New non-competitiveness factor in play

The Citizens Property Insurance Corporation’s Board of Governors last week approved an overall 13.5% increase in rates for next year that includes a 14% increase in its personal lines policies, the maximum allowed under the state’s rate increase cap glide-path. Commercial lines policies would increase 10.3%. These rates take into account the new legislative requirement that Citizens be non-competitive with private insurance companies as a way to reduce the number of policies – and associated assessment risks – to Florida taxpayers, by this state-backed carrier. Among the highlights:

The Citizens Property Insurance Corporation’s Board of Governors last week approved an overall 13.5% increase in rates for next year that includes a 14% increase in its personal lines policies, the maximum allowed under the state’s rate increase cap glide-path. Commercial lines policies would increase 10.3%. These rates take into account the new legislative requirement that Citizens be non-competitive with private insurance companies as a way to reduce the number of policies – and associated assessment risks – to Florida taxpayers, by this state-backed carrier. Among the highlights:

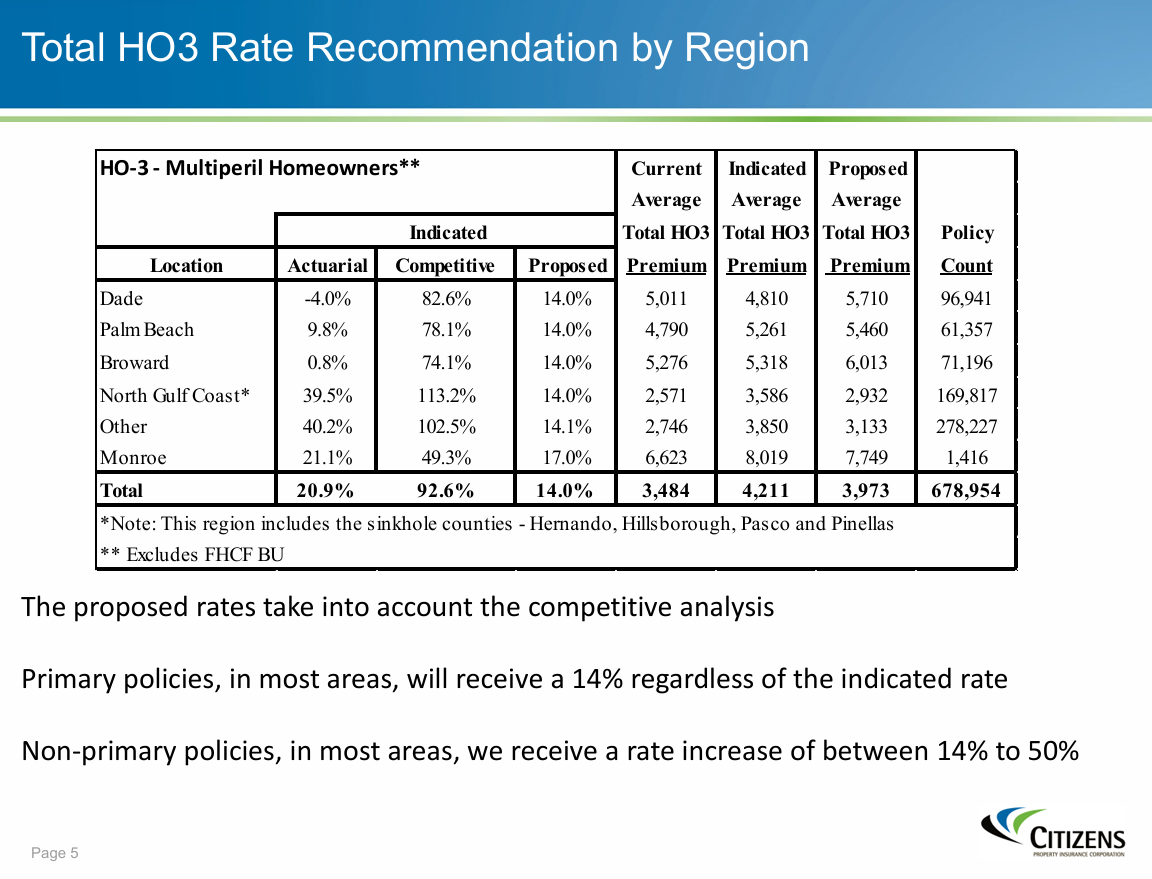

- The rate indication in homeowners multi-peril (HO-3) policies has fallen from 55.1% to 25.2% due to legislative reforms under SB-2A that eliminated Assignment of Benefits (AOB) contracts and one-way attorney fees. “We know exactly what’s causing that (decrease),” Chief Actuary Brian Donovan told the Board. “It’s the litigation.”

- The HO-3 non-catastrophe claims litigation rate has fallen from 44% in 2015 to 10% at year-end 2023. “Again, that’s a drastic improvement,” Donovan said.

- Taking into account actuarial indications and the non-competitive requirement led to a recommended across-the-board 14% increase for Citizens policyholders in 128 of its 151 territories.

- South Florida would see higher rate increases solely based on the non-competitiveness requirement.

These proposed rates will be submitted to the Office of Insurance Regulation (OIR) for an expected public rate hearing and review. Citizens President Tim Cerio also announced the carrier has readjusted its year-end population forecast to be under 1 million policies due to an expected late year increase in participation by private carriers in its depopulation program. You can read our complete report here.

Not all is rosy at Citizens, whose experiences are often indicative of the rest of Florida’s property insurance market. While the non-catastrophe litigation rate has fallen, as noted above, the trend of increasing catastrophe claim lawsuits continues into 2024. In the first four months of this year, 47% of new lawsuits are catastrophe claims (up 24% from the same period in 2023). While the number of AOB lawsuits continue to decline thanks to legislative changes, plaintiff representation at First Notice of Loss is up 32% in the first fourth months of 2024 compared to the same period in 2023 and now represent 63% of new lawsuits. Chief Insurance Officer Jay Adams has previously noted that catastrophe claim litigation from Hurricane Ian isn’t covered by the legislative reforms.

Perhaps more significant: New lawsuits overall have increased 5% in the first four months of 2024 compared to the same period in 2023, a reversal of the decreasing trend of the past two years. Notes Citizens VP of Claims Litigation, Elaina Paskalakis, “It is simply too early to tell if this will be a sustained trend or merely a temporary, seasonal spike in new lawsuits.”

In its effort to help depopulate Citizens and reduce assessment risks, the Florida Legislature this spring passed HB 1503 that the Governor recently signed into law. Starting July 1, Florida insurance agents must have at least three appointments with authorized insurance companies before they can sell policies for Citizens. The previous law required one other appointment. Those who don’t will lose the ability to write, service, or renew Citizens business. It’s an effort to ensure that agents selling Citizens policies will be able to offer at least three private market alternatives to consumers.

LMA Newsletter of 6-24-24