Everyone has felt the strain on homeowner’s insurance, something that has been steadily mounting nationally since the COVID-19 pandemic. A recent report from the Insurance Information Institute (Triple-I) looked for trends and dynamics and found that persistent inflation lingering from the COVID outbreak when combined with increasing natural catastrophe losses and widespread legal system abuse are responsible. But the problem is much more complex than just these broader categories, with more than just the COVID outbreak to blame.

Everyone has felt the strain on homeowner’s insurance, something that has been steadily mounting nationally since the COVID-19 pandemic. A recent report from the Insurance Information Institute (Triple-I) looked for trends and dynamics and found that persistent inflation lingering from the COVID outbreak when combined with increasing natural catastrophe losses and widespread legal system abuse are responsible. But the problem is much more complex than just these broader categories, with more than just the COVID outbreak to blame.

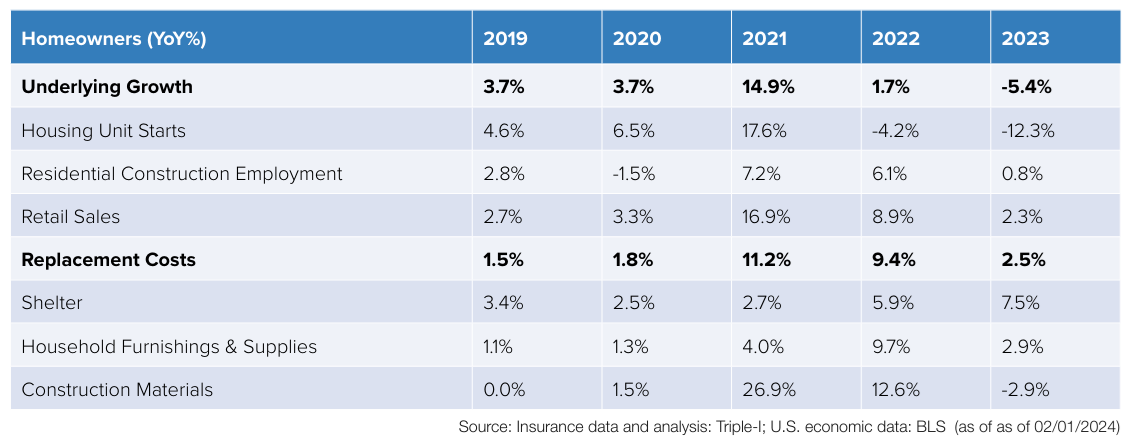

For starters, there has been a marked increase in the cost of almost all material goods since the initial outbreak of COVID and well past its containment – construction materials included. When insurance companies need to pay out to policyholders for a rebuild, all these costs are factored in, and as such, the premiums also rise. According to Triple-I’s economic analysis, replacement costs have skyrocketed 55% between 2020 and 2022. Some of these costs have come down since 2022. Forbes reports lumber prices have dropped 75% since the record-breaking May 2021 numbers because it’s just too expensive for most Americans to even think about building or renovating a house right now.

But those who are building, moving, and buying seem to be heading South, despite an uptick in catastrophes in both the Southwest and Southeast in recent years. Triple-I notes that losses from natural disasters have increased almost tenfold in the same time span, especially in these regions, something that will only be exacerbated by growing coastal development we’re seeing in states such as our own.

Another problem of note that has been the topic of discussion for years in Florida is bad actors in both the insurance and legal industries. As certain groups continue to push litigation as the first course of action, Sean Kevelighan, CEO of Triple-I has some choice words. “This unfortunate phenomenon is a problem that needs more attention and fixing… Third-party litigation funding has become a multibillion-dollar global asset class of dark money, in which the likes of foreign governments can even invest and profit from the U.S. legal system.”

As premiums continue to fall behind rising costs, the US insurance industry has struggled to maintain profitability, a burden that ultimately befalls homeowners nationwide. In 2023, the insurance industry’s net combined ratio of 110.9 was the worst on record since 2011 and meant that insurance companies were paying almost $1.11 in claims and expenses for each premium dollar they received. Triple-I noted a rebalance of the inflation rates could be particularly helpful for homeowner’s insurance growth and to reignite home sales. “Insurers play a vital role in the economy, protecting against financial losses due to unforeseen events such as natural disasters,” said Kevelighan. “However, if insurance companies were to become unprofitable and unable to meet their financial obligations, it leaves policyholders without coverage when they need it most.”

See you on the trail,

Lisa

LMA Newsletter of 7-22-24