Stop ‘em at home, or you’ll have ‘em in the business

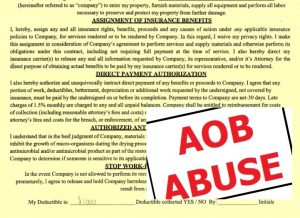

There is increasing concern among insurance analysts that unless Florida reigns-in the Assignment of Benefits (AOB) abuse occurring now statewide in residential properties, the problem could spread to commercial lines. The latest to sound the alarm is the Insurance Information Institute (I.I.I.), which has chronicled Florida’s AOB abuse over the past decade.

There is increasing concern among insurance analysts that unless Florida reigns-in the Assignment of Benefits (AOB) abuse occurring now statewide in residential properties, the problem could spread to commercial lines. The latest to sound the alarm is the Insurance Information Institute (I.I.I.), which has chronicled Florida’s AOB abuse over the past decade.

I.I.I.’s chief actuary James Lynch, in an interview with Best’s News Service last week, said without needed legislative reforms, AOB lawsuits could spread to insurance companies’ commercial lines of business.

“There will be really, really strong incentives to see AOB abuse happening in other lines of business,” particularly business owners policies, unless root issues are addressed legislatively, Lynch said, noting that it started with Personal Injury Protection (PIP) lawsuits, then moved to homeowners and auto glass lawsuits – all using AOBs.

Lynch of course, has the facts to back him up. He co-authored I.I.I.’s January report Florida’s Assignment of Benefits Crisis which outlines the latest startling statistics in the Sunshine State. Nearly 135,000 AOB lawsuits were filed statewide through Nov. 9, 2018 – a 70% increase in five years (growing from 1,300 cases in 2000 to 79,000 in 2013). Auto glass lawsuits in Florida increased to 20,367 in 2017, compared with just 3,821 in 2013, according to the report.

Legal costs have grown, too, with the increased caseload. Legal costs now represent 9.2% of homeowners multiperil losses in 2016 compared to 2% a decade earlier. Within the Tri-county area of South Florida, Broward property AOB lawsuits nearly quintupled, and Miami-Dade’s nearly tripled between 2013 and 2016 for litigated claims disputes, according to the I.I.I.

Citizens Property Insurance Corporation during its Claims Committee meeting last week announced its claims litigation is increasing once again, after a brief hiatus brought on by hurricanes. It’s now back up to 1,000+ new lawsuits filed each month against the company. Almost half of Citizens 2018 claims ended up in litigation (13,064). The company is considering spending nearly $1 million this year on an advanced imagery and analytics membership with the National Insurance Crime Bureau that they say will help fight fraud.

While the Florida legislature contemplates two similar AOB reform bills this session (see Bill Watch), the Florida Supreme Court later this year will hear the case of Restoration 1 vs. Ark Royal Insurance Company that we have been following closely. In February, Restoration 1 file a 45-page initial brief outlining its case that a lower court erred in allowing the insurance company’s provisions requiring all with an insured interest must agree to an AOB. Ark Royal has now answered with its brief. No oral arguments have been scheduled.

LMA Newsletter of 3-25-19