New legislatively-required report shows insurance market’s instability

Earlier this month, the Office of Insurance Regulation (OIR) reported that 27 companies are on its own “enhanced monitoring” list for various indicators of unsound financial condition. OIR also reports that excessive litigation – which we know is at the heart of the property insurance crisis – is getting much worse. Florida companies spent more than $3 billion on legal defense costs and containment in 2021, double the figure reported in 2016.

Earlier this month, the Office of Insurance Regulation (OIR) reported that 27 companies are on its own “enhanced monitoring” list for various indicators of unsound financial condition. OIR also reports that excessive litigation – which we know is at the heart of the property insurance crisis – is getting much worse. Florida companies spent more than $3 billion on legal defense costs and containment in 2021, double the figure reported in 2016.

These are among the interesting and sometimes startling facts and figures reported in OIR’s Property Insurance Stability Report. The July 1 report was mandated by the Florida Legislature as part of SB 2-D, Florida’s latest consumer insurance reforms passed in the May special session. OIR will be updating the report going forward on January 1 and July 1 each year. Highlights of the 27-page report also include:

- Florida’s share of homeowners claims litigation in the country dropped a bit in 2021, from 79% in 2020 to 76% last year, yet we have only 7% of the homeowners insurance claims in the US.

- Reinsurance costs increased 54% from 2019 to 2020 and then another 28% from 2020 to 2021 (2022 costs are expected next month).

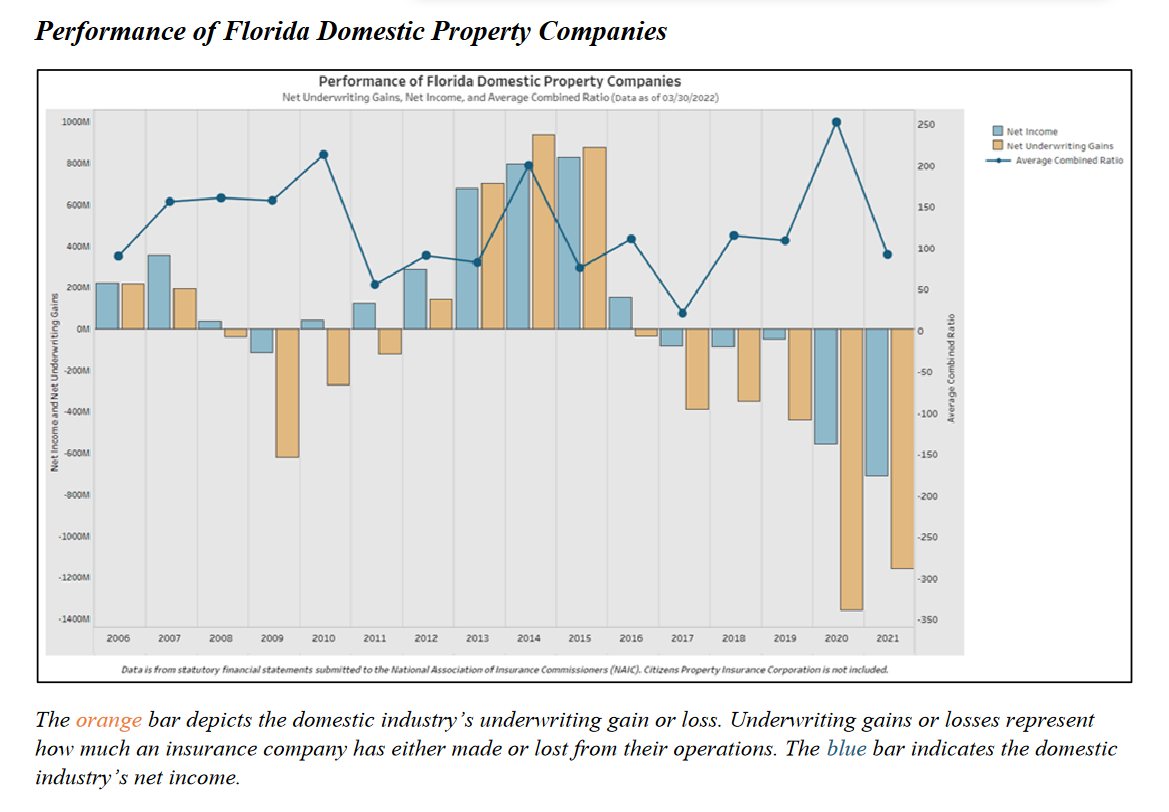

- Florida domestic companies’ negative net income was $700 million in 2021 vs. $480 million in 2020.

- Net underwriting losses improved to just under $1.2 billion in 2021 vs. almost $1.4 billion the year before (see chart below).

- Adverse loss reserve development (the cost of claims greater than reserves allotted) were $676 million more than originally estimated for 2020 claims with the two-year look-back.

Source: Florida Office of Insurance Regulation (Click to enlarge)

These key drivers have increased property insurance rates by double- and triple-digits in Florida (as high as 111%) over recent years.

“These numbers reflect the high degree of uncertainty which exists in the property insurance market, which in turn impacts reinsurance capacity and reinsurance rates for insurers,” according to the report. “In the simplest of terms, the greater the uncertainty that exists on future claims, the more reinsurers will tend to hedge their willingness to offer capacity, and the capacity that is available will cost more as a result. This loss reserve development trend has continued since 2018.”

The 27 insurance companies on OIR’s “enhanced monitoring” list are overseen by its newly formed financial stability unit required under SB 2-D but were not named in the report. They are on the list for a variety of reasons, including failure to file quarterly and/or annual financial reports, non-renewal of 10,000 or more policies, requests for rate increases above 15%, and other indicators of unsound financial condition.

LMA Newsletter of 7-25-22