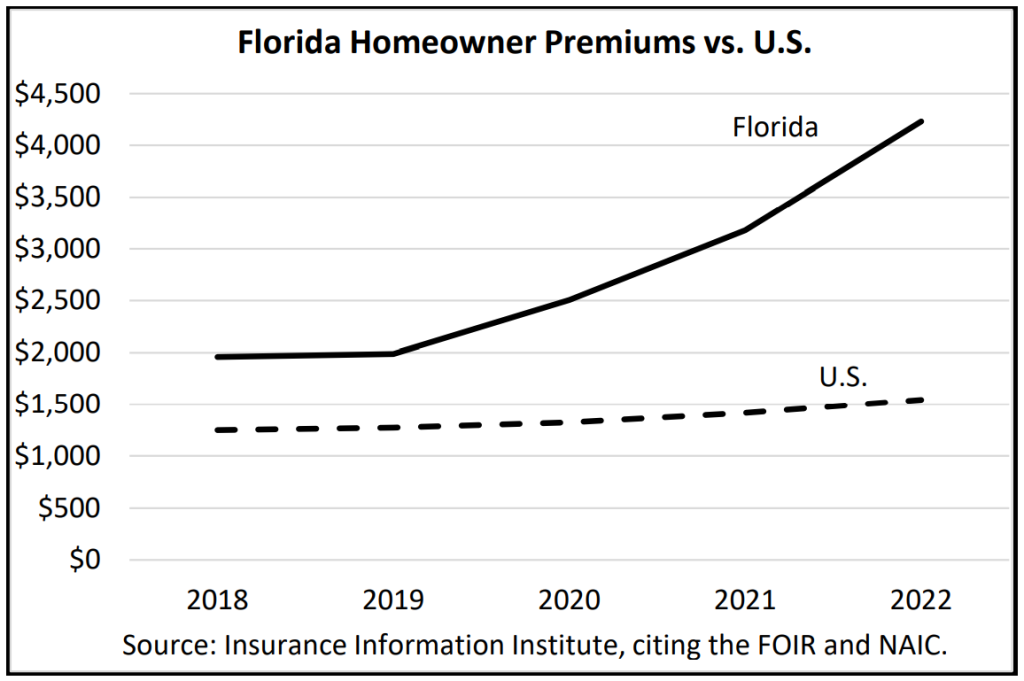

The Florida Legislature is meeting in special session the week of December 12 to address two issues vital to Florida’s economy: disaster relief for Hurricane Ian victims and further insurance consumer protections for homeowners across the state. Property insurance and reinsurance rates have grown by 100% or more in the past three years, yet insurance companies’ losses continue, with six carriers becoming insolvent this year, and 13 others withdrawing coverage, driven in part by a nearly 400% increase in claims litigation since 2013.

Former Florida Deputy Insurance Commissioner Lisa Miller talks with a former legislator and the head of an insurance brokerage for their perspective on the problem and what the legislature should do to help fix the Florida insurance market crisis.

Former Representative Andrew Learned (D-Brandon)

Deb Franklin, Co-CEO, PEAK6 InsurTech

Show Notes

Host Miller was joined by former state representative Andrew Learned, a Democrat from the Tampa Bay area. During his term, he took a keen interest in the consumer protection side of the property insurance reforms passed by the legislature in 2021 and 2022. Also joining her was Deb Franklin, Co-CEO of PEAK6 InsurTech, part of the PEAK6 family of companies. InsurTech provides the technology behind online insurance shopping and offers property and casualty insurance through its Team Focus Insurance Group and WeInsure. The conversation was part of a webinar hosted by the Florida Housing Coalition on December 2, 2022.

Host Miller set the table for the conversation, identifying four key focus areas of insurance industry discussion going into the Florida Legislature’s December 12 special session:

Excessive Litigation – There are renewed calls to eliminate the one-way attorney fees statute altogether, contingency fee multipliers, Assignment of Benefits (AOB) contracts between homeowners and contractors, and reform Bad Faith law under the civil remedy statute.

Roof Coverage – The ongoing debate is how carriers can insure roofs, without the coverage being used as a warranty by unscrupulous contractors seeking work or homeowners who fail to perform proper maintenance – and then suing when the claim isn’t fully covered.

Citizens Property Insurance Corporation Depopulation – The discussion is on how best to return Citizens to being what the 2002 Legislature created, as the “insurer of last resort.” Those analyzing current numbers say that one of every two policies written by the private market end up at Citizens at renewal because they can’t compete on price with Citizens’ legislatively-capped rates.

Reinsurance Availability – Florida’s private insurance market is having difficulty finding adequate capital to purchase reinsurance (insurance for insurance companies) and to write new business. Reinsurance costs have risen by 30%-70% at the same time that major reinsurance companies are limiting their capacity in the Florida market. The Legislature is expected to consider providing assistance to improve the availability of reinsurance.

“Consumers don’t get it. They don’t understand why their rates are climbing or why they’re being non-renewed or cancelled,” said Franklin, whose agents are providing extra education and counseling for customers, while finding coverage alternatives.

Former representative Learned, who owns a local student tutoring company, said he heard from many constituents with the same questions and confusion. “This kind of skirts around the fact that what we’ve essentially done is socialize our insurance market, and put all of the risk of all these policies in Citizens Property Insurance, which is essentially the taxpayers and anybody who owns a car,” he said.

Franklin pointed out that Citizens is now the largest insurance company in the state, with almost 1.2 million policyholders. She said Florida needs to consider what Louisiana recently did, by allowing Citizens to eliminate its caps and raise rates to actuarially-sound levels.

From American Consumer Institute’s “The Incentive to Sue”

Both Franklin and Learned said litigation reform is critical. The Florida Office of Insurance Regulation found that Florida has 7% of homeowners insurance claims in the U.S., yet 76% of homeowners insurance claims lawsuits. “It’s not just that, it’s that in an average payout from a lawsuit, the homeowner only got about 9%. So upwards of 90% is going to lawyers and the insurance companies’ lawyers,” said Learned. “And it’s destroying the marketplace for insurance,” added Franklin. “Private companies are running out of the state as fast as they can because they can’t afford to operate here.”

Door-to-door and other solicitation by roofers and other contractors, especially post-hurricane, feed the litigation frenzy, with a cottage industry of attorneys who specialize in such litigation. “To be honest, I think insurance companies do a terrible job. The problem is they do a terrible job because they are constantly having to beat back fraud claims,” said Learned, who advocates that part of the solution is educating homeowners that “There‘s no such thing as a free roof,” despite the obvious attraction, he said.

Host Miller and her guests also discussed the lack of reinsurance availability in Florida, which relies heavily on reinsurance to help pay catastrophic claims from the state’s frequent hurricanes and flooding events. “Because the insurance companies are not capitalized right now the way they should be, a lot of them aren’t going to be able to buy reinsurance coverage,” said Franklin, noting that reinsurance prices are going up another 35% to 50%. “They’ll be here for the right price,” she said, in answer to Host Miller’s question on whether the reinsurance market is going to be here for Florida’s insurance companies in 2023, following Hurricanes Ian and Nicole.

Miller and guests also discussed the predominance of flood claims versus wind claims from Hurricane Ian. Many residents were left without coverage, as standard homeowners policies don’t cover storm flooding and they didn’t know about or choose to purchase flood insurance. “The flood losses are the worst,” said Franklin, who spent many days at the insurance villages in Southwest Florida after Ian. “You lose everything. Everything’s gone. These people’s belongings including their children’s clothes and toys are out in front of their home. It’s the worst case scenario for consumers,” she said. “The time to prepare for these things is years in advance when we make sure that we design a system that works,” added Learned.

You can read the latest Hurricane Ian news here.

Links and Resources Mentioned in this Episode

Citizens Property Insurance Corporation

Property Insurance Stability Report (Florida Office of Insurance Regulation, July 2022)

2022 Litigation Reform & Consumer Protections (Lisa Miller & Associates)

Is the Legislature Poised for Meaningful Reform? (LMA Newsletter of December 5, 2022)

Florida Market ‘Plagued’ by Attorney Fee-Shifting (LMA Newsletter of December 5, 2022)

Florida’s Floody Mess (LMA Newsletter of December 5, 2022)

Hurricanes Ian & Nicole Latest (LMA Newsletter of December 5, 2022)

Contact Your Legislative Leader:

- House Speaker Paul Renner, 850-717-5019, [email protected]

- Senate President Kathleen Passidomo, 850-487-5028, [email protected]

Florida Department of Financial Services Consumer Hotline, 1-800-342-2762

Hurricane Ian Fraud (LMA Newsletter of October 24, 2022)

FEMA’s National Flood Insurance Program

** The Listener Call-In Line for your recorded questions and comments to air in future episodes is 850-388-8002 or you may send email to [email protected] **

The Florida Insurance Roundup from Lisa Miller & Associates, brings you the latest developments in Property & Casualty, Healthcare, Workers’ Compensation, and Surplus Lines insurance from around the Sunshine State. Based in the state capital of Tallahassee, Lisa Miller & Associates provides its clients with focused, intelligent, and cost conscious solutions to their business development, government consulting, and public relations needs. On the web at www.LisaMillerAssociates.com or call 850-222-1041. Your questions, comments, and suggestions are welcome! Date of Recording 12/2/2022. Email via [email protected] Composer: www.TeleDirections.com © Copyright 2017-2022 Lisa Miller & Associates, All Rights Reserved