Insurance 101 + basic math

Citizens Property Insurance Corporation is defending its treatment of hurricane claims, in the wake of a newspaper article that the state-backed insurer of last resort didn’t pay more than half of its 2023 claims, more than any private insurance company in the state last year. The Tampa Bay Times reported that “nearly 17,000 claims, or 50.4%, filed with Citizens Property Insurance, were either denied for a variety of reasons or didn’t meet the policyholder’s deductible.” The reporting was based on an analysis by Weiss Ratings of Citizens’ 2023 filed claims.

Citizens Property Insurance Corporation is defending its treatment of hurricane claims, in the wake of a newspaper article that the state-backed insurer of last resort didn’t pay more than half of its 2023 claims, more than any private insurance company in the state last year. The Tampa Bay Times reported that “nearly 17,000 claims, or 50.4%, filed with Citizens Property Insurance, were either denied for a variety of reasons or didn’t meet the policyholder’s deductible.” The reporting was based on an analysis by Weiss Ratings of Citizens’ 2023 filed claims.

Jay Adams, Chief Insurance Officer, Citizens Property Insurance. Courtesy, Citizens

Citizens Chief Insurance Officer Jay Adams, addressing its Claims Committee last week, said “some of the facts are misleading” in the article, noting a variety of reasons a claim may be closed without payment, regardless of the year in question:

- Hurricane deductibles range from 2% to 10%, “so they’re pretty significant deductibles,” Adams noted.

- The claim may have been for flood or storm surge, which is not covered by Citizens’ policies.

- The policy may not have been in force. “If a carrier came in and depopulated some of the policies that were involved in one of these storms, that particular carrier after they assume the policy, is responsible for the claim handling. So a lot of the policyholders get confused during the process, and they will submit a claim to Citizens,” Adams said.

He noted that it’s not accurate to use the term “denied” if the claim fell below the deductible limit. “So you might say, ‘Is there truth behind Citizens probably having the highest close without payment rate?’ And I think that’s probably very factual, yes, but why would that be? Well, Citizens is the insurer of the last resort. We are writing the most risky policies in the state. We are the ones that are writing the coastal homes. We’re the ones that are writing the wind-only coverage. And all of these policies have very high all other peril (AOP) deductibles. So if it was not a hurricane, it would fall under the AOP, and those deductibles are probably higher than some of the other carriers that are writing across the state, which, again, loss may fall under that amount. And then our hurricane deductibles, I would venture to say, are also probably more substantial than a lot of the other carriers,” said Adams. Citizens is also the largest property insurance company in the state, with 1.04 million policies as of November 15.

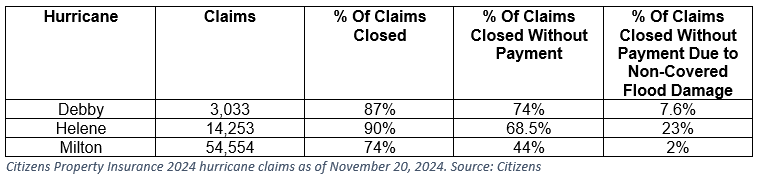

Adams shared the information in the table below on claims to date received by Citizens from this year’s three hurricanes. The number that fell below the deductible was not readily available.

Adams also said Citizens is highly regulated, between state audits and examinations by the Florida Office of Insurance Regulation (OIR), “and we come out with pretty good grades all the time for claim handling.” He said Citizens made an effort to expedite any claim denial from the recent hurricanes, so that a policyholder could provide the proof of denial to FEMA in order to qualify for federal disaster assistance for damages. You can read more in our complete Claims Committee report here.

Another claim by Weiss Ratings has come to the attention of Florida insurance regulators. OIR last month issued subpoenas for all records used to substantiate founder Martin Weiss’ “dire predictions” that Florida insurance companies are “on the brink of a collapse” and that homeowners are at a “high risk” of not being paid for their claims related to Hurricanes Helene and Milton. He made such claims in articles on the firm’s website. You can read more in this Miami Herald story. We again applaud our state regulators for investigating this false narrative relied on by some news media and legislative policymakers. The truth will prevail.

Another claim by Weiss Ratings has come to the attention of Florida insurance regulators. OIR last month issued subpoenas for all records used to substantiate founder Martin Weiss’ “dire predictions” that Florida insurance companies are “on the brink of a collapse” and that homeowners are at a “high risk” of not being paid for their claims related to Hurricanes Helene and Milton. He made such claims in articles on the firm’s website. You can read more in this Miami Herald story. We again applaud our state regulators for investigating this false narrative relied on by some news media and legislative policymakers. The truth will prevail.

In other news, Citizens forecasts a year-end policy count of around 900,000, which would mark the first time since 2021 that the policy count went below one million. This is mostly due to depopulation efforts by private insurance companies. October saw the highest number of policies assumed in Citizens’ depopulation history at 237,323 policies. November has seen another 57,355 policies assumed. You can read more in our complete Market Accountability Committee report here, including the expected full launch in mid-January of Citizens’ new clearinghouse for agents.