Florida market failure warned

Two new research reports are providing hard data and credible insight into two main drivers of Florida’s rapidly rising property insurance rates: increased litigation and unchecked fraud. Both reports outline a series of measures that only the Florida legislature can take to address the problems, protect consumers, and according to one report, stop the “free-fall collapse” of the market.

Two new research reports are providing hard data and credible insight into two main drivers of Florida’s rapidly rising property insurance rates: increased litigation and unchecked fraud. Both reports outline a series of measures that only the Florida legislature can take to address the problems, protect consumers, and according to one report, stop the “free-fall collapse” of the market.

The Fraker Report: Insurance veteran and analyst Guy Fraker recently released his 57-page report Florida’s P&C Market: Spiraling Toward Collapse. Fraker carefully examines the past 20 years of market history, unravels the layers of complexity, and in a gracious and measured manner outlines why litigation is a greater threat to our market than catastrophic storms.

“As an unintended consequence of Florida multiple legislative acts and Florida Supreme Court decisions, litigation practices have placed Florida’s P&C market in a state of crisis regarding viability, accelerating towards collapse, at the expense of Floridian’s financial security,” according to the report.

Among the findings:

- The cost of residential property insurance is 36% greater in Florida than any other catastrophe-prone state, with litigation cost and expense 17% higher. That amounted to $3 billion in lawsuit costs in 2019.

- Fees paid to plaintiff attorneys in Florida claims far exceed the damages paid to policyholders, with fees ranging from 0% to 22,900% of damages.

- A “hidden tax” from litigation amounts to an average $487 per family and is growing annually by 25%.

The report concludes that fixing the problems will “require multiple legislative solutions from this 2021 session….without (which) the residential property insurance marketplace will experience failure.” The report’s front cover features a quote from a plaintiff attorney showing just how important contingency fee multipliers are to the trial bar. Fraker also addresses what’s required to restore investor confidence in the Florida market. The report was the subject of a recent article in the Insurance Journal.

Senator Jeff Brandes

OPPAGA Report: Today at 2:30 pm, the Senate Judiciary Committee, chaired by Senator Jeff Brandes, will hear a presentation examining homeowner and auto insurance fraud in Florida and whether it’s being effectively prosecuted. It comes from the Office of Program Policy Analysis and Government Accountability (OPPAGA), which is Florida’s version of the federal GAO, and will be a preview to a report now due in March.

The report’s six options for legislative consideration:

- Modify fee provisions for attorneys

- Amend assignment of benefits guidelines for auto glass insurance policies

- Reduce the statute of limitations for hurricane/windstorm claims

- Amend the required elements insurance companies must provide in fraud referrals

- Establish the Department of Financial Services capacity to audit insurance company investigative units

- Modify the Anti-Fraud Reward Program

Senator Brandes (R-Pinellas), who prompted the review, has noted that while referrals for property insurance fraud have increased by a cumulative 109%, there hasn’t been a corresponding increase in the annual number of arrests, number of cases presented for prosecution, and successful prosecutions. We will be listening to today’s committee meeting and will report back.

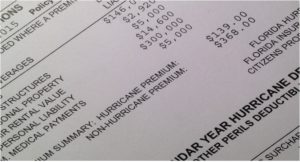

Citizens Insurance: All of these market factors have been playing out in real time at Florida’s insurer of last resort, the taxpayer-backed Citizens Property Insurance Corporation. At a special meeting last week, its Board of Governors approved a proposed 7.2% average rate increase, up from an initial staff recommended 3.7% increase. The extra rate would go to premium set-asides to prevent future assessments in case of catastrophes – assessments that could be borne by Citizens and non-Citizens customers alike across insurance lines. Because of its legislatively-mandated 10% cap on annual rate increases, Citizens is now increasingly attractive in a market that is otherwise seeing much larger double-digit hikes. Its policy count rose from 443,000 to 552,000 in the past year and is projected to reach 630,000 by December.

Citizens Insurance: All of these market factors have been playing out in real time at Florida’s insurer of last resort, the taxpayer-backed Citizens Property Insurance Corporation. At a special meeting last week, its Board of Governors approved a proposed 7.2% average rate increase, up from an initial staff recommended 3.7% increase. The extra rate would go to premium set-asides to prevent future assessments in case of catastrophes – assessments that could be borne by Citizens and non-Citizens customers alike across insurance lines. Because of its legislatively-mandated 10% cap on annual rate increases, Citizens is now increasingly attractive in a market that is otherwise seeing much larger double-digit hikes. Its policy count rose from 443,000 to 552,000 in the past year and is projected to reach 630,000 by December.

Given its growing policy count, the Board also voted to seek permission from regulators to apply non-capped rates to new customers – rates that would be actuarially sound and better reflect true market risk. It’s not clear whether regulators or legislators would ultimately make that decision. Stay tuned!

LMA Newsletter of 2-1-21