On June 11, 2021, Governor DeSantis signed into law Senate Bill 76 (SB 76, now Florida Statute section 489.147) Florida’s most recent property insurance reform law. The new law is designed to stem double-digit rate increases, misleading roof solicitations, costly claims practices, and excessive litigation. These factors are driving a contraction of the private homeowners market in Florida and the resulting expansion of the taxpayer-backed Citizens Property Insurance Corporation. (Read the law’s major provisions)

Regulators are most likely reviewing these sorts of solicitations to determine their legality in light of SB 76 provisions. (Click to enlarge)

Florida’s property insurance market is spiraling toward collapse with domestic insurance companies showing a sea of red ink of net underwriting losses. This is driven by roofing company solicitors promising free roofs and filing questionable claims, backed by the lawyers that launched 1,000 lawsuits (and counting). Despite a doubling of investigative referrals in recent years, few resulted in full investigation and even fewer in prosecution, due to lack of state resources.

These are impacting Florida policyholders in the price, choice, and availability of homeowners insurance. 90% of policyholders settle their claims without involving an attorney. That 90% is paying for the other 10% of the claims, with very little of that benefit trickling down to the homeowner with a claim.

While the new reform law is a start, our team is watching those who specialize in taking advantage of Floridians and driving higher rates, as they strategize on ways to work around the law’s provisions, including court challenges. Although the new law became effective July 1, 2021, its hopeful effects will take 12-24 months to make their way through carriers’ books of business. Read about additional 2022 Litigation Reform & Consumer Protections

Lisa Miller & Associates is proud of the role it plays in educating the news media on Florida’s property insurance dilemma, including an article in the Wall Street Journal on how rising insurance costs threaten Florida’s real estate boom, an article in Trading Risk and Inside P&C on claim trends that are crippling insurance carriers and punishing reinsurers, and our viewpoint article in the national Claims Journal citing NAIC data that Florida has 8% of all homeowners’ claims in the U.S., yet 76% of all homeowners’ claims lawsuits. With our great partners, these articles and data were essential in successfully convincing the 2021 Legislature to pass SB 76 and related reforms in SB 1598.

“I just wanted to reach out and tell you that you are a KICK ASS woman! I am so impressed by you, your advocacy and your work product. I look forward to continuing our relationship.” Jennifer Tedesco, Esq., Claim Director, Pharos Claims Services, Orlando, FL

A Roofing contractor’s “No Roof Left Behind” campaign solicitation pitch (click image to play video)

“So much of the market is changing with property insurance companies shrinking their footprints and solicitors going door to door encouraging claims, many of which shouldn’t be claims but normal wear and tear and home maintenance. What a difference a decade makes when the days of replacing a roof as a good way to maintain a home is now an insurance claim.” Lisa Miller

“Of the $15 billion spent on litigated claims since 2015, only 8% was paid to policyholders. Plaintiff attorneys got 71% with the remaining 21% spent by insurance companies on defense attorneys. Runaway litigation costs over roof claims and other damage are threatening the stability of not only Florida’s insurance market, but also its real estate marketplace.” Guy Fraker, author of Florida’s P&C Insurance Market is Spiraling Toward Collapse, February 2021.

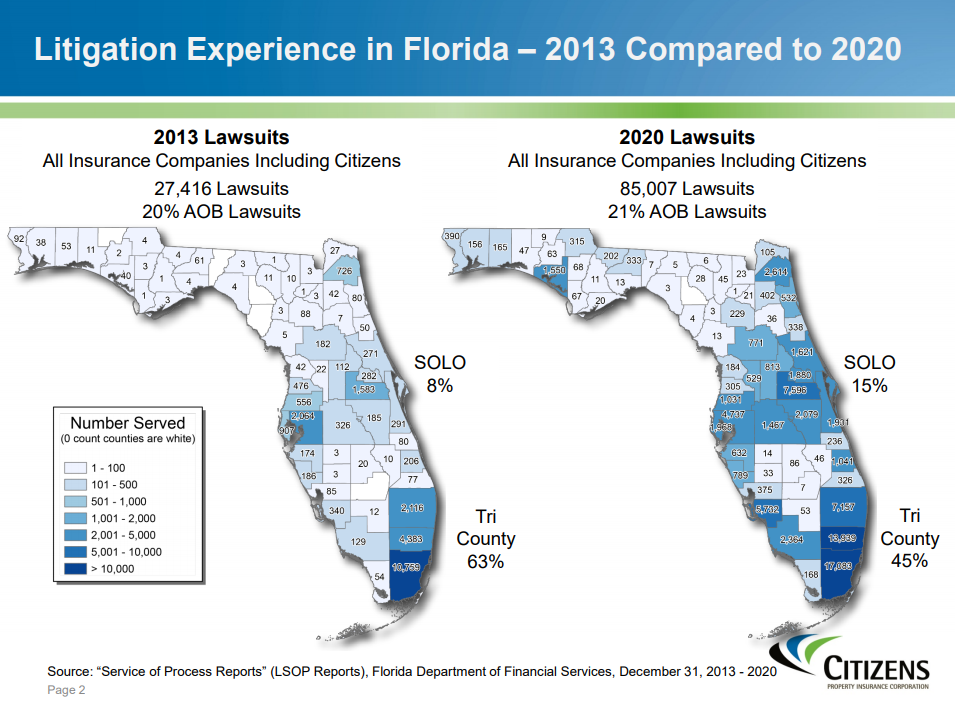

And in 2021, Citizens reports lawsuits against it rose 54% in the first four months, year-to-year

“We need a system where an insured – they have a claim, that they have a dispute, and they sue – they get a payment. But the payment should not result in attorney fees that are many, many, many multiples of the payment to the insured. It’s not unusual for someone with a $20,000 or $30,000 dispute to have their attorney get $100,000 or $200,000. There needs to be a link between what an insured receives and a legal payment.” Roger Desjadon, CEO, Florida Peninsula Insurance

Lisa Miller hosts The Florida Insurance Roundup podcast, regularly featuring the latest developments in insurance defense and helping consumers by raising awareness of various claims fraud and abuse so they don’t fall prey to the litigation explosion.

Listen to Special Session on Property Insurance podcast (May 2022) |

Listen to A Conversation with Real Estate Agents about Property Insurance podcast (February 2022) |

Listen to Legal Challenges to SB 76 podcast (October 2021) |

Listen to Condo Underwriting & Presuit Settlements podcast (August 2021) |

Listen to Defense Attorneys’ Take on SB 76 podcast (June 2021)  Listen to Florida’s Property Insurance Dilemma podcast (March 2021) |

Listen to Property Insurance Reform podcast (May 2021  Listen to 2021’s Insurance Consumer podcast (January 2021) |

Lisa’s Blog: How a $41,000 Plumbing Leak Turned Into a $1.2 Million Attorney Fee, March 12, 2020

Media Coverage of LMA Efforts on Litigation & Solicitation Reform

- AOB abuse has created an additional $1 billion of inflated insurance claims in recent years, according to a recent newsletter published by Lisa Miller, a former deputy Florida insurance commissioner. “While the reforms seem to have helped in reducing the number of AOB lawsuits, AOBs are still being used and some contractors and their lawyers have been scheming with new tactics to try to get around the reforms,” Miller wrote. Florida Litigated Claims Dropped 9% in September, Insurance Journal, October 22, 2021

- Miller, a former deputy Florida insurance commissioner, is chief executive officer of Lisa Miller & Associates in Tallahassee, a public relations and consulting firm that represented property insurers. Viewpoint: The Cold, Hard Truth About Florida Litigation, Claims Journal, April 16, 2021

- Lisa Miller, a former Florida deputy insurance commissioner who now works with consumers on property insurance issues, said there was an 80% drop in lawsuits in Texas within 30 days of the law’s enactment. Miller in an email to S&P Global Market Intelligence said the reform law “restored the guardrails” for the state’s legal system. Fla. Lawmakers Seeking New Ways to Curb Wave of Litigation Against P&C Insurers, S&P Global, December 22, 2020

- Former Florida Deputy Insurance Commissioner Lisa Miller blames the increases on billions of claims triggered by hurricanes Irma and Michael and fraudulent roofing claims. “All those costs have to be paid by somebody, and those somebodies are consumers as claims costs go up, rates go up and we are seeing rates go up exponentially,” said Miller. Miller points to thousands of lawsuits filed against insurance companies when they deny claims for items not covered under a homeowner’s policy. Miller said these rising costs have pushed insurance companies like the one that covered Epstein’s house to stop writing policies in Florida, leaving consumers to pay more to the companies still insuring Florida homes at a higher price. Florida homeowners may experience sticker shock when it’s time to renew their insurance, WFTS-TV, September 3, 2020

Other Lisa Miller & Associates (LMA) Produced Products & Resources

- Citizens: 20% of Presuit Demands Go to Court, LMA Newsletter of December 13, 2021

- More Fraud Squads Please!, LMA Newsletter of December 13, 2021

- Legal Briefs, LMA Newsletter of December 13, 2021

- Property Insurance Lawsuits up 29%, LMA Newsletter of November 29, 2021

- Adjusters as Appraisers?, LMA Newsletter of November 29, 2021

- Court: Wait for the Documents, LMA Newsletter of November 15, 2021

- Court Says No to Attorney Fees, LMA Newsletter of November 1, 2021

- Boyd Leading on Consumer Reforms, LMA Newsletter of November 1, 2021

- Florida Litigated Claims Dropped 9% in September, Insurance Journal, October 22, 2021

- Florida Insurance Market “Dire”, LMA Newsletter of October 4, 2021

- Citizens Growing Faster, Exposure Doubled, LMA Newsletter of October 4, 2021

- Second Challenge to Insurance Reform Law, LMA Newsletter of September 20, 2021

- DFS Asked About Public Adjusters, LMA Newsletter of August 23, 2021

- Warnings on Deductible Fraud, LMA Newsletter of August 23, 2021

- Property Insurance Lawsuits Up 51%, LMA Newsletter of August 9, 2021

- Florida’s Citizens Insurance Seeks Rate Increase as Policy Count Skyrockets, Insurance Journal, July 15, 2021

- Roofers Block Section of SB 76 For Now, LMA Newsletter of July 12, 2021

- Roofers Fighting Property Insurance Reform, LMA Newsletter of June 28, 2021

- New Consumer Protections Now Law, LMA Newsletter of June 28, 2021

- Fla. homeowners insurance market likely needs ‘more’ after latest reform law, S&P Global Market Intelligence, June 25, 2021

- The Florida Hurricane Catastrophe Fund Demystified: Legislative Relief for Florida’s Homeowners, Federal Association for Insurance Reform, June 21, 2021

- Property Insurance Reform Signed, LMA Newsletter of June 14, 2021

- Reducing Policyholder Litigation, LMA Newsletter of June 14, 2021

- Insurance Fraud, LMA Newsletter of June 14, 2021

- Florida’s Property Insurance Reform: Different Perspectives, LMA Newsletter of June 1, 2021

- Million Dollar Contractor Fraud, LMA Newsletter of June 1, 2021

- The Knock on the Door, LMA Newsletter of May 17, 2021

- Alleged Home Inspection Scammers Busted, LMA Newsletter of May 17, 2021

- 3 Florida Insurers to Drop Thousands of Policies, Make Moves to Stay Afloat, Insurance Journal, May 12, 2021

- The Weekend After, LMA Newsletter of May 3, 2021

- Bill Watch – End of 2021 Session, LMA Newsletter of May 3, 2021

- Florida Legislature Passes Major Changes to Auto, Property Insurance Markets, Insurance Journal, April 30, 2021

- Trying to Refute the Irrefutable – 3 points on Florida’s insurance market woes, LMA Newsletter of April 26, 2021

- Insurance Costs Threaten Florida Real-Estate Boom, Wall Street Journal, April 25, 2021

- Regulators Reject Citizens Rate Cap Request, LMA Newsletter of April 26, 2021

- Consumer Advocacy Now More Than Ever, LMA Newsletter of April 19, 2021

- Florida’s Insurance Litigation Factories, LMA Newsletter of April 19, 2021

- Viewpoint: The Cold, Hard Truth About Florida Litigation, by Lisa Miller, Claims Journal, April 16, 2021

- What has happened to the Florida property insurance market? by Barry Gilway, Florida Politics, April 15, 2021

- National Association of Insurance Commissioners: The Cold, Hard Truth about Florida Litigation, LMA Newsletter of April 12, 2021

- NAIC Data: Florida Property Lawsuits Total 76% of Insurer Litigation in U.S., Insurance Journal, April 14, 2021

- Reforming Florida’s broken insurance market, Trading Risk and Inside P&C, April 12, 2021

- Regulator Deems Florida-Based American Capital Assurance Corp. Insolvent, Insurance Journal, April 6, 2021

- Litigation Trends in the Florida Insurance Market, Insurance Commissioner David Altmaier letter to House Commerce Committee, April 2, 2021

- Court Reverses Bad Faith Decision, LMA Newsletter of March 29, 2021

- Citizens’ CEO: Florida Property Insurance Market is Shutting Down, Insurance Journal, March 14, 2021

- Florida Property Insurance Cos. Financials, LMA Newsletter of March 15, 2021

- Homeowners Insurance Fraud Probes Lacking, LMA Newsletter of March 15, 2021

- Several Factors Hinder Homeowner and Auto Glass Insurance Fraud Processing, Florida Office of Program Policy and Government Accountability (OPPAGA), March 2021

- Citizens Rate Hike Hearing, LMA Newsletter of March 15, 2021

- Demotech Financial Stability Ratings for the Florida Domestic Market, March 12, 2021

- Demolish Contractor Fraud!, LMA Newsletter of March 8, 2021

- Call for Insurance Market Reform Grows, LMA Newsletter of March 8, 2021

- Citizens Poised to Raise Rates, LMA Newsletter of March 8, 2021

- Florida Regulators Make the Case for Reform, LMA Newsletter of March 1, 2021

- Florida Bar v. Scot Strems, LMA Newsletter of March 1, 2021

- Consumer Alert: Don’t Fall Victim to Contractor Fraud, Florida’s Insurance Consumer Advocate Office, March 2021

- Cost Drivers Affecting Florida’s Insurance Rates, Insurance Commissioner David Altmaier letter to House Commerce Committee, February 24, 2021

- Reports Urge Legislative Action, LMA Newsletter of February 1, 2021

- Florida’s P&C Market: Spiraling Toward Collapse, Guy Fraker of Cre8tfutures Advisory, February 2021

- Insurers Pursuing Fraud with RICO Suits, by Barry Zalma in the Johnson Strategies Blog, February 1, 2021

- Florida’s Property Insurance Market Is ‘Spiraling Towards Collapse’ Due to Litigation, Insurance Journal, January 20, 2021

- Strengthening Florida’s Homeowners Market, LMA Newsletter of January 4, 2021

- Citizens Exposure Reduction and Depopulation Opportunities Analysis, FSU Florida Catastrophic Storm Risk Management Center, November 2020

- Summary Judgment Standard Changed, LMA Newsletter of January 4, 2021

- 2021’s Insurance Consumer, LMA Newsletter of January 4, 2021

- Florida Bar v. Scot Strems, LMA Newsletter of December 14, 2020

- Florida Appellate Court Says No to a $442,000 Attorney Fee in a $25,000 Settlement, LMA Newsletter of November 30, 2020

- Florida Property Insurance Market Inches Closer to Crisis – Part 1 and Part 2, Insurance Journal, October 29 & 30, 2020

- Funny, But No Laughing Matter, LMA Newsletter, September 28 ,2020

- Citizens Insurance Tracking Contingency Fee Multipliers, LMA Newsletter, September 14, 2020

- “A Tale of Two Tails” on insurance claims lawsuits, Demotech webinar, August 18, 2020

- Florida Appellate Court Says No to a $442,000 Attorney Fee in a $25,000 Settlement, LMA Newsletter of November 30, 2020

- Funny, But No Laughing Matter, LMA Newsletter, September 28 ,2020

- Citizens Insurance Tracking Contingency Fee Multipliers, LMA Newsletter, September 14, 2020

- “A Tale of Two Tails” on insurance claims lawsuits, Demotech webinar, August 18, 2020.

(You can find the most recent LMA Products & Resources on the 2022 Litigation Reform & Consumer Protections webpage and previous LMA Products & Resources on the 2019 AOB Reform webpage)