Plus, the latest changes in mitigation discounts

There are new concerns that recent legislation my leave Florida condominium buildings underinsured, more changes are in the works to homeowners insurance mitigation discounts, plus the state catastrophe fund releases new numbers on past claims and future coverage. It’s all in this week’s Property Insurance News.

There are new concerns that recent legislation my leave Florida condominium buildings underinsured, more changes are in the works to homeowners insurance mitigation discounts, plus the state catastrophe fund releases new numbers on past claims and future coverage. It’s all in this week’s Property Insurance News.

The Port Royale Condominium in Miami Beach. Courtesy Google Earth

Condo Insurance: There’s an alarming trend in Florida’s condo association community in the growth of what are called “loss limit” property insurance policies. It’s the result of the legislature’s passage of HB 913 that was meant to ease some condo complex’s hardship and expenses in bringing their buildings up to code, and awaits the Governor’s signature. However, as we reported in our last edition’s Bill Watch, instead of mandating full replacement cost coverage, the bill states that the requirement that condo associations have “adequate” property insurance “may be satisfied” by purchasing enough coverage for a probable maximum loss in a 1-in-250-year windstorm event per model indications. Loss limit polices allow coverage for less than the property’s total insured value and therefore cost less.

While individuals make decisions every day on which insurance policy is appropriate for them and may choose a policy that doesn’t cover every risk, the difference here is that a condo board of directors makes decisions that impact all unit owners. From our firm’s perspective, we don’t think this is good public policy to make decisions that will underinsure potentially hundreds and thousands of condo unit owners. Florida emergency management chief Kevin Guthrie in a recent speech told his audience that one of his biggest concerns is the structural vulnerability of condos in Southeast Florida. Some brokers, however, have no problem writing loss limit policies, believing we’ll never have a total loss like the Surfside Condo Collapse ever again. Yet, another building was evacuated in the last two weeks. You can read more about this issue in the Insurance Journal, which also includes concerns on appraisal language in the bill. The Florida Office of Insurance Regulation (OIR) is looking into these matters.

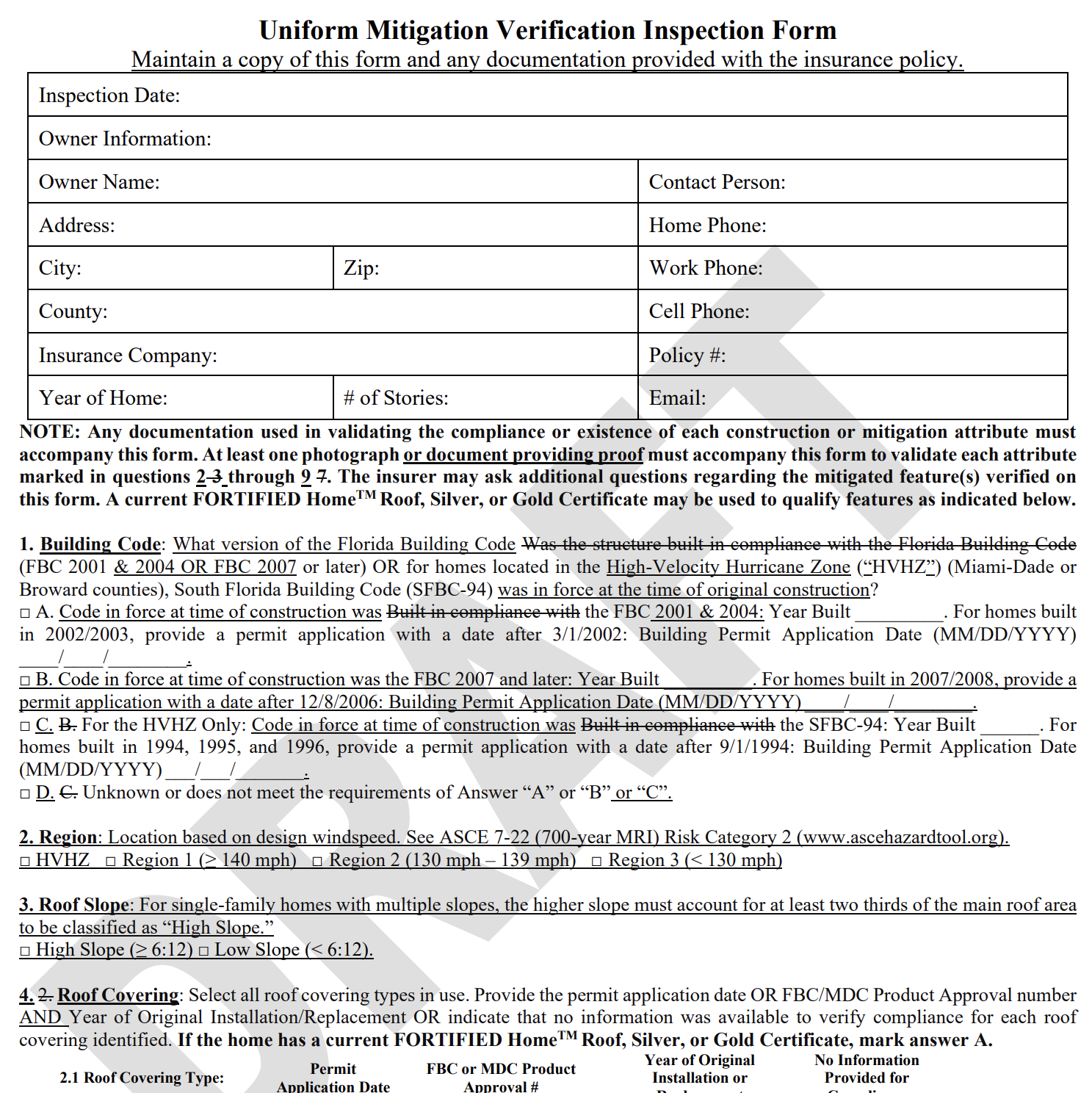

Mitigation Discounts: OIR recently held another workshop with the property insurance and construction industries on the new storm mitigation discount credits and forms its proposing for carriers to use with their policyholders. OIR shared its new iteration of the mitigation verification inspection form (Form 1802) reflecting changes since its February workshop. The form now includes verification on whether the home and roof meet the IBHS Fortified standard, verification of double layers of secondary water resistance and sealed roof decks, and the addition of a roof slope section that classifies “high slope” roofs as requiring at least two-thirds of the main roof be higher sloped. All of the changes generated some concerns among stakeholders. Home inspectors voiced support for the Fortified standard, while the roofing association was against it being included, noting the Florida Building Code standards are stronger. OIR said it will work to finalize changes to this and the other two forms we’ve reported on and hold a final workshop this summer. It did clarify that the new inspection form will be required for all new and renewal policies beginning January 1, 2026.

Cat Fund: The Florida Hurricane Catastrophe Fund, the state entity that provides the initial layer of reinsurance for our property insurance companies, announced last week that it has $6.72 billion in cash for this year’s hurricane season. It also has access to another $3.25 billion in pre-event bonds. The Cat Fund also reported that its estimated losses from last year’s Hurricane Milton were about $3 billion. Losses from Hurricane Helene, which was mostly a flood event, were just $10 million. There were no losses from Hurricane Debby last August. For comparison, its losses from 2022’s Hurricane Ian amounted to $8.5 billion.

Cat Fund: The Florida Hurricane Catastrophe Fund, the state entity that provides the initial layer of reinsurance for our property insurance companies, announced last week that it has $6.72 billion in cash for this year’s hurricane season. It also has access to another $3.25 billion in pre-event bonds. The Cat Fund also reported that its estimated losses from last year’s Hurricane Milton were about $3 billion. Losses from Hurricane Helene, which was mostly a flood event, were just $10 million. There were no losses from Hurricane Debby last August. For comparison, its losses from 2022’s Hurricane Ian amounted to $8.5 billion.