Citizens Property Insurance heading for pre-2003 policy count

Florida Insurance Commissioner Michael Yaworsky testifies before the Florida House Insurance & Banking Subcommittee on November 18, 2025. Courtesy, The Florida Channel

Florida Insurance Commissioner Michael Yaworsky went before both insurance committees of the state legislature this week to report the positive outcomes to date of the legislature’s 2022 and 2023 reforms. It happened on the same week that the state-created Citizens Property Insurance Corporation reported a record number of polices shifted back to the private market, with an expected year-end policy count at pre-2003 levels.

Legislative Hearings

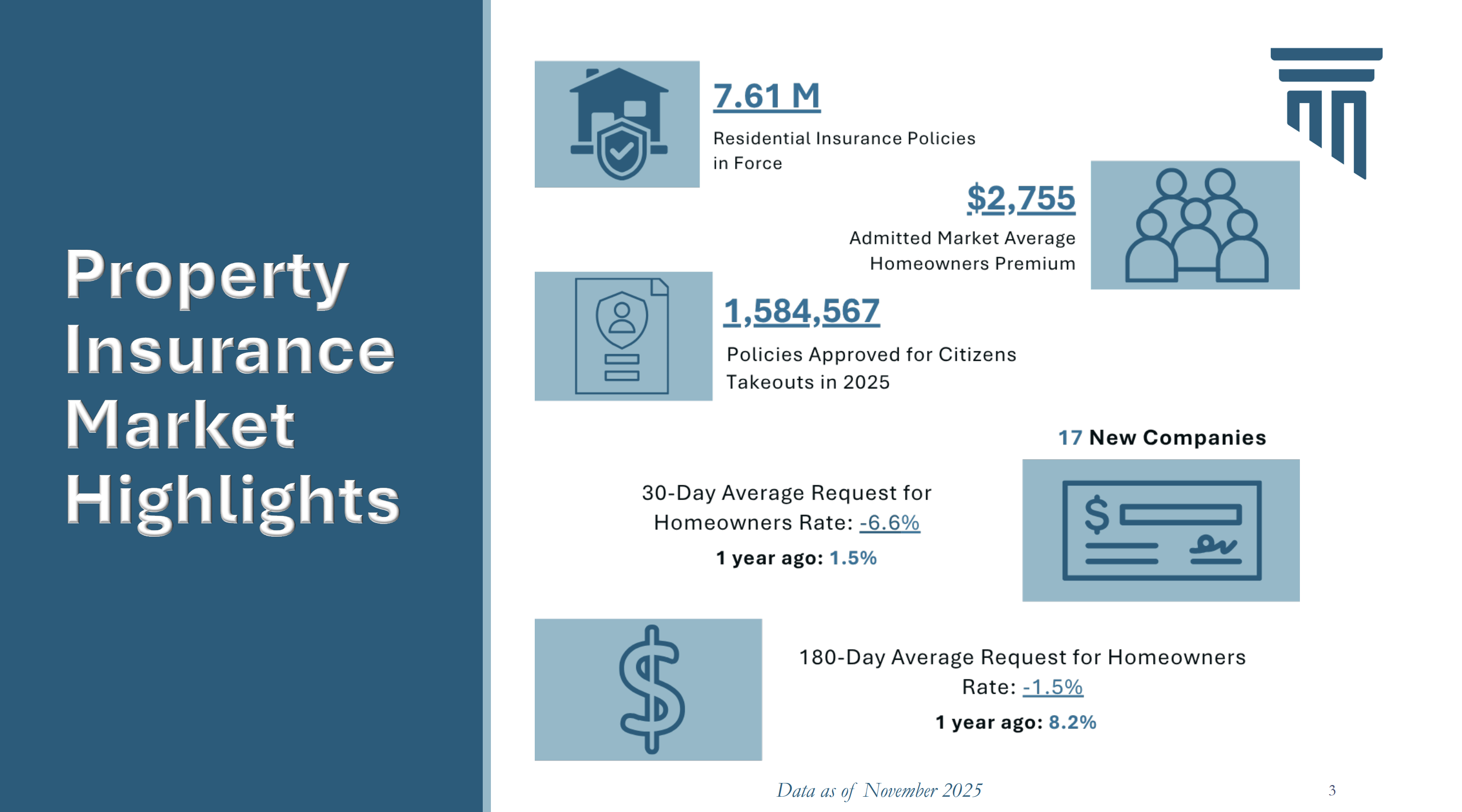

Yaworsky’s message to the House Insurance & Banking Subcommittee and the Senate Banking and Insurance Committee was clear: the consumer and litigation reforms have worked, resulting in rate decreases in both property and automobile insurance, more available homeowners insurance, lower reinsurance rates, a return to profitability for insurance companies, and a successful depopulation of taxpayer-backed Citizens Insurance. He shared the below graphic with lawmakers, showing the 30-day average homeowners rate requested by carriers is -6.6%, compared to +1.5% a year ago, and a considerable turnaround from the double-digit increases of 2020-2022. He said he expects rate decreases to continue and he set the record straight again that the average annual homeowners premium in Florida is $2,755 − not the $4,500 to $8,000 appearing in some media publications. Yaworsky told legislators that the same litigation reforms have resulted in filed auto rate decreases of up to 17.6%.

From: Florida Office of Insurance Regulation

Yaworsky reminded lawmakers that the reforms also increased the authority and power of the Florida Office of Insurance Regulation (OIR), resulting in greater accountability by insurance companies. This includes more market examinations and investigations, with the power to take corrective action to protect insurance consumers from unlawful or harmful business practices. He said that OIR’s Market Conduct Unit has initiated over 100 examinations, completed more than 340 investigations, and secured $14.5 million in consumer restitution.

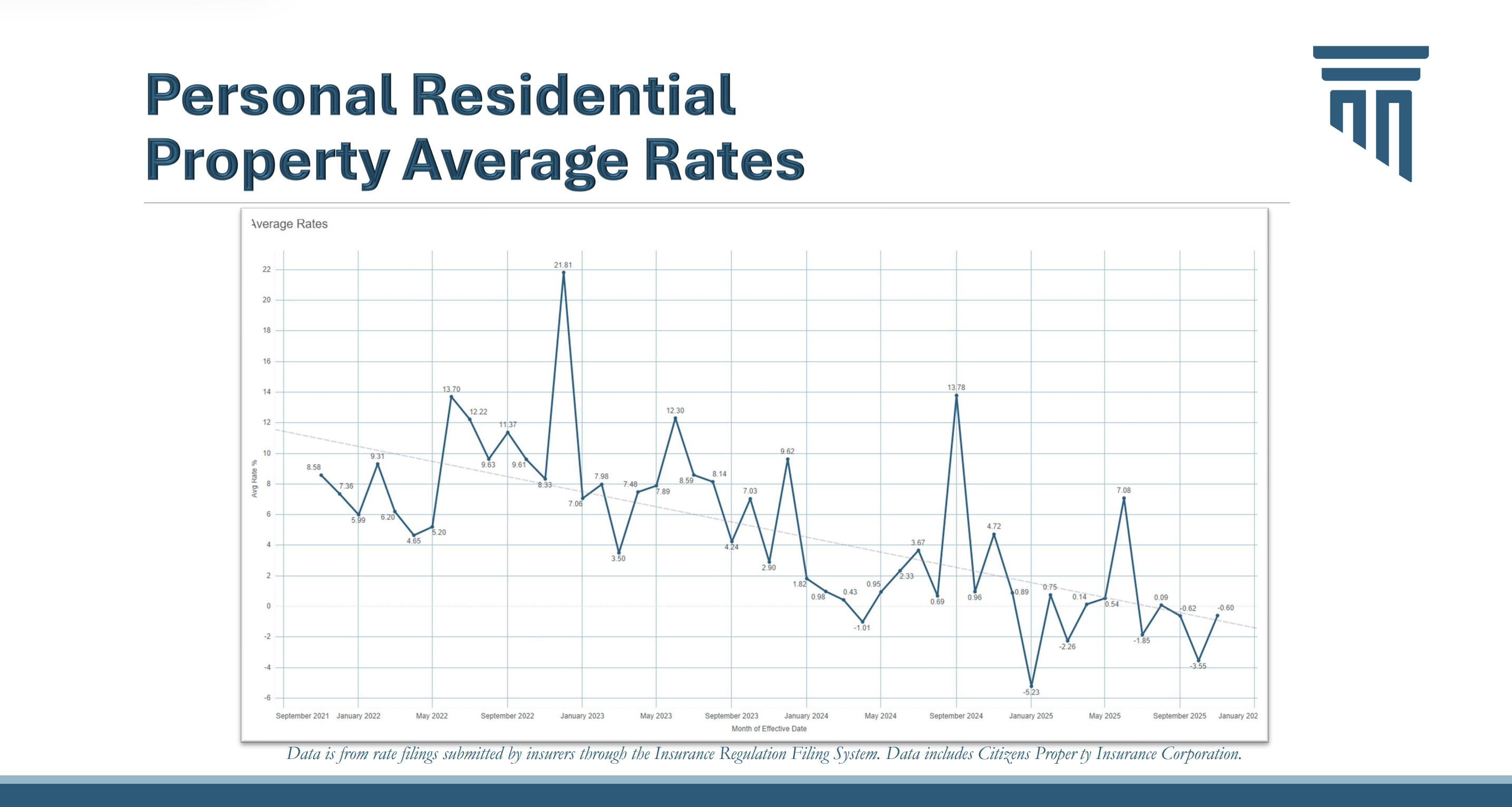

He also provided data showing that the reforms have re-righted the property insurance market as a whole. Florida’s insurance companies writing our 7.6 million residential policies are on solid financial footing, with positive net income and underwriting gains, and are once again profitable. Yaworsky stressed that’s a big turnaround from 2017-2022, when net income and underwriting gains were negative. Average personal residential property insurance rates are decreasing as a result, per the chart he shared below. The 180-day average homeowners insurance rate request is -1.5%. Yaworsky told lawmakers that while inflation is putting upward pressure on rates and has a direct impact on premiums, rates are still coming down.

From: Florida Office of Insurance Regulation. Click to enlarge

Yaworsky’s slide deck from this week’s committee meetings include the latest Florida market information on policies in force, the admitted and non-admitted companies’ market share, industry performance in terms of net income, underwriting gains, and combined ratios, total insured value, direct written premium, and more.

Yaworsky took questions from lawmakers, some of whom are property insurance lawyers, skeptical about whether the legal reforms went too far. He was asked whether the reforms, including the elimination of one-way attorney fees for plaintiff lawyers, were preventing consumers from hiring lawyers to sue in claim disputes. Yaworsky responded that he and OIR have seen no systemic evidence of that. He also pointed out that Florida still has a disproportionate share of homeowners insurance litigation, despite the reforms, although it’s getting better. OIR’s latest Property Insurance Stability Report shows that in 2023, Florida had 9.7% of the nation’s homeowners insurance claims yet 71.5% of the homeowners insurance lawsuits.

Yaworsky also took questions on:

- The Florida Hurricane Catastrophe Fund – He was asked whether the current retention point and capacity of the Cat Fund should be lowered to make affordable reinsurance more available for carriers. Yaworsky said that some “serious thinking” needs to be done about the Cat Fund’s role but with thoughtful deliberation.

- Managing General Agents (MGAs) & Insurance Company Affiliates – He was asked whether OIR is looking into the financial arrangements between property insurance companies and their parent companies, including affiliate payments of MGA’s, an issue raised earlier this year. Yaworsky replied that OIR is not, as one was not funded in the last legislative session, and that the OIR study from 2022 was not valid. He said OIR is mindful of capital flow between insurance companies and their parent corporations and included language to define “fair and reasonable” fees in an agency bill last session. Ironically, that bill died when lawmakers inserted late language to repeal the litigation reforms.

- OIR Proposed Legislation for 2026 – Yaworsky didn’t share any particular proposals that he and OIR may be formulating for the upcoming legislative session that begins in January 2026, but stressed four goals that OIR is focusing on: Home resiliency and code plus adoption (to achieve premium savings for homeowners who make improvements); Strengthening OIR; Policyholder protection and education (including an overhaul of the myriad of disclosures included in policies); and a Stable, predictable, and reliable marketplace.

Yaworsky said OIR is looking into how Artificial Intelligence is being used by insurance companies. He also mentioned that OIR is conducting a study on the seven property insurance companies that went insolvent between 2021-2023.

Citizens Property Insurance

The commissioner’s presentations to legislative committees occurred in the same week that Citizens Property Insurance shared that its depopulation of policies into the private market has worked so well that Citizens is now forecasting a year-end policy count of about 395,000 policies – a count that hasn’t been that low since before 2003. It’s dropped 544,000 policies so far this year – 200,000 of them in last month’s takeout and another 128,000 in this month’s so far. While most policies leaving Citizens are HO-3, its commercial lines takeout numbers for November are expected to be “huge” at close to 3,400 policies. What policies remain in Citizens? Mostly DP-3 and lower Coverage A, with its business “really shifting into those more modest homes,” another sign of a “significantly improving market across the state,” said Carl Rockman, VP of Citizens Agency & Market Services, during the Market Accountability Advisory Committee meeting. You can read more in our full LMA report here, including the ongoing implementation of Citizens revamped policy clearinghouse, and some of the challenges that it and its agents are working through on the policy renewal portion.

Citizens this week also provided further proof in the pudding of the positive impacts of the legislative reforms. Its declining policy count, coupled with a quiet 2025 hurricane season have resulted in new claims decreasing 80% from September 2024 to September 2025. New litigation has decreased by 40% in the same period and pending litigation is down 47%, bringing Citizens to under 9,000 pending lawsuits as of the end of September 2025. You can read more in our full LMA report on the Citizens Claims Committee meeting here, including the continued decrease in Assignment of Benefits (AOB) lawsuits.