Contractor, lawyer workarounds up, too

Credit: Vladislav Chorniy

As we said, so far, the additional needed insurance consumer protection reforms haven’t been filed yet in the Florida Legislature, but new data supports that they are needed now more than ever. A look at property insurance lawsuit data from the Florida Department of Financial (DFS) shows a big increase in lawsuits filed against the 57 companies writing property insurance in Florida – despite the spring reforms in the SB 76 law.

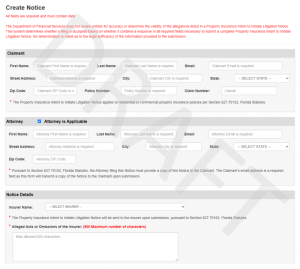

A review of the data shows that the number of lawsuits in the first ten months of 2020 compared to the same period in 2021 rose a tad over 29% (from 52,503 to 67,762) among the 57 writers, which includes the state-backed Citizens Property Insurance Corporation. One of the provisions of SB 76 requires that insurance companies receive a ten-day notice and demand before a lawsuit is filed by first-parties, such as homeowners or commercial building owners. And it gives carriers 10 days to respond in writing to such notices, called Notices of Intent to Litigate (NOITL).

The data shows that in addition to the increase in lawsuits in 2021, there were 8,797 NOITLs filed from July 1 (when the law became effective) through October. These are actions that otherwise would have been filed as lawsuits, which would have resulted in a net increase in lawsuits of 45.8% year-over-year from 2020 to 2021. The good news: thank goodness for the new provision, for its purpose was to allow insurance companies to resolve conflicts which lead to better insurance consumer outcomes and to reduce Florida’s out-of-control litigation. The bad news: an unknown number of these NOITLs are going to become lawsuits anyway, adding to the problem. As noted defense attorney Michael Monteverde observed in our August Florida Insurance Roundup podcast, presuit settlements have become a “chess game”, especially when you factor in attorney fees, which SB 76 also tempered by eliminating the one-way attorney fee statute. (LMA has the public DFS data and we are happy to share with you, if you email me at [email protected].)

DFS adopted the NOITL form on an emergency basis on July 1 and recently held a workshop to get needed feedback from insurance interests. There were some very good suggestions on changing the form that included noting that the claimant is not always a person, adding the street address of the property (as it’s not always the same as the mailing address) and to add a section to input a law firm name and attorney bar number.

DFS adopted the NOITL form on an emergency basis on July 1 and recently held a workshop to get needed feedback from insurance interests. There were some very good suggestions on changing the form that included noting that the claimant is not always a person, adding the street address of the property (as it’s not always the same as the mailing address) and to add a section to input a law firm name and attorney bar number.

One of the bills mentioned in the legislative update of this newsletter that we’re waiting to be hopefully filed would address “Directions to Pay” contracts, used more frequently now by contractors in place of Assignment of Benefits (AOB) contracts, which were further regulated in 2019’s HB 7065 AOB reform law. Ron Hurtibise of the Sun Sentinel recently wrote an insightful article on this practice, Repair contractors’ newest billing strategy leaves homeowners on the hook if insurers don’t pay. Roofers in particular are using this AOB work-around more frequently. Florida’s Insurance Consumer Advocate Tasha Carter is calling on the legislature to extend AOB reforms to these Directions to Pay. We’ll keep you updated!

LMA Newsletter of 11-29-21