End of Special Session on Property Insurance, Hurricane Ian Relief

The Florida Legislature ended its special session this afternoon (December 14, 2022) passing a package of reforms addressing the dire escalating issues in our property insurance market and providing economic relief for Hurricane Ian victims, as well as toll-road discounts. The House approved the reform bill today on an 84-33 vote along pure party lines, with Democrats opposed. The Senate had approved it yesterday on a 27-13 vote, with two Republicans joining all but one of the Democrats in opposing it. It’s the second special session of the year on property insurance

The Florida Legislature ended its special session this afternoon (December 14, 2022) passing a package of reforms addressing the dire escalating issues in our property insurance market and providing economic relief for Hurricane Ian victims, as well as toll-road discounts. The House approved the reform bill today on an 84-33 vote along pure party lines, with Democrats opposed. The Senate had approved it yesterday on a 27-13 vote, with two Republicans joining all but one of the Democrats in opposing it. It’s the second special session of the year on property insurance

Many believe the bill accomplishes almost all of the much needed reform to help re-right Florida’s decimated property insurance market ̶ plagued by high insurance and reinsurance rates, carrier insolvencies, inflated claims, excessive litigation, and a residual market that needs to be restored to the market of last resort. The bill significantly builds on the May 2022 special session reforms and becomes effective upon the signature of the Governor, which is expected quickly. These provisions are not retroactive.

The major provisions of the bill cover:

- Attorney Fees: Ends one-way attorney fees in residential and commercial property insurance policy lawsuits;

- Offers of Judgment: Reinstates the civil offer of judgment statute (also known as Proposals for Settlement) and makes attorney fees available for the prevailing party, while also allowing for joint offers of judgment;

- AOBS: Prohibits Assignment of Benefits (AOB) contracts of residential and commercial property insurance policies issued on or after January 1, 2023;

- Bad Faith: Prohibits the filing of a bad faith lawsuit until a final judgement is issued against the insurance company in the original claim dispute;

- Citizens Property Insurance Reforms: Makes many essential improvements to current laws governing the state-backed Citizens Property Insurance Corporation, including:

- Changing the eligibility to remain a Citizens policyholder, by requiring that private insurance company coverage has to be 20% more expensive (up from 15%, to match current rules on new policies) and likewise for commercial residential policies;

- Ending capped rates (the so-called “glide-path”) and requiring its rates be actuarially-sound and be “non-competitive” with admitted companies’ market rates;

- Defining and allowing higher rates for second (non-homesteaded) homes; and

- Requiring personal lines policyholders purchase flood insurance to become or remain a Citizens policyholder.

- Reinsurance: Establishes a second optional hurricane reinsurance fund (The Florida Optional Reinsurance Assistance Program) for carriers, offering rates of 50% to 65% of the cost of on-line rates, while maintaining the Reinsurance to Assist Policyholders (RAP) program created in the May special session;

- Arbitration: Allows carriers to include mandatory binding arbitration in their policies;

- Claims Handling: Reduces from 90 days to 60 days the time insurance companies have to pay or deny a claim, unless extended by regulators; and reduce from 14 days to 7 days the time a carrier has to review and acknowledge a claim communication and begin an investigation, along with other time requirement changes;

- Claim Filing: Further tightens deadlines for policyholders to report a claim from 2 years to 1 year for a new or reopened claim, and from 3 years to 18 months for a supplemental claim;

- Greater OIR Regulation: Allows the Florida Office of Insurance Regulation (OIR) to withdraw approval of policies with an appraisal clause for companies that routinely invoke it; allows OIR to do market conduct exams after a hurricane on those companies in the top 20% of claims filed or DFS complaints and to include an examination of their MGAs; and requires companies begin monthly reporting of the numbers of claims opened, closed, pending, and those seeking alternative dispute resolution and of which type.

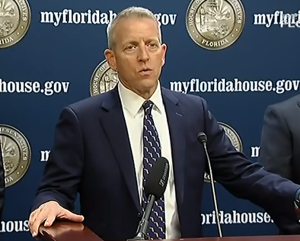

Florida House Speaker Paul Renner

“Today is a big day in that we provide relief for Floridians who desperately need it,” said House Speaker Paul Renner (R-Palm Coast) after the session ended this afternoon. He was joined by Rep. Tom Leek (R-Ormond Beach) who called it “the biggest, meatiest, beefiest property insurance reform legislation that the state has ever seen.” They, along with Rep. Bob Rommel, stressed that the goal is to provide market stability and competition that will bring new money into the state and new insurance companies, that in turn, will eventually lead to reduced rates overall.

“What I am confident of is that today we have fixed the property insurance market,” added Renner. “That does not mean that tomorrow your insurance rates are going to go down because tomorrow’s premiums are based on the storms of the last year and the years preceding that. We still have a window for Ian claims to be filed.” He said he “absolutely has higher expectations” as the result of this session that insurance companies will work to lower rates.

“It does provide immediate relief by raising the prospect that the insurance you had last year will still be here this year. That’s where we are. I don’t like that and Floridians don’t like that. But because of a lot of litigation and two bad storms, we’re in a very, very bad spot,” Renner said. “I’m not suggesting that there won’t still be companies that go out of business after this bill because again, there’s nothing that anyone could do to change what’s happened in the past. And what’s coming next year, early next year, is in large part for the companies that are here, a function of what’s happened in the past that is beyond our control.”

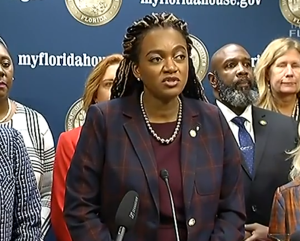

Florida House Minority Leader Fentrice Driskell

House Democrats after the session criticized the bill for having no immediate rate relief for homeowners and as a $1 billion bailout to insurance companies. “We’re at a time where Florida has the largest budget surplus in its history and rather than directly help homeowners, we provided a bailout to the industry,” said House Minority Leader Fentrice Driskell (D-Tampa). She was joined by Rep. Hillary Cassel (D-Dania Beach) who called it damaging to consumers. “The bill’s new language carries a burden of proof that has shifted on to the homeowner to prove now an exclusion in an 80 to 110 page policy. You can’t prove a burden of proof without an attorney,” said Cassel.

Senator Jim Boyd (R-Bradenton) who sponsored the bill and is an insurance agent, said prior to yesterday’s Senate floor vote that “we’re getting at what I believe is the root cause of the problem” of excessive litigation against insurance companies that are reflected in multiple double-digit rate increases over the past two years. Democrats during the session argued that eliminating one-way attorney fees would put the burden on policyholders to pay their attorneys out of any insurance proceeds and create a “David vs. Goliath” situation. “We have allowed the system to become what it is, so let’s just blame the attorneys,” said Senator Tina Polsky (D-Boca Raton), herself an attorney.

Noticeably absent from the bill was any consideration for allowing carriers to pay actual cash value (ACV) instead of replacement cost on claims requiring new roofs. The bill instead relies on elimination of AOBs as the solution to unscrupulous contractors, aided by attorneys, pursuing “free roofs” for homeowners.

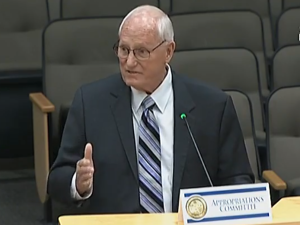

“There’s a reset button with this legislation that’s going to take place,” Florida CFO Jimmy Patronis testified during yesterday’s House Appropriations Committee meeting. “There’s a lot of changes in the Florida insurance market that you’re going to see because of this.”

Citizens Property Insurance Co. President & CEO Barry Gilway

Barry Gilway, President & CEO of Citizens Property Insurance, who has repeatedly urged many of these changes in recent years, called the bill “absolutely historic.” He, too, said it represents a major change in Florida’s property insurance market, in his testimony before the same committee. “It will draw capital back into the Florida marketplace. It won’t happen overnight but it will happen a lot sooner than people think. It will give the reinsurance community far more confidence in their ability to place the limited capacity they have back into the market,” said Gilway. He pointed out that the reason Florida’s “absolutely absurd” homeowners rates are three times greater than the national average is to simply stay ahead of the litigation costs.

We must also point out that the bill’s inclusion of mandatory flood insurance for Citizens policyholders is a significant and positive step to protect more Floridians from the hidden dangers of flood waters. We most recently witnessed this in Hurricanes Ian and Nicole, where many residents didn’t know that homeowners policies don’t cover flooding or who otherwise chose not to purchase it. Our recent Florida Insurance Roundup podcast explores many of the bill’s issues. You can listen and/or read more here. For more background on past reforms, you can visit our Assignment of Benefits and Insurance Litigation webpage.

The Democrats offered a series of amendments in the House and Senate committees that heard the bill – none of them passed. These included: enacting a freeze on rates for one year with a rate rollback of 6.4% for the following three years; prohibiting insurance company executive bonuses if the company raises rates; making it an unfair trade practice for carriers to alter the original adjuster report or estimate without consent; requiring carriers provide the original copies of adjuster and contractor reports; and capping homeowners insurance rate increases to the Consumer Price Index.

Speaker Renner told reporters after the session ended this afternoon that there were two categories of amendments offered by Democrats. “Things that we can address during the upcoming regular session that make some tweaks and adjustments to the bill that was just passed and some suggestions not part of the subject matter of the bill but are worthwhile pursuing….and other suggestions that really put us in an alternative state of reality.”

The legislature also passed a bill in this special session to provide property tax and other economic relief to victims of Hurricanes Ian and Nicole, as well as help local governments with clean-up costs. Plus, a discount for those who regularly use Florida’s toll roads.

Here are the details of all three bills: .

Property Insurance – SB 2-A by Senator Jim Boyd (R-Bradenton) passed the Senate on a 27-13 vote, with two Republicans joining all but one of the Democrats in opposing it, followed by passage in the House (84-33) along party lines. (It had an identical bill HB 1-A in the House by Reps. Tom Leek and Bob Rommel and was vetted by two committees in each chamber.) Here’s more detail on what the bill will do, effective upon the Governor’s signature.

Florida Optional Reinsurance Assistance Program

- Establishes the Florida Optional Reinsurance Assistance (FORA) Program for the 2023 hurricane season, which:

- Creates an optional hurricane reinsurance program that insurers can purchase at “reasonable” rates. Rates vary by tier level purchased and will range from 50% to 65% rate on-line.

- Provides purchase tiers that begin at the Florida Hurricane Catastrophe Fund (FHCF) attachment point and cumulatively are limited to no more than $5 billion below the FHCF attachment point.

- Allows insurers that purchase FORA coverage or receive free Reinsurance to Assist Policyholders (RAP) coverage at each tier to have the option to purchase the next tier down.

- Maintains the Reinsurance to Assist Policyholders (RAP) program created in last May’s special session, thus allowing those insurers and their policyholders that could not participate during 2022-2023, to receive and benefit from RAP reinsurance in 2023-2024.

- Funds FORA coverage with $1 billion in general revenue funds and the premiums insurers pay for FORA coverage.

- Returns remaining revenue to general revenue after the FORA program ends.

Claim Filing Deadline

- Reduces the deadline for policyholders to report a claim under the policy from 2 years to 1 year for a new or reopened claim, and from 3 years to 18 months for a supplemental claim.

Regulation of Insurance in Florida

- Authorizes the Office of Insurance Regulation (OIR) to subject any authorized insurer to a market conduct examination after a hurricane under certain conditions relating to property insurance claims.

- Ensures that insurers do not abuse the appraisal process under property insurance policies by:

- Specifying the OIR has discretionary authority to suspend or revoke an insurer’s certificate of authority or issue administrative fines and restitution upon if the insurer engages in a general business practice of, without just cause, compelling insureds to participate in appraisal in order for the insured to secure the full payment or settlement of a property insurance claims.

- Adding additional elements to the mandated insurer’s quarterly reports filed with the OIR related to claims.

- Authorizing the OIR, based on finding that the insurer had exhibited a pattern or practice of one or more willful unfair insurance trade practice violations with regard to its use of appraisal, to withdraw OIR approval of the property insurer’s forms and, in addition to any other authorized regulatory action, issue an order that prohibits the insurer from invoking appraisal for up to two years.

- Adding an element to the Property Insurer Stability Unit’s required semiannual report on the status of the homeowners’ and condominium homeowners’ insurance market to include the name of any insurer found to have exhibited a pattern or practice of one or more willful unfair insurance trade practice violations with regard to its use of appraisal. The bill also requires the OIR to publish this same information on its internet webpage.

Prompt Pay Laws for Property Insurance

- Amends the prompt pay laws to encourage the prompt payments of claims, as follows:

- Reduces the time for insurers to pay or deny the claim from 90 to 60 days. Allows the Florida Office of Insurance Regulation (OIR) to extend the 60 day period up to 30 additional days if a state of emergency, cyberattack, or computer systems failure prevents the insurer from meeting the time frames of the prompt-pay law.

- Reduces the time for insurers to review and acknowledge a claim communication from 14 days to 7 days.

- Reduces the time for insurer to begin an investigation from 14 days to 7 days.

- Reduces the time for insurer to conduct a physical inspection from 45 days to 30 days, and applies this requirement to hurricane claims.

- Specifies insurers may use electronic methods to investigate the loss and allows policyholders to participate in the use of such methods.

- Requires insurers to send any adjuster’s report estimating the loss to the policyholder within 7 days after it is created.

- Requires that the insurer’s claim records include various parts of the claim investigation and their dates.

- Provides that the requirements of the section are tolled: during the pendency of any mediation or alternative dispute resolution procedure provided in the insurance contract and upon failure of a policyholder or representative to provide material claim information within 10 days, if the request for such information was made within the first 45 days after notice of the claim.

- Amends the Homeowner Claim Bill of Rights to conform to the bill’s changes to the prompt pay laws.

- Amends the Unfair Insurance Trade Practices Act to conform to changes made to the prompt pay laws by reducing the requirement to pay undisputed amounts of benefits from 90 days to 60 days and revising the factors that excuse failure to perform.

Awards of Attorney Fees in Litigation under Property Insurance Contracts

- Provides that the one-way attorney fee provisions of s. 627.428, s. 626.9373, and s. 627.70152 are not applicable in a suit arising under a residential or commercial property insurance policy.

- Reinstates application of the civil offer of judgment statute to civil actions arising under a residential or commercial property insurance policy.

- Allows joint offers of settlement in property insurance litigation contingent on acceptance of all joint offerees.

- Removes provisions regarding attorney fees relating to the alternative procedure for resolution of disputed sinkhole insurance claims.

Assignments of Benefits

- Prohibits the assignment, in whole or in part, of any post-loss insurance benefit under any residential property insurance policy or under any commercial property insurance policy issued on or after January 1, 2023.

Bad Faith Failure to Settle Actions against Property Insurers

- Provides that bad faith litigation for failure to settle a property insurance claim may not be filed until after the insured has established through adverse adjudication by a court that the insurer breached the insurance contract and a final judgment or decree has been rendered against the insurer.

Citizens Property Insurance Corporation

- Increases the eligibility threshold for Citizens renewal personal lines policyholders. Under the bill, such policyholders are ineligible for Citizens coverage at renewal upon receiving an offer of comparable coverage from an authorized insurer for a premium that is not more than 20 percent greater than the Citizens renewal premium.

- Increases the eligibility threshold for Citizens new policies for commercial residential coverage from 15 percent to 20 percent, which is consistent with the current threshold for new policies of personal residential coverage.

- Amends provisions on take-out offers and the Citizens clearinghouse to conform to the increased eligibility thresholds contained in the bill.

- Requires that Citizens’ rate be non-competitive with the approved rates charged in the admitted market, in addition to being actuarially sound.

- Increases the potential rates charged for coverage on risks that are not primary residences.

- Defines the term “primary residences.”

- Repeals language allowing policyholders to return to Citizens as a renewal if the take-out carrier increases their rates above the Citizens’ glidepath.

- Combines Citizens three accounts into a single account upon Citizens eliminating all outstanding financing obligations. A single account structure will allow Citizens to access its entire surplus to pay claims. Currently, surplus in a particular account may only be used to pay claims in that account. The bill also revises the Citizens policyholder surcharge imposed in the event of a deficit from 15 percent per account (maximum 45 percent) to 15 percent for the single account.

- Provides that Citizens personal lines residential policyholders must secure and maintain flood insurance that meets certain requirements as a condition of eligibility for Citizens coverage.

- Provides a timetable for which flood insurance coverage must be implemented for personal lines residential Citizens policyholders.

- For risks located in areas designated by the Federal Emergency Management Agency as special flood hazard areas, flood insurance must be secured for new Citizens policies with an effective date on or after April 1, 2023, and at renewal for Citizens policies that renew on or after July 1, 2023.

- For all other risks, the requirement to obtain flood insurance at policy issuance or renewal is effective:

- March 1, 2024, for policies insuring property to a limit of $600,000 or more.

- March 1, 2025, for policies insuring property to a limit of $500,000 or more.

- March 1, 2026, for policies insuring property to a limit of $400,000 or more.

- March 1, 2027, for all other policies.

Flood Notice

- Amends the mandatory flood insurance notice by requiring it to be part of the declarations page and makes revisions to the content of notice to encourage purchase of flood insurance.

Arbitration

- Provides conditions whereby a property insurer may include mandatory binding arbitration in its policies. The insurer may not require a policyholder to participate in mandatory binding arbitration unless specified conditions are met, including that the insurer also offer a policy that does not have a mandatory binding arbitration clause. Insurers must also provide an appropriate premium discount in exchange for the rights ceded by the policyholder.

Continuation of Coverage

- Authorizes the OIR to extend the 30-day coverage period for policies of insolvent insurers by an additional 15 days if the OIR reasonably believes that market conditions are such that the policies cannot be placed with an authorized insurer within the 30-day period.

Appropriations

- For 2022-2023 fiscal year, appropriates $1,757,982 in recurring funds from the Insurance Regulatory Trust Fund to the OIR with an associated salary rate of $844,464.

- Allocates the funds as follows: $1,356,615 for Salaries and Benefits, $400,000 for Other Personal Services Category, and $1,367 to DMS. Funds also will be used for recruitment and retention of personnel within the OIR.

- Authorizes cumulative transfers from general revenue not to exceed $1 billion from the General Revenue Fund to the Florida Optional Reinsurance Assistance (FORA) Program for the 2022-23 contract term beginning June 1, 2023.

Disaster Relief –SB 4-A by Senator Travis Hutson (R-Palm Coast) passed unanimously in both the Senate and House. It provides a variety of economic relief for residents and local governments impacted by this fall’s Hurricanes Ian and Nicole. It had an identical bill in the House, HB 3-A by Reps. Stan McClain and Tom Leek. First and foremost is property tax relief to the hurricane victims. The measure grants a property tax refund and deferment for homes and businesses destroyed or made uninhabitable for at least 30 days in either storm by retroactively applying this past spring’s Surfside building collapse law that created rebates when residential properties are rendered uninhabitable for 30 days or more by catastrophes. It also extends the due dates for property taxes levied in 2022 for those same property owners.

The measure, which comes with a total proposed appropriation of $751.5 million, also:

- Appropriates $350 million from the General Revenue Fund to the Division of Emergency Management (DEM) to provide the full match requirement for FEMA Public Assistance grants to local governments affected by the two hurricanes.

- Appropriates $150 million from the General Revenue Fund to the Florida Housing Finance Corporation, of which $60 million will go to local governments to assist residents with the repair or replacement of their house, relocation costs, housing reentry assistance, and insurance deductibles. $90 million will fund the Rental Recovery Loan Program to promote development and rehabilitation of affordable housing in affected areas.

- Appropriates $251.5 million from the General Revenue Fund to the Department of Environmental Protection (DEP) for:

- Beach erosion projects ($100 million) without the need of local government matching

- Hurricane Reimbursement Grant Program ($50 million)

- Hurricane Stormwater and Wastewater Assistance Grant Program ($100 million)

- DEP administrative costs ($1.5 million)

- Provides for the creation of a direct-support organization for the DEM to provide assistance, funding, and support to DEM in its disaster response, recovery, and relief efforts for natural emergencies.

Looking to the regular legislative session that begins March 7, 2023, House Speaker Paul Renner has formed a Select Committee on Hurricane Resiliency and Recovery. It will look at issues resulting from the hurricanes and “accelerate rebuilding and gather lessons learned, so that we are even better prepared for future storms,” said Renner. He has appointed Rep. Michael Grant (R-Port Charlotte) as Chair and Rep. Adam Botana (R-Bonita Springs) as Vice Chair. Expect a report similar to a previous select committee’s 2018 report on Hurricanes Maria & Irma.

Toll Relief – SB 6-A by Senator Nick DiCeglie (R-St. Petersburg) passed unanimously in both the Senate and House. It gives discounts for motorists who regularly use Florida’s toll roads beginning January 1, 2023. It had an identical bill in the House, HB 5-A by Rep. Demi Busatta-Cabrera. It provides a 50% discount for commuters who pay more than 35 tolls in a month and use a transponder to pay. The bill funds $500 million to cover the lost revenue to the various tollway authorities. The program is based on a current six-month pilot program that has offered a 20-25% discount for motorists with 40 toll transactions a month.

Other Bills – There were several other bills filed in the House, by Democrats, that proposed a variety of ideas but the first two were withdrawn prior to the actual beginning of the special session. The last one on the Catastrophe Pool did receive a first hearing and can be considered in the regular legislative session that begins on March 7, 2023.

HB 7-A Hurricane Property Insurance Claim Mediation, by Rep. Jervonte Edmonds (D-Palm Beach) that would establish the Hurricane Property Insurance Claim Alternate Dispute Resolution Program within the Florida Office of Insurance Regulation (OIR).

HB 9-A Insurance, by Rep. Fentrice Driskell, the House Minority Leader, that covers a variety of topics, including having an elected state insurance commissioner, creating a Property Insurance Commission, and establishing capped premiums.

HM 11-A Establishment of Federal Catastrophe Pool, by Rep. Kelly Skidmore (D-Palm Beach). Filed as a House Memorial, urging Congress to establish a federal catastrophe pool.

The LMA Newsletter and future editions of Bill Watch will return in the New Year! Happy Holidays!

LMA Bill Watch of 12-14-22