Litigation among all carriers up by a third

Assignment of Benefits (AOB) abuse is being blamed in part for Citizens Property Insurance Corporation’s recent 8.2% average rate increase in personal lines which becomes effective this September. The state’s insurer of last resort had delayed submitting its 2019 rate request until last month so it could assess the impact its managed repair program was having on curbing those water loss claims and lawsuits. The answer unfortunately – not enough yet.

Assignment of Benefits (AOB) abuse is being blamed in part for Citizens Property Insurance Corporation’s recent 8.2% average rate increase in personal lines which becomes effective this September. The state’s insurer of last resort had delayed submitting its 2019 rate request until last month so it could assess the impact its managed repair program was having on curbing those water loss claims and lawsuits. The answer unfortunately – not enough yet.

“The bottom line is AOB abuse and runaway litigation threaten to raise premiums for many Citizens policyholders who otherwise would see their rates remain steady or go down,” CEO Barry Gilway said back in September.

Citizens Chief Actuary Brian Donovan said water losses were the primary driver of the rate increase. They expect that 50% of all water claims in 2019 will end up in litigation. Litigated claims cost are almost five times as expensive to settle as non-litigated claims ($9,000 versus $41,000 for loss and loss expenses). If not for the increase in litigation and water claims, Citizens said it would otherwise have recommended a rate decrease for multi-peril HO-3. (Overall, the proposed rate change would instead have been +0.2%., essentially achieving actuarially-sound rates!)

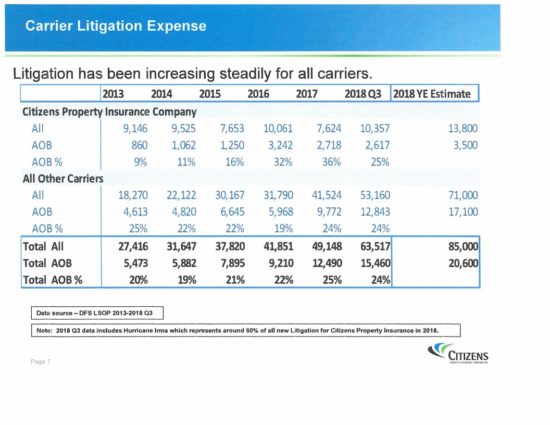

Citizens isn’t alone. Litigation has been increasing steadily for all carriers, as have cases specifically involving AOBs, both of which are expected to have increased by as much as one-third in 2018 over 2017 figures. (see chart at right).

Citizens isn’t alone. Litigation has been increasing steadily for all carriers, as have cases specifically involving AOBs, both of which are expected to have increased by as much as one-third in 2018 over 2017 figures. (see chart at right).

In 2017, while the tri-counties of South Florida accounted for 57% of Citizens’ HO-3 exposure, it accounted for 94% of all litigated claims. 2018 saw an increase in litigation rates in other parts of the state, so the problem is spreading.

Citizens’ Managed Repair Program and the $10,000 sublimit on water claims that became effective last August 1 are expected to mitigate rising costs by reducing litigation. In addition to the average 8.2% rate increase on personal lines, Citizens’ commercial lines rates are going up an average of 9%.

Another amazing statistic is that in 48% of all the litigated cases at Citizens, the case was previously settled and the amount paid never questioned before a suit was brought. So it’s clearly crooked attorneys and contractors and “loss consultants” working with them that are pulling off the scam of the century and Florida policyholders are paying for it.

“It is not that Citizens underpaid any claims. In fact, we have been aggressive in asking policyholders to question any settlement they do not agree with and have actually reached out to policyholders to recommend they put in a claim,” Gilway said at the Citizens’ December Board meeting.

The situation is so dire and the litigation costs so severe, that Citizens has taken the extraordinary step to expedite the settlement of about 6,500 open lawsuits. It’s offering to pay to have appraisers review disputes and try to resolve the cases. And if they can’t, Citizens will also pay for umpires to make binding decisions. (Current policy language has both sides paying for their own appraisers and splitting the cost of an umpire if it comes to that.) Citizens Claims Chief Jay Adams told Board members he hopes to settle about 50% of those lawsuits by going this route.

Citizens, along with private carriers, is urging the Florida legislature to change the one-way attorney fee statute to help curb AOB and other lawsuit abuse. The statute requires insurance companies to pay legal costs even when they win in court, incentivizing plaintiff attorneys to file suit.