Standby for more rate increases

Two sister, Florida-based property insurance companies are seeking double-digit homeowners insurance rate increases, continuing the trend we’ve talked about here that is a symptom of our state’s property insurance market woes.

Two sister, Florida-based property insurance companies are seeking double-digit homeowners insurance rate increases, continuing the trend we’ve talked about here that is a symptom of our state’s property insurance market woes.

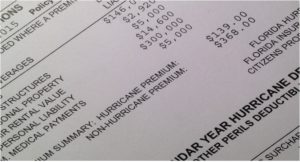

Southern Fidelity Insurance Company seeks a 31.1% increase in its homeowners multi-peril line. Capitol Preferred Insurance Company seeks a 26.2% hike in its homeowners multi-peril line. In May, regulators allowed the company to cancel about a quarter of its 108,870 policies with a 45-day notice to the policyholders, citing unsustainable losses and reinsurance costs. Rate hearings will be held on both filings this Friday (August 7) at 10am via webinar by the Florida Office of Insurance Regulation. (You can also access it by telephone at 1(877) 309-2074 and access code 373-559-297.)

The companies are the latest seeking such rate increases, brought on by the growing culmination of four factors we’ve outlined in the pages of this newsletter over the past 12 months: claims creep, growing attorney fees, rising reinsurance costs, and the resulting contraction of the private market with taxpayer-backed Citizens Property Insurance Corporation left picking up the policies.

We know of some incredible policyholder lawyers who work WITH insurance companies to bring in claims for a landing versus using litigation tactics that are not productive and do nothing but increase claims costs. Ed Leefeldt, a longtime and credible investigative and insurance reporter, wrote a piece in Forbes recently that tells it like it is.

Senator Jeff Brandes

As for forward-looking solutions, Senator Jeff Brandes (R-Pinellas) told Trading Risk magazine that upward and “unsustainable” cost pressures and various market shenanigans may finally get the attention of the Florida Legislature to finish the reforms it started last year. “The opportunity for reform has never been better than the next two years,” he said, noting that many lawmakers who had “a different perspective on insurance” have left the House and Senate after fulfilling their term limits. The article is a nice summary by Senator Brandes on the state of the Florida market right now and good reading for those needing an update or primer on the subject, together with fair, workable solutions!

LMA Newsletter of 8-3-20