Big increases for the most risky homes

In our last newsletter we reported that FEMA had just released more data on the National Flood Insurance Program’s (NFIP) Risk Rating 2.0: Equity in Action, its new model for better pricing risk to rate. Since then, several news outlets across Florida have been using the zip code lookup feature in these recent exhibits to see exact pricing – and the results are significant over time. The caveat is that increases are capped at 18% annually until the full rate is reached.

In our last newsletter we reported that FEMA had just released more data on the National Flood Insurance Program’s (NFIP) Risk Rating 2.0: Equity in Action, its new model for better pricing risk to rate. Since then, several news outlets across Florida have been using the zip code lookup feature in these recent exhibits to see exact pricing – and the results are significant over time. The caveat is that increases are capped at 18% annually until the full rate is reached.

WLRN-FM in Miami reports that for the worst-hit ZIP code in South Florida, 33469, a stretch of coastal Palm Beach County that covers parts of Jupiter and Tequesta, it will mean a 342% premium increase, on average. In the most expensive ZIP code for flood insurance in South Florida, 33149, which covers Key Biscayne, the average premiums will rise north of $7,000 a year.

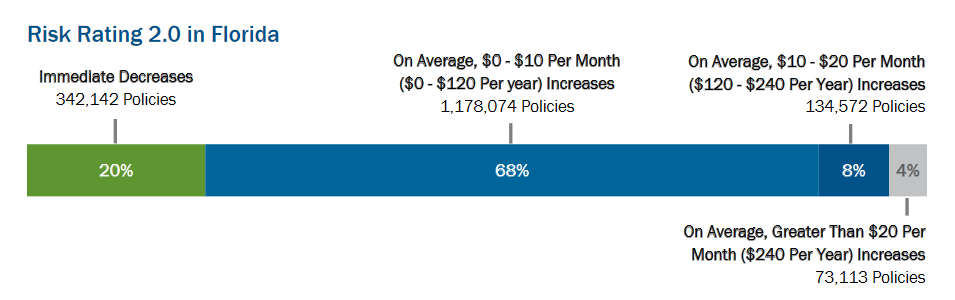

These, of course, are the outliers in the data, those living in the most vulnerable areas of the state, probably representing about 4% of Florida policies. FEMA in premiering the program in 2021, said that 20% of the NFIP policies in Florida will see immediate premium decreases, with another 68% seeing increases of $0-$120 annually, and another 8% seeing $120-$240 annual increases, per the chart below. Florida has by far the largest number of federal flood insurance policies: 1.6 million of the total 4.7 million.

Source: FEMA

In the most potentially flood-prone counties of all – Pinellas and Hillsborough – the Tampa Bay Times reports that on average, among coastal and inland properties, NFIP rates will increase over time by 112% and 125% respectively under Risk Rating 2.0. FEMA, in moving from the one-size-fits-all flood maps that were sometimes decades old to this new system utilizing modern house-specific data, insists 2.0 better prices risk to rate in a program that has been running multiple billion dollar deficits for the past 15 years.

“The new methodology allows FEMA to equitably distribute premiums across all policyholders based on the value of their home and the unique flood risk of their property,” FEMA wrote in an April 2021 press release. “Currently, many policyholders with lower-value homes are paying more than they should and policyholders with higher-value homes are paying less than they should.”

Flood waters remained to the bottom of car doors and nearly to front door knobs of homes in Ft. Lauderdale the morning after the big rain, April 13, 2023. Courtesy, Broward S.O.

Although the rate increases will be gradual for renewal policyholders, new policyholders since April 2022 have enrolled at the full Risk Rating 2.0 rate. With the Florida Legislature requiring Citizens Property Insurance policyholders with HO3 policies to get flood insurance – whether federal NFIP or the growing number of private writers – look for the policy count to go up. We think that’s a good thing. The greater public benefit is more Florida residents with flood insurance that for most, is very reasonably priced, offering protection from the increasing ravages of flooding most recently demonstrated in Broward County’s April floods and last September’s Hurricane Ian.

LMA Newsletter of 5-22-23