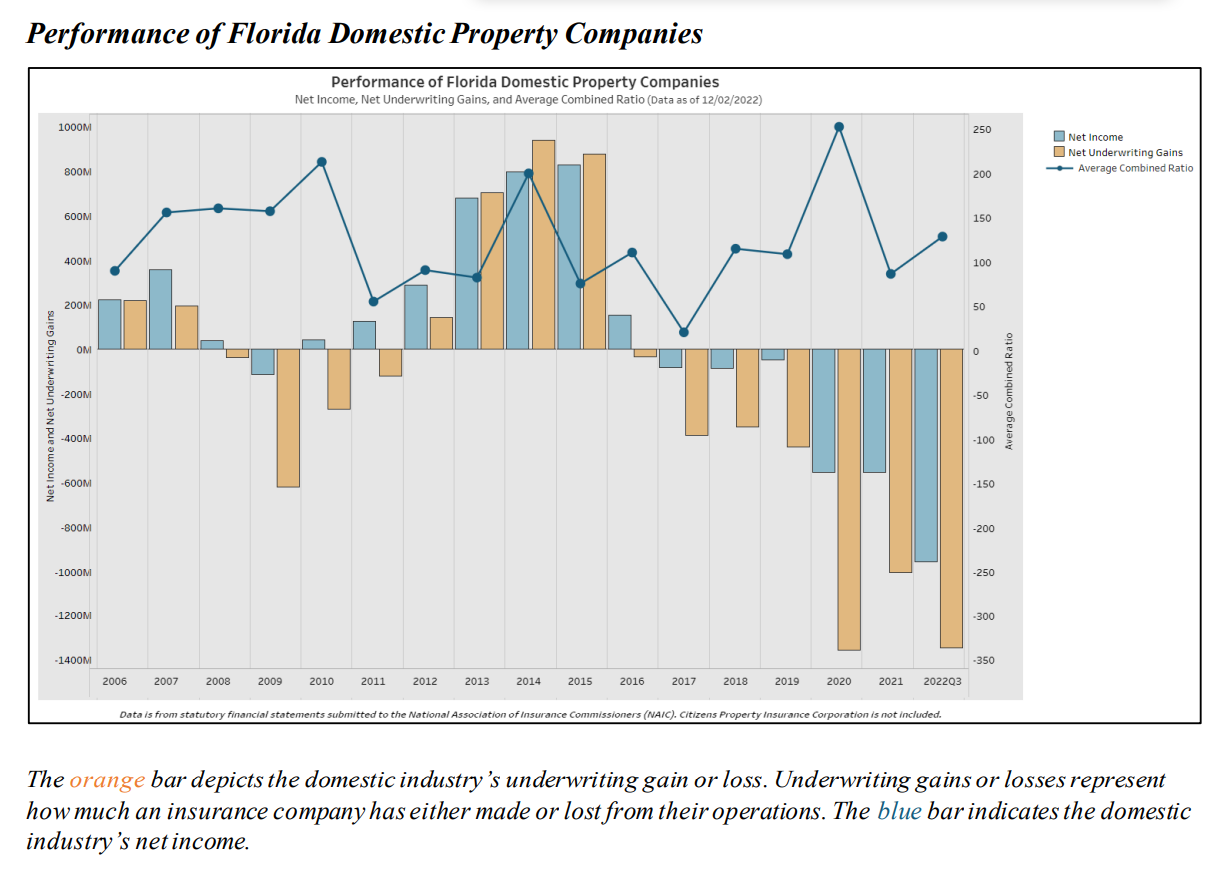

- Losses by Florida domestic carriers plunged even deeper into the red in 2022, with a negative Net Income of almost $1 billion and Net Underwriting Losses of nearly $1.4 billion through December 2 (see chart below), marking the seventh year in a row of losses;

- Adverse loss reserve development (cost of claims greater than reserves allotted) was $676 million in 2020 and $337 million in 2021;

- Florida still has 7% of the homeowners claims yet 76% of homeowners claims lawsuits in the U.S.;

- In 2021, insurance companies paid just under $3.1 billion in direct Domestic Homeowners Defense Costs & Containment Expenses in their claims lawsuits. (Data for 2022 will be available in March 2023);

- Citizens Property Insurance Corporation has just under 15% of the HO3 homeowners and just under 75% of the Wind-Only market:

- Actual info from the newly created Property Insurer Stability Unit within OIR, shows there were 24 insurers referred to the stability unit for enhanced monitoring from July 1-December 22, 2022, with reasons noted in the report. 22 referrals were for violating the ratio of actual or projected annual written premiums (per 7154(4)(e), F.S., enacted in the May 2022 reforms). Of the 24, six were deemed appropriate for enhanced monitoring, with 4 of those for violating the premiums ratio.

From Florida Office of Insurance Regulation, January 1, 2023. Click here to enlarge image

The report also has 2022 Q3 numbers on Legal Service of Process filings, Notice of Intent to Litigate filings, and Civil Remedy Notice filings. It also lists the average premiums charged by county and numbers on reinsurance costs. Commenting on the adverse loss reserve development, OIR wrote, “These numbers reflect the high degree of uncertainty which exists in the property insurance market, which in turn impacts reinsurance capacity and reinsurance rates for insurers.” Sure enough, just this past week, Gallagher Re reported that some cat loss treaties had rate increases of more than 100% at the January 1 renewal, spurred by Hurricane Ian and other catastrophes, but also inflation, which includes inflated claims. Triple-I concurs, noting reinsurance rate increases of 45%-100%.

Meanwhile, Florida consumers continue to experience the sticker shock of the resulting double-digit increases in their homeowners insurance premiums. I spent time over the holidays with news media suggesting policy changes to consider in 2023 to help save consumers money. And I always stress to talk to your agent! My advice is the same to commercial properties: communicate with your broker or your insurance company. They are there to help.

Although the reforms passed in last month’s special session became effective on December 16 (and no, they are not retroactive), some of the provisions require to be actually put in the policy form and until they are – and are approved by OIR – they’re essentially not effective. Market recovery will be a marathon, not a race.

LMA Newsletter of 1-9-23