2021 legislation filed

The first bills of the 2021 Florida legislative session have been filed, as we near the start of committee weeks on January 11 leading to the beginning of session on March 2. They include two insurance bills, the first of many we expect to see filed this session.

The first bills of the 2021 Florida legislative session have been filed, as we near the start of committee weeks on January 11 leading to the beginning of session on March 2. They include two insurance bills, the first of many we expect to see filed this session.

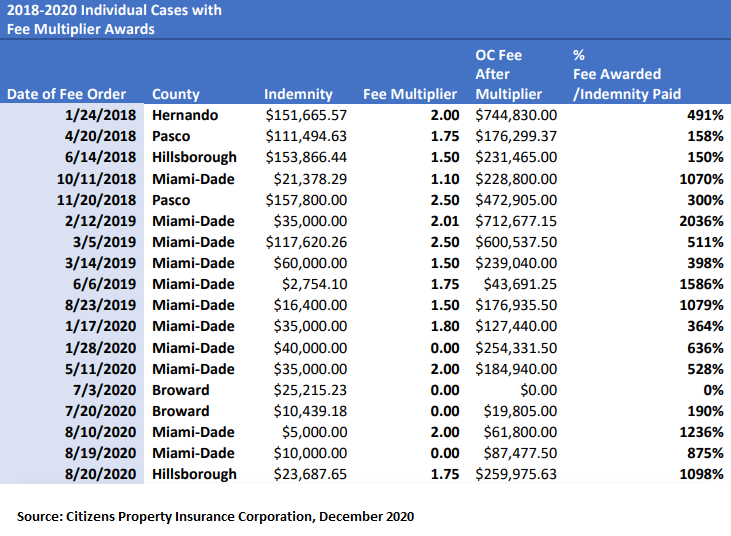

SB 212 – Contingency Risk Multipliers by Senator Jeff Brandes (R-Pinellas) is a renewed attempt to put the brakes on a growing abuse of attorney fee awards. The bill provides that for certain attorney fees awarded for claims arising under property insurance policies, a strong presumption is created that a lodestar fee is sufficient and reasonable; and providing that such presumption may be rebutted only under certain circumstances, specifically “in a rare and exceptional circumstance with evidence that competent counsel could not be retained in a reasonable manner.” The bill passed the House last session but got hung up in the Senate.

Citizens Property Insurance has added six more cases to its ongoing list of cases with contingency fees (see chart below). “Courts continue to award them and appeals courts for the most part continue to support them,” said Citizens’ Lisa Walker at last week’s Claims Committee meeting, noting however the recent 3rd DCA case where the court struck the fees (as featured in our last newsletter).

SB 168 – Hurricane Loss Mitigation Program by Senator Ed Hooper (R- Pinellas) continues a controversial program that while on its face appears to “harden” mobile homes from the threat of hurricanes, it has been questioned by many mitigation experts who have said the effectiveness of the $2 million annual program is doubtful. We will keep a close eye on this bill in hopes the legislature will ask for concrete data to show the results of this appropriation post Hurricane Irma.

Both bills are expected to go to the Senate Banking and Insurance Committee, which has a new Chairman, Senator Jim Boyd (R-Bradenton). He is an insurance agent who was elected to the Senate this year after serving for eight years in the Florida House.

We expect other insurance bills to be filed in the next few weeks. As was recently reported by the Sun-Sentinel, “Lawsuits in Florida against insurers of all types, including property, auto and health, increased from 142,316 between Jan. 1 and Dec. 9 in 2015 to 322,704 during the same period in 2020.” Those lawsuits are one of the reasons homeowners rates are rising rapidly in Florida. Regulators have approved about 100 rate increases this year, with a few close to 30%. Several companies have also reduced the number of policies they write each month with some deciding to stop writing new business completely while they wait for the rates to catch up to the costs.

Floridians for Lawsuit Reform (www.FLTortReform.com) is a great site to stay informed and communicate/take action about many insurance issues in the marketplace. We are happy to share with you if you want to call our office and discuss other key legislation and those who are making a difference like Senator Brandes.

LMA Newsletter of 12-14-20