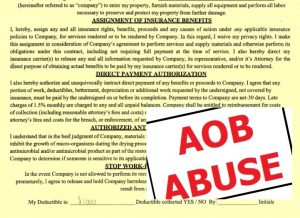

Homeowner beware

One of our readers working in the insurance industry shared the following Assignment of Benefits (AOB) story involving a roofing solicitation. We think it’s an instructive reminder of what’s out there – and why we need to remain vigilant and ask our customers to do likewise. Here’ the letter:

One of our readers working in the insurance industry shared the following Assignment of Benefits (AOB) story involving a roofing solicitation. We think it’s an instructive reminder of what’s out there – and why we need to remain vigilant and ask our customers to do likewise. Here’ the letter:

“Good Afternoon,

I really didn’t think it would only take eight days for me to have a company knock on my door after some severe weather in our area of Tomoka Oaks. This is the first time in the eight years I have lived here that I took time to hear the whole pitch while standing on my front porch. Best I can tell these two guys have a pickup truck and a ladder along with flyers and that is where their expertise ends. I believe they are just out cruising the neighborhoods looking for roofs they can inspect.

So here is the pitch. He hands me the flyer and asks how old my roof is (I say 12 years) and he says do you have Insurance (I say yes). He says yeah we were driving by and think that your roof has damage, we saw four damaged shingles (I say yeah the previous owner had a basketball goal above the garage I removed and repaired four shingles). If you let us inspect it and we can take at least 15 pictures and send them back to our office. My manager will inspect the photos and determine if you need patches or a whole new roof. He said yeah the insurance company wants to pay for a ‘WHOLE NEW ROOF not Patches’ (I’m not sure how I kept a straight face at this point but I did) and you need a whole new roof. He next begins to tell me that all I would have to pay is whatever my deductible is but that isn’t for like 30 days or more, and they have 14 shingle colors to choose from.

All I would need to do is sign a form in two spots, one gives permission to get on the roof and the second gives them permission to contact my insurance company. While they inspect the roof I would need to get my Policy Number and Claim Number (they want me to open a claim before they have even inspected the roof w/boss’ approval). Once the photos are approved (and of course mine will be approved) they would have to set up a time to meet with the insurance company’s adjuster so that he can verify their findings and approve the insurance company to write a check.

This whole process took 3-4 minutes, and although this guy wasn’t a very good salesman I can see where people would easily agree to this. If he was a better salesman I would be scared by the number of people that would agree to this because they made it seem so easy. I hope this helps you see the insured’s side of this situation, without insurance knowledge or previous experience with a contractor signing them up for an AOB. Anyone is susceptible to fairly easily allowing this to happen to themselves.

Knowledge is power. Share stories like this with your friends and family who don’t know how insurance works. The more people that hear these stories, the fewer people will fall into this situation, and the less our industry will have to pay out for claims that should be normal wear and tear upkeep of homes.”

Word to the wise, indeed!

LMA Newsletter of 5-26-20