Record premiums, transactions

As Florida’s property insurance companies have pulled back from the market, the Excess and Surplus Lines (E&S) carriers have been filling the gap in a big way, recording record overall premiums and transactions here in Florida and across the country.

As Florida’s property insurance companies have pulled back from the market, the Excess and Surplus Lines (E&S) carriers have been filling the gap in a big way, recording record overall premiums and transactions here in Florida and across the country.

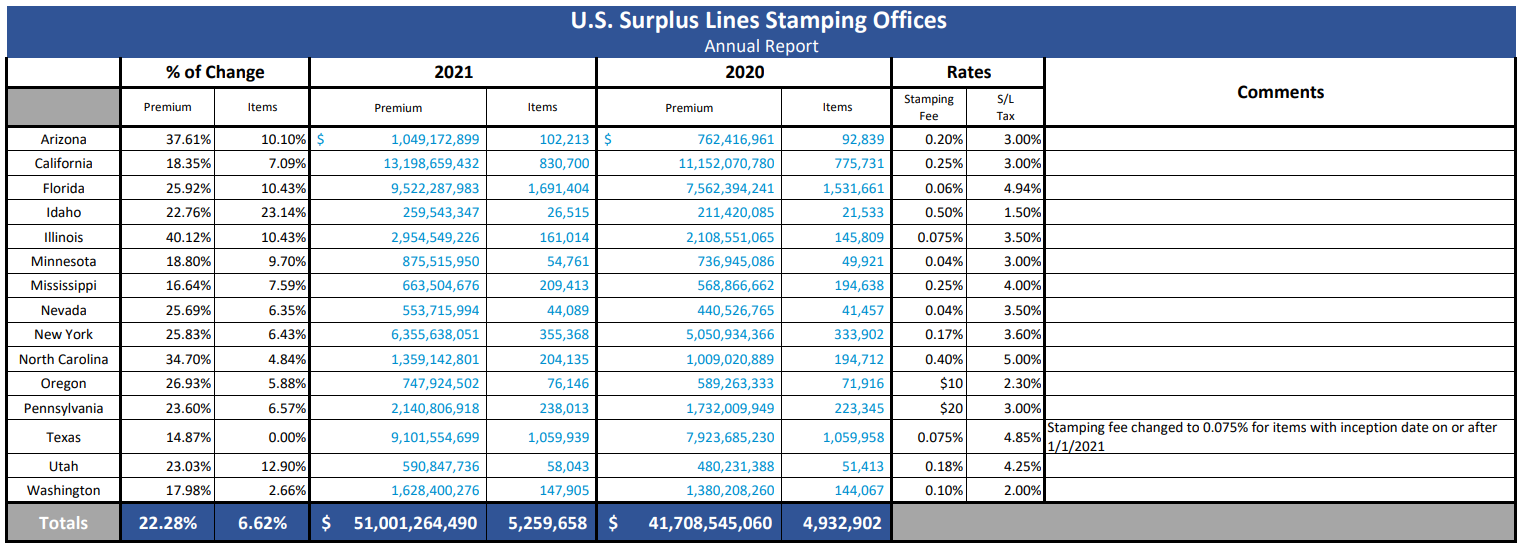

The Wholesale & Specialty Insurance Association (WSIA) reports that surplus lines premium increased 22% (to $51 billion) and transactions increased 6.6% (to 5.3 million) in 2021 across the 15 states with stamping offices. The Florida Surplus Lines Services Office reported an almost 26% increase in premiums in 2021 (to $9.5 billion) over the previous year ($7.5 billion) with a 10.5% increase in transactions (see chart). Each of the 15 offices across the country had double-digit growth last year, with Illinois the highest at over 40% across a variety of insurance lines. The offices accounted for 63% of all U.S. surplus lines premium volume in 2020 and are a helpful indicator of the total E&S market.

Source: Wholesale & Specialty Insurance Association (Click here to enlarge)

“The data is quite telling and confirms what many industry leaders have been saying for the last two years,” said Dan Maher, Executive Director of the Excess Line Association of New York. “Premiums on renewals have increased substantially and at the same time the admitted market has retrenched in several areas, which is causing business to shift to the E&S market. The shift is across numerous lines of business from property with CAT loss exposures to liability risks such as excess, umbrella, D&O and cyber where social inflation and new exposures are of serious concern.” Maher noted in the association’s news release that new capacity in the E&S market “should moderate or stabilize pricing as that capacity is deployed in 2022.”

One of the ways that Florida lawmakers are trying to help the state’s beleaguered admitted property insurance market is by making insurance more available by easing restrictions on surplus lines carriers. The legislature this session is considering a bill that would allow domestic surplus lines carriers to write Florida policies as an “eligible surplus lines insurer” and allow specified non-admitted carriers to do likewise. Another bill would allow surplus lines companies to do takeouts of Citizens Property Insurance policies, just as admitted carriers can do.

LMA Newsletter of 1-31-22