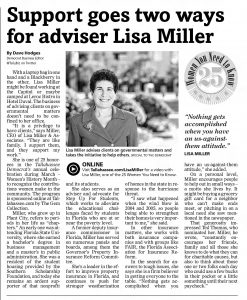

Lisa Miller presents on a panel addressing the Champlain Towers South condominium collapse before the National Council of Insurance Legislators (NCOIL), November 19, 2021

In today’s political and regulatory climate, the insurance industry is experiencing unprecedented change. Lisa Miller & Associates leads the pack in keeping on top of these developments, interpreting how they will affect our clients, and helping them adopt changes in their business plans. More importantly, we are on the ground in Tallahassee and in districts statewide working with local, state, and federal officials, lawmakers, and regulators advocating for our companies and their policyholders’ interests in shaping insurance regulation.

LMA’s efforts have brought greater attention and action on Florida’s Assignment of Benefits and Insurance Litigation crisis. The resulting series of progressive reforms on the contracting industry and plaintiff attorneys will help stem underwriting losses that have caused double-digit rate increases on homeowners and a growing number of carriers to restrict coverage or stop writing altogether.

In 2022, LMA continues its leadership role as the lead consulting firm to encourage a true private flood insurance market in Florida and the rest of the nation. The National Flood Insurance Program (NFIP) is a 50 year-old federal monopoly that is collapsing under its own weight of $24 billion in debt, inefficient bureaucracy, and outdated data and modeling techniques. Teaming with an influential Tampa Bay area state senator, LMA helped develop and implement an ongoing comprehensive policy and regulatory framework (through SB 542 and SB 1094) to encourage private firms to write flood insurance in Florida as an alternative to NFIP’s rising premiums. This framework, the first of its kind in the country, is now spreading to other states through LMA’s efforts, giving more consumers real choice.

In 2022, LMA continues its leadership role as the lead consulting firm to encourage a true private flood insurance market in Florida and the rest of the nation. The National Flood Insurance Program (NFIP) is a 50 year-old federal monopoly that is collapsing under its own weight of $24 billion in debt, inefficient bureaucracy, and outdated data and modeling techniques. Teaming with an influential Tampa Bay area state senator, LMA helped develop and implement an ongoing comprehensive policy and regulatory framework (through SB 542 and SB 1094) to encourage private firms to write flood insurance in Florida as an alternative to NFIP’s rising premiums. This framework, the first of its kind in the country, is now spreading to other states through LMA’s efforts, giving more consumers real choice.

Property & Casualty Services Include:

Property & Casualty Services Include:

- Flood Insurance

- Wind and Water Mitigation

- Personal Injury Protection (PIP)/Auto Insurance

- Workers’ Compensation Insurance

- Property & Liability Insurance

- Commercial Insurance

- Captives

- Surplus Lines

- Reinsurance

- Self-Insurance Plans

At Lisa Miller & Associates, we have a passion for policy and client success. Put Our Passion to Work for You – Give Us a Call Today!

Lisa’s P&C Expertise

As a former Deputy Insurance Commissioner, Lisa consults for insurance companies of all types including those that write personal and commercial lines as well as life and health insurance organizations. In the property and casualty insurance arena, Lisa Miller & Associates represents and advises companies writing 25% of Florida’s six million property insurance policies and works diligently to drive sound insurance public policy, assisting her clients with keeping their promises to their policyholders.

She served as lead advisor to Florida’s Property and Casualty Insurance Fraud Task Force and many other insurance boards and advisory organizations. In addition, she serves as regulatory consultant to investors who are entering Florida’s insurance market, helping them navigate the regulatory environment and understand the Florida insurance market opportunities.

Lisa also is recognized as a subject matter expert for Florida’s Property Assessed Clean Energy (PACE) program that allows city and county property owners to reduce premiums by strengthening their properties against the wind and reducing electricity costs by improving a structure’s energy efficiency. Lisa was on the negotiation team that landed $2 billion in funds to finance the Florida PACE Funding Agency’s program.

Lisa served for a decade as the exclusive insurance lobbyist and technical consultant for the Florida Realtors, statewide trade association, where she worked with Citizens Property Insurance Corporation in streamlining its sinkhole insurance coverage offerings in order to improve property values and real estate transactions in Florida’s sinkhole alley.

One of the consequences of the Great Recession was that Citizens Insurance transformed from the “insurer of last resort” to the largest property insurer in Florida – a role never intended by its original legislative creation or mandate. LMA, in discussion with key private clients, helped create and fight hard for the eventual solution (HB 1127) in the 2012 legislative session, which made storm assessments fairer and removed a major barrier to market entry into Florida by private insurers.

This success was followed in the 2013 session by further assessment reductions in the Florida Insurance Guaranty Association. LMA led the team to revise how FIGA funds an insurer insolvency. This first-of-its-kind-in-the-country legislation changed the way guaranty associations garner financial resources to pay claims. Lisa Miller & Associates has sophisticated knowledge in the P&C markets and maintains relationships with the Office of Insurance Regulation, Office of Financial Regulation, and Florida Department of Financial Services.

“I saw what happened when the wind blew in 2004 and 2005, so people being able to strengthen their homes is very important to me.”

Lisa Miller