3 points on Florida’s insurance market woes

Efforts fell flat on their face this past week by those trying to refute the damning data from the National Association of Insurance Commissioners (NAIC) about Florida’s lawsuit factories. It was that NAIC data that Florida Insurance Commissioner and NAIC President David Altmaier cited in his recent letter to legislators: that our state has 8% of all homeowner’s claims in the U.S., yet 76% of all homeowners’ claims lawsuits. It’s caught the attention of the Wall Street Journal, which published this article yesterday on the impact to Florida’s real estate market.

Efforts fell flat on their face this past week by those trying to refute the damning data from the National Association of Insurance Commissioners (NAIC) about Florida’s lawsuit factories. It was that NAIC data that Florida Insurance Commissioner and NAIC President David Altmaier cited in his recent letter to legislators: that our state has 8% of all homeowner’s claims in the U.S., yet 76% of all homeowners’ claims lawsuits. It’s caught the attention of the Wall Street Journal, which published this article yesterday on the impact to Florida’s real estate market.

Birny Birnbaum, executive director of the Center for Economic Justice, said he took a look at the data and submitted his own review to the House Commerce Committee, on behalf of the Florida Consumer Action Network, whose website lists the Florida Justice Association, the state trial lawyers, as among its organization members. Birnbaum tried to argue that “any homeowners insurance litigation problem can be tied to a small number of insurers and is not an industry-wide problem demanding wholesale changes to the civil justice system.”

Commissioner Altmaier’s Office of Insurance Regulation (OIR) responded in an Orlando Sentinel article that Birnbaum’s review “misrepresents the data in OIR’s April 2nd analysis, ignores previously published information, and provides absolutely no foundation for its speculative alternative analysis.” OIR spokeswoman Alexis Bakofsky wrote, “The data shows unequivocally that Florida is experiencing far more litigation than the rest of the nation. Consumers are paying for this excessive litigation in the form of higher rates, reduced options for coverage, and market uncertainty.”

Which leads us to the very same 3 points that many knowledgeable insurance professionals have been sharing with us for months now and that we share with you here:

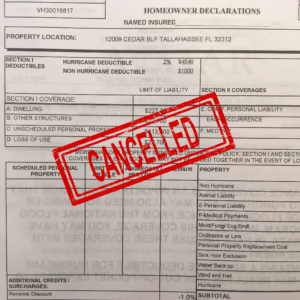

- Price. Consumers have seen the price increases in their mailbox and additional increases are sure to follow if the legislature doesn’t act. Many insurance companies are projecting double-digit yearly increases for the next several years. One company reports a cumulative price increase over 100% since 2017. The bulk of these increases are only required to cover the increased costs of litigation, most of which is driven by Florida statutes which favor attorneys.

- Choice. As the number of companies writing business decreases there is less competition which usually leads to higher prices and fewer choices for customers with good risks.

- Availability. If you have a single roof over ten years old, your only available coverage will be Actual Cash Value. If you have a home built prior to 1980 the only coverage you will be able to get will exclude water damage. If you live near the coast, the state-backed Citizens Property Insurance might be your only option because of the cost of reinsurance. You can thank the roofers and attorneys for those restrictions in coverage.

Insurance consumers may not care about the disreputable attorneys or whether insurance companies go bankrupt. But they do care about a system that’s not fair. 90% of policyholders settle their claims without involving an attorney. That 90% is paying for the other 10% of the claims, with very little of that benefit trickling down to the homeowner with a claim.

We haven’t seen any sound arguments against the proposed legislative changes other than they “restrict access to the courts.” That’s utter nonsense. There are over 100,000 licensed attorneys in Florida and if you need one, they are a phone call or text away. If you don’t remember who they are, you haven’t been driving to work to see the billboards or watching TV.

The increase in price, the reduction in choice, and the elimination of coverage are the real results of doing nothing.

LMA Newsletter of 4-26-21