Deductible should come off the top

The practice by healthcare providers to take the deductible right off the top of total medical expenses before applying the Personal Injury Protection (PIP) formula was upheld last month by the Florida Supreme Court, in a ruling closely watched by insurance companies. It’s an issue that’s generated conflicting decisions by trial courts.

The practice by healthcare providers to take the deductible right off the top of total medical expenses before applying the Personal Injury Protection (PIP) formula was upheld last month by the Florida Supreme Court, in a ruling closely watched by insurance companies. It’s an issue that’s generated conflicting decisions by trial courts.

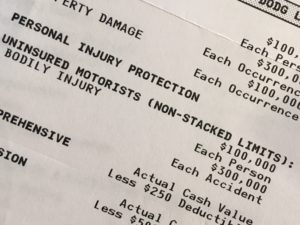

The Supreme Court unanimously ruled against the insurance company in Progressive Select Insurance Company v. Florida Hospital Medical Center which focused on how the deductible should be applied under Section 627.739(2), Florida Statutes, when PIP benefits are sought by a healthcare provider, as the assignee of an insured.

In this case, Jonathan Parent was in an automobile accident and his expenses exceeded his auto policy’s $1,000 deductible. He assigned his PIP benefits under his Progressive policy to Florida Hospital. The hospital took the total charge of $2,718 and subtracted the $1,000 deductible, then applied the statutory reimbursement limitations (Section 627.736(5)(a)1.b and Section 627.736(5)(a)1) to arrive at the $1,068.60 that it billed Progressive.

Progressive instead, refigured the bill, using a different method. The insurance company took the $2,718 charge, applied Section 627.736(5)(a)1.b, then subtracted the $1,000 deductible, before applying Section 627.736(5)(a)1 limitations to arrive at an amount due of $868.60 – a $200 difference.

The hospital sued for the $200 difference and a trial court agreed in a summary judgement in favor of the hospital and which the 5th District Court of Appeal upheld.

The Supreme Court agreed with the 5th DCA that the deductible should be applied to the overall charges. “A plain reading of the statutory provisions makes clear that the deductible must be subtracted from the provider’s charges before the reimbursement limitation is applied,” wrote Chief Justice Charles Canady in the 15-page opinion.