Further federal flood insurance policy delays expected

While the longest government shutdown in US history has finally ended, there are still issues reverberating throughout many industries. Particularly in low-lying Florida, federal flood insurance coverage lapses from the shutdown left many in a tricky situation, with FHA, VA, and USDA loans also stalling, sending shockwaves through the housing market. With the budget agreement reached, everything is now back online, but a six-week backlog in many programs means further delays should be expected. Federal housing programs have their funding restored, and the National Flood Insurance Program (NFIP) has an extension of insurance-writing authority through January 30, 2026.

While the longest government shutdown in US history has finally ended, there are still issues reverberating throughout many industries. Particularly in low-lying Florida, federal flood insurance coverage lapses from the shutdown left many in a tricky situation, with FHA, VA, and USDA loans also stalling, sending shockwaves through the housing market. With the budget agreement reached, everything is now back online, but a six-week backlog in many programs means further delays should be expected. Federal housing programs have their funding restored, and the National Flood Insurance Program (NFIP) has an extension of insurance-writing authority through January 30, 2026.

In an effort to right the ship, bipartisan bill H.R. 5848 has been introduced in the U.S. House by Reps. Troy A. Carter, Sr. (D-LA) and Mike Ezell (R-MS), aptly titled the NFIP Retroactive Renewal and Reauthorization Act. If passed, this legislation would backdate reauthorization for the NFIP to September 30, 2025, and extend the program until December 31,2026, ensuring that renewing policyholders would not be punished with partial-risk assessments or higher rates because of the lapse in NFIP reauthorization during the shutdown. There’s no companion bill yet in the Senate. Any lapse in coverage creates new risk of flood losses, adding to market instability and costing Americans big time with no new federal policies being issued by the feds during the shutdown.

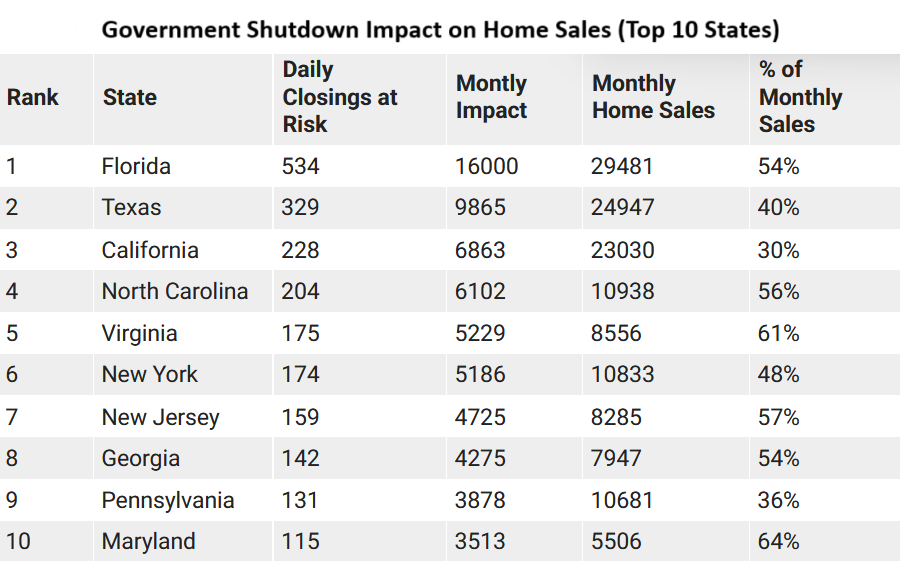

When the NFIP faces lapses, home purchases requiring federally backed mortgages are immediately at risk, if the property is in a designated flood zone, as flood insurance is then mandated. The government shutdown put a whopping 54% of monthly Florida home sales in potential jeopardy according to a HomeAbroad study. Anticipating trouble, the FDIC issued guidance to lenders that loans could proceed without the flood insurance requirement, but the fears of crashing home sales and a nosediving market haven’t materialized, all thanks to private flood insurance stepping up to the plate.

Source: HomeAbroad

Particularly in Florida, where 1.8 million of the 4.7 million total NFIP policyholders reside, private insurance companies had their work cut out for them. But so far, they’ve filled the gap. Nationally, they account for 30% of the total flood insurance market, up from just 12% of the pie nine years ago. Similarly, Florida has grown from 31 listed private flood writers last year to 57 today, according to the Florida Office of Insurance Regulation flood insurance website. In many ways the shutdown served as a market stress test, demonstrating that the housing market can and will continue to function even without the NFIP − with private carriers ready to lend a helping hand to homeowners.