Lisa Miller & Associates has worked tirelessly with industry and consumer interests, including educating the news media on Florida’s property insurance dilemma.

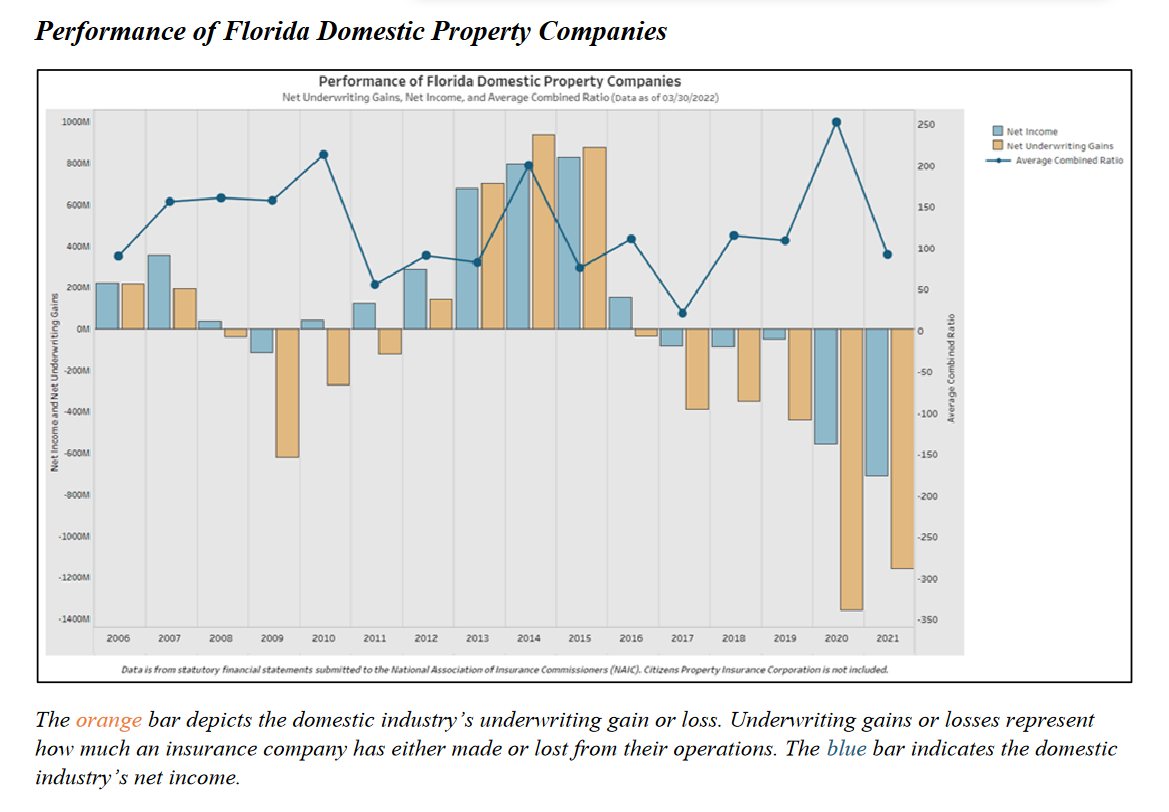

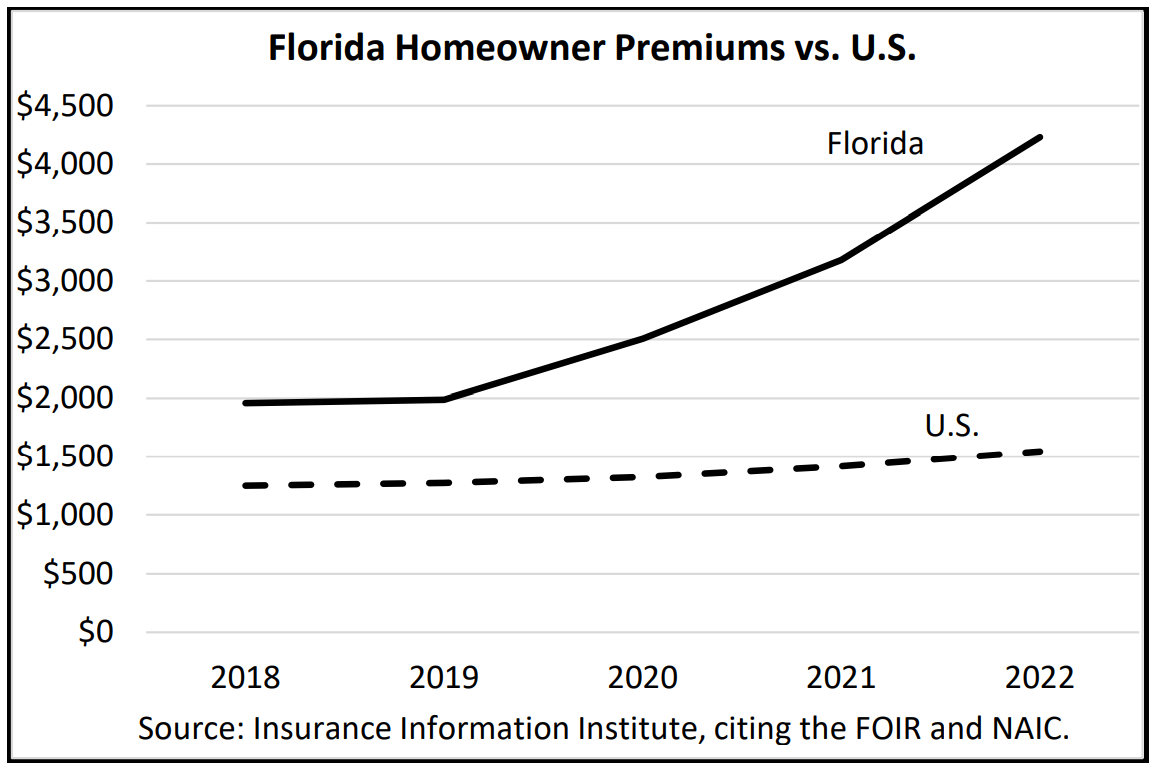

2022 saw a growing contraction of Florida’s property insurance market that Insurance Commissioner David Altmaier described as “dire.” Homeowners are suffering big rate increases and some have lost their coverage, while a growing number of insurance companies are insolvent or reducing or eliminating their policy-writing in the state. The chief culprit: excessive and often frivolous litigation, driven by questionable roof claims. According to the Florida Office of Insurance Regulation, Florida has 7% of the nation’s homeowners insurance claims yet 76% of the nation’s homeowners insurance lawsuits.

Unscrupulous roofing contractors with their offers of “free roofs” are driving up the costs of homeowners insurance in Florida

The Florida Legislature responded in two special sessions in 2022, eventually passing comprehensive reforms. These reforms built on its 2019 Assignment of Benefits (AOB) reform and 2021 Litigation & Solicitation reforms, the latter of which were challenged in court by the roofing and restoration industry.

The 2022 laws attempt to make reinsurance more available to insurance companies that could ease higher homeowners premiums, require greater transparency in roofing solicitations together with a separate roof deductible, eliminate AOBs, and revamp claims handling, together with a series of litigation reforms and greater insurance regulation. There’s also funding to hire more fraud investigators to pursue unscrupulous contractors. (Read the 2022 laws’ major provisions)

Lisa with Rep. Spencer Roach during the 2022 special session

Yet, more insurance companies face financial rating downgrades and potential insolvency until the new laws’ impacts are felt in the marketplace. Six Florida property insurance companies became insolvent in 2022, among the 11 since November of 2019. A seventh is in an orderly runoff of policies. Twenty-seven others are on a special watch list by regulators. And more homeowners face double-digit rate hikes, special assessments by insolvent companies, and the risk of further assessments across all insurance lines by the state-backed Citizens Property Insurance Corporation.

At Lisa Miller & Associates, our team will focus on those who take advantage of Floridians and drive rate increases by working around the new 2022 laws.

Door-to-door solicitor Jairo Adolfo Rivera of Adjusting Experts in Miami arrested in April 2022 on six counts of Impersonation of a Public Adjuster without a License and connected with The Strems Law Firm. Click here for his story

Brian Webb and Brandon Jourdan, co-owners of a Fort Myers roofing and construction firm arrested in March 2022 on insurance fraud for allegedly running a homeowner solicitation scheme offering free roof replacements in lieu of paying the insurance policy deductible. Click here for their story

“In Florida, contractor fraud is one element contributing to increasing premiums, insurer insolvency, and consumers scrambling under deadlines to find an insurer to meet mortgage lender requirements. In some instances, homeowners in Florida are signing with non-admitted insurers.” National Insurance Crime Bureau report

A typical “Free Roof” advertisement on social media

Consumer Alert from Florida’s Insurance Consumer Advocate “These schemes are real and are happening more frequently” – Tasha Carter, Florida’s Insurance Consumer Advocate

S

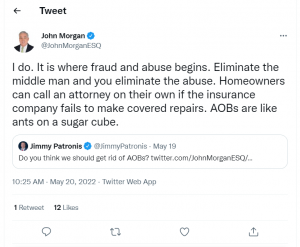

Plaintiff attorney John Morgan agrees with Florida CFO Jimmy Patronis that Assignment of Benefits (AOB) contracts between contractors and homeowners should be prohibited in this May 20, 2022 tweet

“For the second month in a row, Assignment of Benefits (AOB) lawsuits make up more than 30% of new litigation and have been on the rise steadily from the low 17% to 20% figures that were registered in the first six months of 2021,” according to CaseGlide in February 2022

“While the two bills passed in the 2022 special session had many positives, more comprehensive measures were needed to address the root cause of our property insurance dilemma in Florida: excessive litigation, driven by widespread fraud, especially roofing scams.” Lisa Miller

“We had as high as $34 million a year in claims coming from this group with 600 claims a year.” Citizens President & CEO Barry Gilway on a $1 million settlement paid by Scot Strems and his Strems Law Firm along with co-defendants Contender Claims Consultants and All Insurance Restoration Services. Click here for his story

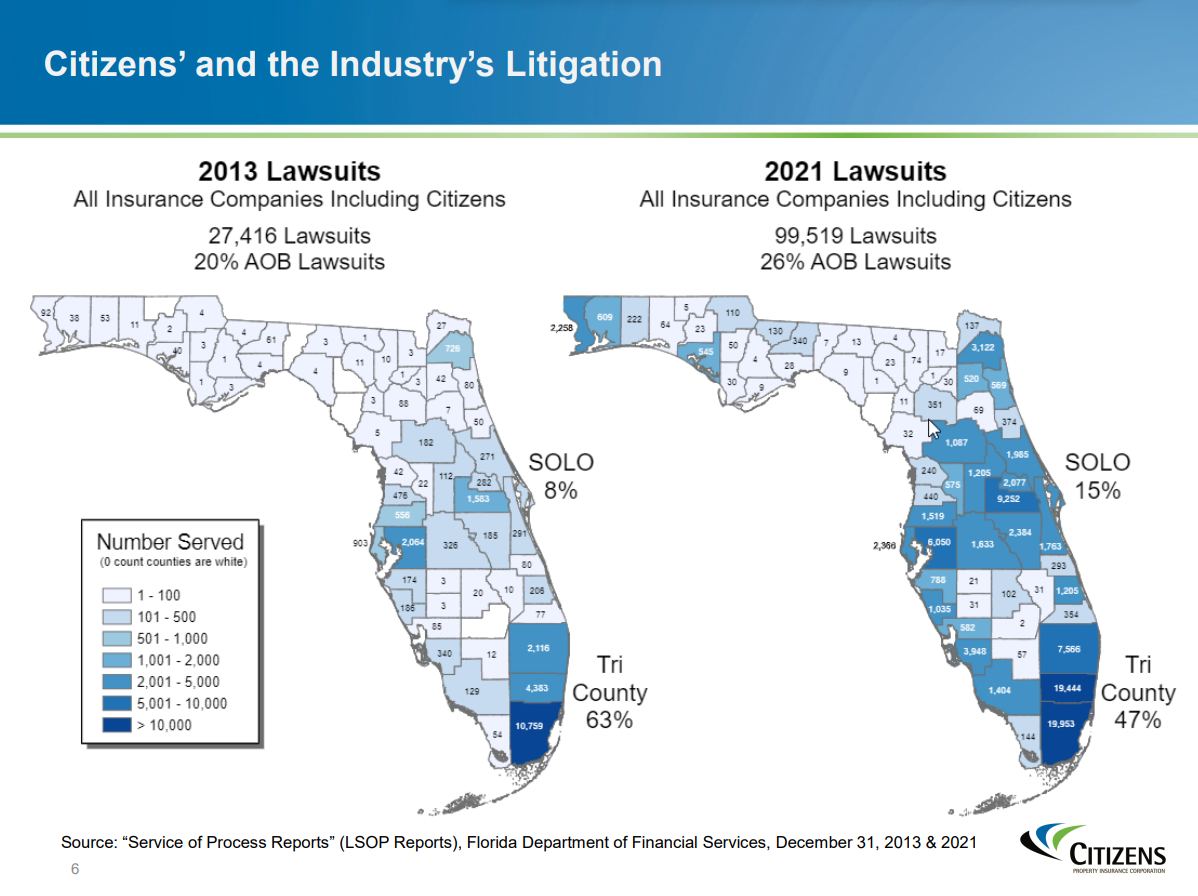

Property insurance lawsuits in Florida have increased 363% in the past nine years (Click map for printable version)

“Of the $15 billion spent on litigated claims since 2015, only 8% was paid to policyholders. Plaintiff attorneys got 71% with the remaining 21% spent by insurance companies on defense attorneys. Runaway litigation costs over roof claims and other damage are threatening the stability of not only Florida’s insurance market, but also its real estate marketplace.” Guy Fraker, author of Florida’s P&C Insurance Market is Spiraling Toward Collapse, February 2021.

“We need a system where an insured – they have a claim, that they have a dispute, and they sue – they get a payment. But the payment should not result in attorney fees that are many, many, many multiples of the payment to the insured. It’s not unusual for someone with a $20,000 or $30,000 dispute to have their attorney get $100,000 or $200,000. There needs to be a link between what an insured receives and a legal payment.” Roger Desjadon, retired CEO, Florida Peninsula Insurance

“Meaningful legislative reform must move Florida toward being 7%, not 76%, of the country’s litigated HO claims.” Joe Petrelli, President, Demotech

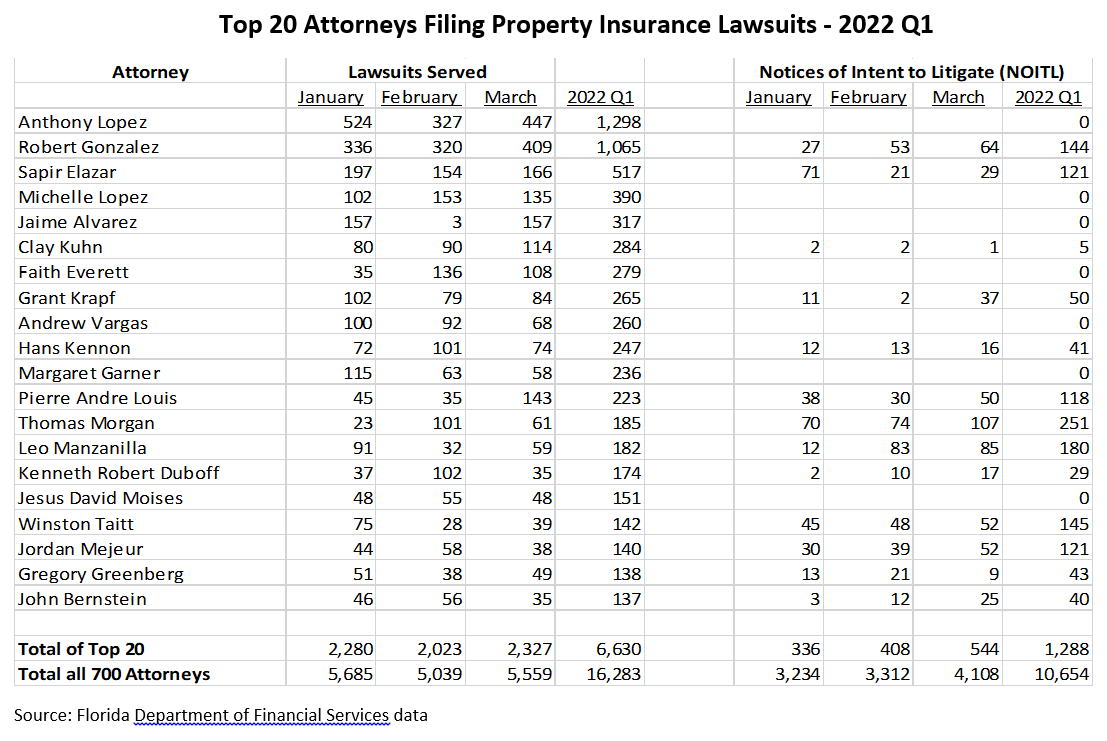

Source: Florida Office of Insurance Regulation, from its July 1, 2022 Property Insurance Stability Report. (Click to enlarge above chart)

“Floridians are seeing homeowners’ insurance become costlier and scarcer because for years the state has been the home of too much litigation and too many fraudulent roof-replacement schemes.” Insurance Information Institute Issues Brief, August 2022

From American Consumer Institute’s “The Incentive to Sue”

Lisa Miller hosts The Florida Insurance Roundup podcast, regularly featuring the latest developments in insurance defense and helping consumers by raising awareness of various claims fraud and abuse so they don’t fall prey to the litigation explosion.

Listen to Barry Gilway: Florida’s New Law is a Profound Change podcast (December 2022)

Listen to Special Session Preview podcast (December 2022)

Listen to Take Care of the Insurance Customer: Job One podcast (September 2022)

Listen to New Property Insurance Reforms podcast (June 2022)

Listen to Special Session on Property Insurance podcast (May 2022)

Listen to A Conversation with Real Estate Agents about Property Insurance podcast (February 2022)

(You can listen to previous podcasts here)

Lisa being interviewed by the news media at the Capitol during the May 2022 Special Session

S

Media Coverage of LMA Efforts on Litigation Reform & Consumer Protections

- Florida’s former Deputy Insurance Commissioner Lisa Miller said lawmakers need to make bold moves in order to curb some of the highest homeowner rates in the nation. “That number is going to continue to escalate as the weather continues to worsen and the litigation continues to grow,” she said. Back-to-back hurricanes will lead to higher property insurance premiums for Floridians, WFTS-TV ABC Action News, Tampa, November 11, 2022

- Insurance companies operating in Florida say they have been forced to raise rates to cover the costs of handling lawsuits. “We’re all paying for that frivolous litigation,” said Lisa Miller, a former deputy Florida insurance commissioner who now works as an insurance industry consultant in Tallahassee…. It’s possible the state could see a million total claims across all types of insurance, including flood insurance, said Miller. Florida’s Property Insurance Market Was Already Under Stress. Ian Could Make It Worse, National Public Radio, Washington, October 6, 2022

- Lisa Miller, a former deputy director of the Florida Office of Insurance Regulation who now consults for the industry, was more blunt. “Do not answer your front door,’’ she said. “People you know come to your back door. People you don’t know come to your front door.” Beware of Scams, and Other Tips on Filing Hurricane Ian Insurance Claims, Miami Herald, September 30, 2022

- Insurance industry lobbyist Lisa Miller, a former deputy Florida insurance commissioner, said at the webinar Thursday that the key to reducing fraudulent or exaggerated roof claims, or efforts by roofers to cover the deductible, is strict enforcement of the law. She urged state regulators to contact RoofClaim.com and let the company know that its actions will be scrutinized. com Fires Up Florida Insurers with Roof Financing Plan, Insurance Journal, June 3, 2022

- Lisa Miller of Lisa Miller & Associates says widespread fraud including roofing scams and the resulting litigation are to blame. She says these lawsuits drive up the cost of insurance premiums for everyone. “The insurance commissioner testified that Florida has only 8 percent of all property insurance claims in the country, yet Florida has almost 80 percent of all the litigation in the entire country.” Nothing in life is free: roofing scams drive up property insurance rates in Florida, WMFE-FM Orlando, May 23, 2022

“Thank you for continuing to fight the good fight, Lisa! We all need to do more to combat the rampant fraud in our state.” Chad LaTour, Vice President of Sales, PEAK6 InsurTech

Other Lisa Miller & Associates (LMA) Produced Products & Resources

- More Policy Nonrenewals, LMA Newsletter Property Insurance News of January 23, 2023

- Awaiting more reinsurance help, LMA Newsletter of January 23, 2023

- Serial Litigator Strems Disbarred, LMA Newsletter of January 9, 2023

- Suggestions for insurance, future storm recovery, LMA Newsletter of January 9, 2023

- Post-Reform: Where Do We Go from Here?, LMA Newsletter of January 9, 2023

- Property Insurance Stability Report, Florida Office of Insurance Regulation, January 1, 2023

- Special Session Wrap-UP on Property Insurance, Hurricane Ian Relief, LMA Bill Watch of December 14, 2022

- Special Session Preview on Property Insurance, Hurricane Ian Relief, LMA Bill Watch of December 12, 2022

- Florida Market ‘Plagued’ by Attorney Fee-Shifting, LMA Newsletter of December 5, 2022

- Further signs of a deteriorating property insurance market, LMA Newsletter of December 5, 2022

- Florida Developers Are Holding Off on Big Projects as Insurance Costs Surge, Wall Street Journal, November 29, 2022

- Restoration Association Loses Court Challenge, LMA Newsletter Property Insurance News of November 21, 2022

- AOB Ruling Favors Contractor – For Now, LMA Newsletter Property Insurance News of November 7, 2022

- Judge Criticizes Bulk Filing of Property Lawsuits, LMA Newsletter of November 7, 2022

- What Can the Legislature Do in the Upcoming Special Session?, LMA Newsletter of November 7, 2022

- Hurricane Ian Fraud, LMA Newsletter of October 24, 2022

- Special Session Ahead, LMA Newsletter of October 24, 2022

- Ian’s Impact on the Florida Insurance Market, LMA Newsletter of October 10, 2022

- Another Insolvency, More Lawsuits, LMA Newsletter Property Insurance News of October 10, 2022

- Roofers Pursuing Appeal, LMA Newsletter of September 19, 2022

- New Questions on Citizens’ Proper Role, LMA Newsletter of September 19, 2022

- OIR: Florida Insurance Litigation Declining, LMA Newsletter of September 6, 2022

- Legal Fight Heating Up on Insurance Reforms, LMA Newsletter of August 22, 2022

- Litigation Reporting Conundrum, LMA Newsletter of August 22, 2022

- Relative Calm Returns to the Florida Market, LMA Newsletter of August 22, 2022

- Florida’s Homeowners Insurers Are Facing Multiple Crises, Insurance Information Institute, August 9, 2022

- Enhanced Fraud Squads Making a Difference, LMA Newsletter of August 8, 2022

- New Florida Market Stabilization Program Premiers, LMA Newsletter of August 8, 2022

- Another Florida Insurance Company Insolvent, LMA Newsletter of August 8, 2022

- Demotech Rating Downgrades, LMA Newsletter of July 25, 2022

- 27 Companies on OIR’s Watch List, LMA Newsletter of July 25, 2022

- Florida Market “75% Shut Down”, LMA Newsletter of July 25, 2022

- Large Insurance Company Considers “Moves”, LMA Newsletter of July 25, 2022

- Property Insurance Market Contraction Continues, LMA Newsletter of July 11, 2022

- AOB Ruling a Win for Consumers, LMA Newsletter of July 11, 2022

- Property Insurance Stability Report, Florida Office of Insurance Regulation, July 1, 2022

- Insurance Insolvencies, Rates Growing, LMA Newsletter of June 27, 2022

- A conversation with a lawmaker & a litigation analyst on further reform needed, LMA Newsletter of June 27, 2022

- Cast Iron Drainpipes – the newest questionable claim, LMA Newsletter of June 27, 2022

- Florida HO Premiums Highest in Nation at $4,200 Average, Triple I Report Shows, Insurance Journal, June 16, 2022

- Another Property Insurance Company Fails, LMA Newsletter of June 13, 2022

- Special Session Follow-up: Next Steps, LMA Newsletter of June 13, 2022

- Roofers Sue Over New Reforms, LMA Newsletter of June 13, 2022

- Settlement Agreements Now a Basis for a Bad Faith Claim, LMA Newsletter of June 13, 2022

- Florida Supreme Court Changes Rule on Proposals for Settlement, LMA Newsletter of June 13, 2022

- Bills Don’t Fix Florida’s Insurance Crisis, Panel Told, Law360, June 2, 2022

- Fears mount that many insurers might not be financially prepared for hurricane season, despite reforms, South Florida Sun-Sentinel, May 28, 2022

- Florida Legislature Wraps Early with Insurance Fund, Roof and Condo Bills, Insurance Journal, May 26, 2022

- Florida lawmakers leave lots of unfinished business on property insurance reforms, Orlando Sentinel, May 26, 2022

- Final Special Session 2022 Florida Legislature Bill Watch, LMA May 25, 2022

- Florida’s insurance carriers over-litigated, not under-capitalized: Demotech’s Petrelli, Artemis, May 24, 2022

- If you can’t legislate, regulate: Altmaier enacted property insurance policies lawmakers didn’t OK, Orlando Sentinel, May 23, 2022

- Beleaguered homeowners shouldn’t expect quick relief on insurance rates, lawmakers say, Miami Herald, May 23, 2022

- Bill Watch – Special Session on Property Insurance, LMA Newsletter of May 23, 2022

- Messages to the Legislature – The Road to Reform, LMA Newsletter of May 23, 2022

- More Rate Hikes & Market Retrenchment, LMA Newsletter of May 23, 2022

- Contractors Sue Insurance Commissioner & Companies, LMA Newsletter of May 23, 2022

- Strems & Contractors Settle Citizens’ RICO Action, LMA Newsletter of May 23, 2022

- Billions in Claims Fraud, LMA Newsletter of May 23, 2022

- Florida lawmakers want to fix property insurance. Here are the big issues. Tampa Bay Times, May 23, 2022

- FL lawmakers unveil property-insurance fixes but market has ‘further devolved’, Florida Phoenix, May 22, 2022

- Florida’s homeowners paying heavy price for massive roofing scams, The Villages-News, May 21, 2022

- Florida lawmakers scramble to fix a property insurance crisis before hurricane season, NBC News, May 21, 2022

- Florida Chief Financial Officer Jimmy Patronis letter to Florida State Attorneys to encourage them to help fight insurance fraud in the state, May 20, 2022

- Insurance reforms could put an end to conflicts over roof coverage and replacements, South Florida Sun-Sentinel, May 20, 2022

- Florida lawmakers to target roof claims, lawyers during property insurance session, Tampa Bay Times, May 20, 2022

- Florida Appeals Court Slashes $600,000 Attorney Fee on $52,000 Claim, Insurance Journal, May 20, 2022

- Florida Chief Financial Officer Jimmy Patronis letter to the Florida Bar encouraging crackdown on unethical attorneys involving property insurance lawsuits and the use of Assignment of Benefits (AOB), May 19, 2022

- Fate of Fla. property insurance market at stake as special session looms, S&P Global Market Intelligence, May 19, 2022

- Florida lawmakers, too busy with culture wars, missed an actual crisis, Washington Post, May 19, 2022

- Florida’s ‘artificial’ insurance structure is ‘untenable’ – ALIRT, Reinsurance News, May 18, 2022

- Property insurance market in ‘very precarious position’ as hurricane season approaches, Palm Beach Post, May 18, 2022

- Biggest economic crisis in Florida history looms, Business Observer, May 18, 2022

- State senator on insurance debacle: We need political courage, Business Observer, May 18, 2022

- DeSantis Expects Reforms as Insurers Set to Cancel Policies, News Service of Florida, May 17, 2022

- Policy changes approved by state insurance commissioner violate policyholders’ rights, lawsuit says, South Florida Sun-Sentinel, May 17, 2022

- When Florida’s property insurers fail, few ask why. Tampa Bay Times, May 17, 2022

- 68,200 home insurance policies to be canceled as hurricane season begins, South Florida Sun-Sentinel, May 14, 2022

- Strems, Adjusters, Restoration Firm Settle Florida Citizens Lawsuit for $1M, Insurance Journal, May 13, 2022

- Law firm, co-defendants settle fraud claims with Citizens Property Insurance Corp. for $1 million, Citizens News Release, May 12, 2022

- Florida’s Failing Insurers – Who’s Next?, R-Street, May 12, 2022

- Contingency Fee Multipliers Expected to be Discussed During Property Insurance Special Session, Florida Bar News, May 11, 2022

- Readying for Special Session, LMA Newsletter of May 9, 2022

- Suggestions for Property Insurance Reform, LMA Newsletter of May 9, 2022

- Homeowners Impacts Growing – Plaintiff attorney glib, LMA Newsletter of May 9, 2022

- Ron DeSantis and the Florida Legislature could reduce insurance rates right now. A giant insurance company is standing in the way, Seeking Rents Newsletter, May 3, 2022

- Coming Soon: A Florida Special Session on Insurance. But Will it Come Soon Enough? Insurance Journal, May 2, 2022

- Special Session Coming on Property Insurance, LMA Newsletter of April 25, 2022

- More Insurance Companies in Trouble, LMA Newsletter of April 25, 2022

- Unlicensed Adjuster Busted – The Strems Law Firm Connection, LMA Newsletter of April 25, 2022

- Court Rules on AOB 10-Day Notice Requirement, LMA Newsletter of April 25, 2022

- Perspective on the State of the Property Insurance Market in Florida and the Necessary Impact of a Special Session, Demotech, April 22, 2022

- Here’s why Florida’s property insurance market is a dumpster fire, The Capitolist, April 16, 2022

- Special Session on Property Insurance? LMA Newsletter of April 11, 2022

- If You Can’t Legislate, Regulate! LMA Newsletter of April 11, 2022

- More Insurance Companies Taking a Hit, LMA Newsletter of April 11, 2022

- Florida Insurance Market Needs Strong Medicine, R Street Blog on Insurance Journal, April 7, 2022

- Insurance Company Sues OIR, LMA Newsletter of March 28, 2022

- Roofers Busted in “Free Roof” Fraud, LMA Newsletter of March 28, 2022

- Perspective on the State of the Property Insurance Market in Florida and the Need for Immediate Legislative Reform in a Special Session, Demotech, March 23, 2022

- Public Adjuster Targeted by DFS, LMA Newsletter of March 14, 2022

- Citizens Sued for Attorney Fees, LMA Newsletter of March 14, 2022

- No Ambiguity in these Policies, LMA Newsletter of February 28, 2022

- Insurance rates to continue going through the roof, Business Observer, February 23, 2022

- Insurance Litigation Rising, LMA Newsletter of February 21, 2022

- Florida lawmakers grapple with home insurance ‘catastrophe’, News Service of Florida, February 17, 2022

- Floridians running out of options for home insurance, WINK-TV, February 17, 2022

- Judge Says No to Fee Multiplier, LMA Newsletter of February 14, 2022

- Attention Florida Lawmakers – Part II, Scott Johnson Blog, February 2, 2022

- There’s No Such Thing as a Free Roof, LMA Newsletter of January 31, 2022

- Insurance Companies Defend Rate Hikes, LMA Newsletter of January 24, 2022

- Court Denies Effort to Stop SB 76 for Now, LMA Newsletter of January 24, 2022

- Tornadoes Bring Out Solicitors, LMA Newsletter of January 24, 2022

- Citizens Roof Inspections Begin, LMA Newsletter of January 18, 2022

- Appealing Punitive Damages Made Easier, LMA Newsletter of January 18, 2022

- Right to Repair Upheld, LMA Newsletter of January 3, 2022

- Citizens: 20% of Presuit Demands Go to Court, LMA Newsletter of December 13, 2021

- More Fraud Squads Please!, LMA Newsletter of December 13, 2021

- Legal Briefs, LMA Newsletter of December 13, 2021

- Property Insurance Lawsuits up 29%, LMA Newsletter of November 29, 2021

- Adjusters as Appraisers?, LMA Newsletter of November 29, 2021

- Court: Wait for the Documents, LMA Newsletter of November 15, 2021

- Court Says No to Attorney Fees, LMA Newsletter of November 1, 2021

- Boyd Leading on Consumer Reforms, LMA Newsletter of November 1, 2021

- Florida Litigated Claims Dropped 9% in September, Insurance Journal, October 22, 2021

- Florida Insurance Market “Dire”, LMA Newsletter of October 4, 2021

- Citizens Growing Faster, Exposure Doubled, LMA Newsletter of October 4, 2021

- Second Challenge to Insurance Reform Law, LMA Newsletter of September 20, 2021

- DFS Asked About Public Adjusters, LMA Newsletter of August 23, 2021

- Warnings on Deductible Fraud, LMA Newsletter of August 23, 2021

- Property Insurance Lawsuits Up 51%, LMA Newsletter of August 9, 2021

- Florida’s Citizens Insurance Seeks Rate Increase as Policy Count Skyrockets, Insurance Journal, July 15, 2021

- Roofers Block Section of SB 76 For Now, LMA Newsletter of July 12, 2021

- Roofers Fighting Property Insurance Reform, LMA Newsletter of June 28, 2021

- New Consumer Protections Now Law, LMA Newsletter of June 28, 2021

- Fla. homeowners insurance market likely needs ‘more’ after latest reform law, S&P Global Market Intelligence, June 25, 2021

- The Florida Hurricane Catastrophe Fund Demystified: Legislative Relief for Florida’s Homeowners, Federal Association for Insurance Reform, June 21, 2021

- Property Insurance Reform Signed, LMA Newsletter of June 14, 2021

- Reducing Policyholder Litigation, LMA Newsletter of June 14, 2021

- Insurance Fraud, LMA Newsletter of June 14, 2021

- Florida’s Property Insurance Reform: Different Perspectives, LMA Newsletter of June 1, 2021

- Million Dollar Contractor Fraud, LMA Newsletter of June 1, 2021

- The Knock on the Door, LMA Newsletter of May 17, 2021

- Alleged Home Inspection Scammers Busted, LMA Newsletter of May 17, 2021

- 3 Florida Insurers to Drop Thousands of Policies, Make Moves to Stay Afloat, Insurance Journal, May 12, 2021

- The Weekend After, LMA Newsletter of May 3, 2021

- Bill Watch – End of 2021 Session, LMA Newsletter of May 3, 2021

- Florida Legislature Passes Major Changes to Auto, Property Insurance Markets, Insurance Journal, April 30, 2021

- Trying to Refute the Irrefutable – 3 points on Florida’s insurance market woes, LMA Newsletter of April 26, 2021

- Insurance Costs Threaten Florida Real-Estate Boom, Wall Street Journal, April 25, 2021

- Regulators Reject Citizens Rate Cap Request, LMA Newsletter of April 26, 2021

- Consumer Advocacy Now More Than Ever, LMA Newsletter of April 19, 2021

- Florida’s Insurance Litigation Factories, LMA Newsletter of April 19, 2021

- Viewpoint: The Cold, Hard Truth About Florida Litigation, by Lisa Miller, Claims Journal, April 16, 2021

- What has happened to the Florida property insurance market? by Barry Gilway, Florida Politics, April 15, 2021

- National Association of Insurance Commissioners: The Cold, Hard Truth about Florida Litigation, LMA Newsletter of April 12, 2021

- NAIC Data: Florida Property Lawsuits Total 76% of Insurer Litigation in U.S., Insurance Journal, April 14, 2021

- Reforming Florida’s broken insurance market, Trading Risk and Inside P&C, April 12, 2021

- Regulator Deems Florida-Based American Capital Assurance Corp. Insolvent, Insurance Journal, April 6, 2021

- Litigation Trends in the Florida Insurance Market, Insurance Commissioner David Altmaier letter to House Commerce Committee, April 2, 2021

- Court Reverses Bad Faith Decision, LMA Newsletter of March 29, 2021

- Citizens’ CEO: Florida Property Insurance Market is Shutting Down, Insurance Journal, March 14, 2021

- Florida Property Insurance Cos. Financials, LMA Newsletter of March 15, 2021

- Homeowners Insurance Fraud Probes Lacking, LMA Newsletter of March 15, 2021

- Several Factors Hinder Homeowner and Auto Glass Insurance Fraud Processing, Florida Office of Program Policy and Government Accountability (OPPAGA), March 2021

- Citizens Rate Hike Hearing, LMA Newsletter of March 15, 2021

- Demotech Financial Stability Ratings for the Florida Domestic Market, March 12, 2021

- Demolish Contractor Fraud!, LMA Newsletter of March 8, 2021

- Call for Insurance Market Reform Grows, LMA Newsletter of March 8, 2021

- Citizens Poised to Raise Rates, LMA Newsletter of March 8, 2021

- Florida Regulators Make the Case for Reform, LMA Newsletter of March 1, 2021

- Florida Bar v. Scot Strems, LMA Newsletter of March 1, 2021

- Consumer Alert: Don’t Fall Victim to Contractor Fraud, Florida’s Insurance Consumer Advocate Office, March 2021

- Cost Drivers Affecting Florida’s Insurance Rates, Insurance Commissioner David Altmaier letter to House Commerce Committee, February 24, 2021

- Reports Urge Legislative Action, LMA Newsletter of February 1, 2021

- Florida’s P&C Market: Spiraling Toward Collapse, Guy Fraker of Cre8tfutures Advisory, February 2021

- Insurers Pursuing Fraud with RICO Suits, by Barry Zalma in the Johnson Strategies Blog, February 1, 2021

- Florida’s Property Insurance Market Is ‘Spiraling Towards Collapse’ Due to Litigation, Insurance Journal, January 20, 2021

- Strengthening Florida’s Homeowners Market, LMA Newsletter of January 4, 2021

- Citizens Exposure Reduction and Depopulation Opportunities Analysis, FSU Florida Catastrophic Storm Risk Management Center, November 2020

- Summary Judgment Standard Changed, LMA Newsletter of January 4, 2021

- 2021’s Insurance Consumer, LMA Newsletter of January 4, 2021

- Florida Bar v. Scot Strems, LMA Newsletter of December 14, 2020

- Florida Appellate Court Says No to a $442,000 Attorney Fee in a $25,000 Settlement, LMA Newsletter of November 30, 2020

- Florida Property Insurance Market Inches Closer to Crisis – Part 1 and Part 2, Insurance Journal, October 29 & 30, 2020

- Funny, But No Laughing Matter, LMA Newsletter, September 28 ,2020

- Citizens Insurance Tracking Contingency Fee Multipliers, LMA Newsletter, September 14, 2020

- “A Tale of Two Tails” on insurance claims lawsuits, Demotech webinar, August 18, 2020

- Florida Appellate Court Says No to a $442,000 Attorney Fee in a $25,000 Settlement, LMA Newsletter of November 30, 2020

- Funny, But No Laughing Matter, LMA Newsletter, September 28 ,2020

- Citizens Insurance Tracking Contingency Fee Multipliers, LMA Newsletter, September 14, 2020

- “A Tale of Two Tails” on insurance claims lawsuits, Demotech webinar, August 18, 2020.

(You can find previous LMA Products & Resources on the 2019 AOB Reform webpage)

“History of Florida’s Property Insurance Market by Locke Burt, May 2015”: