But lawsuit notices, AOB’s on the rise

State regulators have approved an extension of a special assessment on Florida property insurance policyholders, while they consider loosening rules on Citizens Insurance coverage. Meanwhile, the insurance commissioner says litigation against companies is decreasing as Citizens reports their litigation and especially Assignment of Benefits (AOB) lawsuits are rapidly increasing. It’s all in this week’s Property Insurance News.

State regulators have approved an extension of a special assessment on Florida property insurance policyholders, while they consider loosening rules on Citizens Insurance coverage. Meanwhile, the insurance commissioner says litigation against companies is decreasing as Citizens reports their litigation and especially Assignment of Benefits (AOB) lawsuits are rapidly increasing. It’s all in this week’s Property Insurance News.

FIGA Assessment: The Florida Office of Insurance Regulation (OIR) has approved a plan by the Florida Insurance Guaranty Association (FIGA) to extend the existing 0.7% assessment on property insurance policies through the end of 2023. It’s part of FIGA’s plan as we reported last edition to borrow $150 million so it can continue to pay outstanding claims from the Southern Fidelity Insurance insolvency in June. This is on top of the 1.3% assessment OIR approved that runs from July 1, 2022 to June 30, 2023 to help FIGA pay claims on the other four Florida companies that have gone insolvent this year.

FIGA Assessment: The Florida Office of Insurance Regulation (OIR) has approved a plan by the Florida Insurance Guaranty Association (FIGA) to extend the existing 0.7% assessment on property insurance policies through the end of 2023. It’s part of FIGA’s plan as we reported last edition to borrow $150 million so it can continue to pay outstanding claims from the Southern Fidelity Insurance insolvency in June. This is on top of the 1.3% assessment OIR approved that runs from July 1, 2022 to June 30, 2023 to help FIGA pay claims on the other four Florida companies that have gone insolvent this year.

Florida Insurance Commissioner David Altmaier

Litigation Update: Florida Insurance Commissioner David Altmaier told the Governor and Cabinet at its August 23 meeting that insurance reforms passed by the Florida Legislature over the past three years are working. “We’ve already seen a 30% year over year decrease in litigation,” he said, noting that “between HB 7065, SB 76, and now SB 2D I think we have already taken a number of positive steps in addressing this crisis. As we have said numerous times before, there is no overnight fix to this insurance crisis. It’s been years in the making, unfortunately,” Altmaier said. SB 76, passed in 2021, requires that insurance companies receive Notices of Intent to Litigate (NOITL) and a pre-suit settlement demand 10 days before a lawsuit can be filed. The purpose is to allow companies to resolve conflicts before they turn into lawsuits.

What Commissioner Altmaier didn’t mention is there’s been an increase in NOITLs, as we would expect. Data shows that in the first four months of 2022 alone, about 14,300 were filed. If just 70% turn into lawsuits, that’s another 10,000 lawsuits.

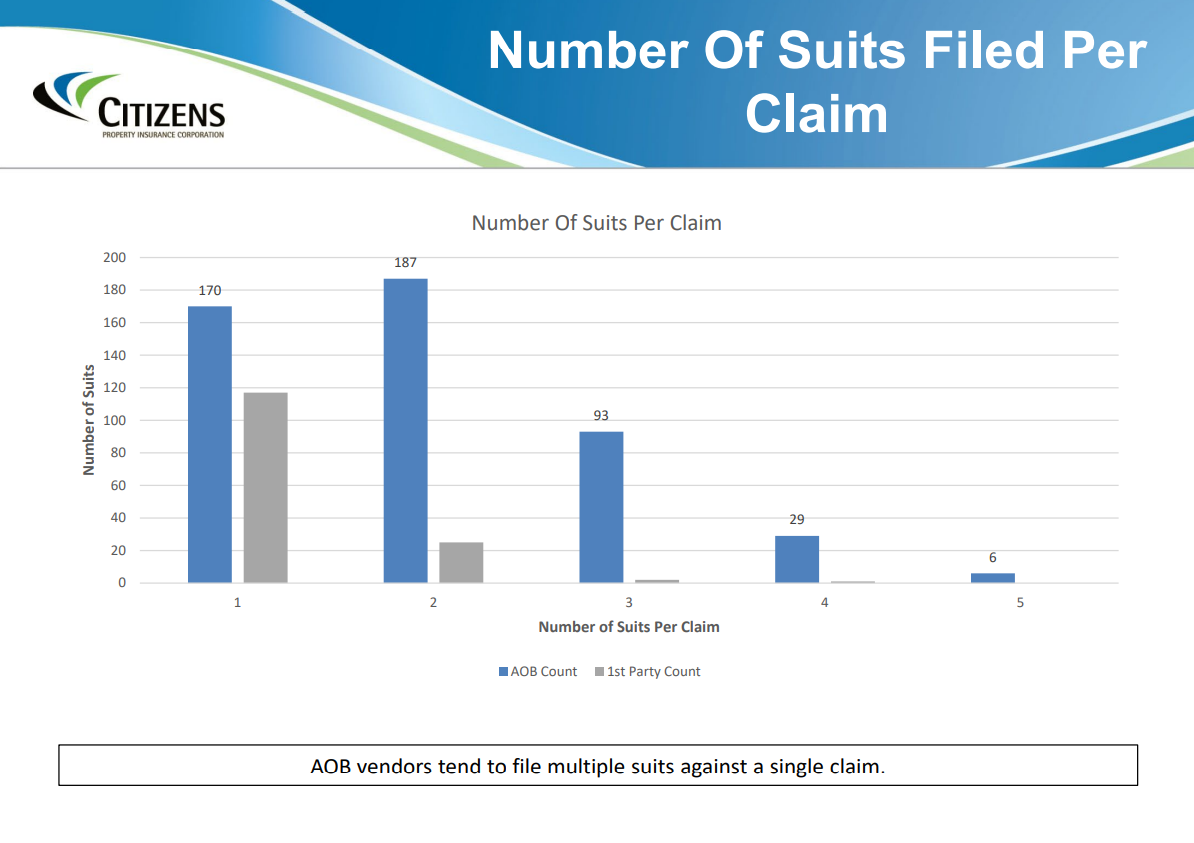

AOB Lawsuits on the Rise: State-backed Citizens Property Insurance reports that it’s averaging 1,200 new lawsuits with 550 NOITLs per month. The balance are late reported, old damage claims not eligible under SB 76 or 2019’s HB 7065 reforms. Older claims are being mined for current lawsuit submissions and many are wind related from older tropical activity. Of particular interest: Lawsuits arising from Assignment of Benefits (AOB) contracts between vendors and homeowners represent more than 50% of Citizens new lawsuits for each of the past eight months, despite the reforms. AOB Vendors are filing multiple lawsuits on a single claim, per the June 2022 chart below.

AOB Lawsuits on the Rise: State-backed Citizens Property Insurance reports that it’s averaging 1,200 new lawsuits with 550 NOITLs per month. The balance are late reported, old damage claims not eligible under SB 76 or 2019’s HB 7065 reforms. Older claims are being mined for current lawsuit submissions and many are wind related from older tropical activity. Of particular interest: Lawsuits arising from Assignment of Benefits (AOB) contracts between vendors and homeowners represent more than 50% of Citizens new lawsuits for each of the past eight months, despite the reforms. AOB Vendors are filing multiple lawsuits on a single claim, per the June 2022 chart below.

Citizens Claims Litigation Vice President Elaina Paskalakis told its Claims Committee last week the increase in AOB’s is disappointing. “We saw the initial chilling effect from legislation, but quite honestly, as people understand the statute better, and then understand ways around it, or how to work within it and sustain a business model, I think that’s what we’re experiencing. There’s also been an increase in the multiple AOBs per claim. In the past, we’d see just the water mitigation. Now it’s water mitigation, then there’s mold testing, and then there’s mold remediation, all coming in as separate AOBs on one claim, and that certainly has been increasing over time,” she said. Paskalakis says Citizens has seen a 10% increase in litigation so far this year over last year, with pending volume now in excess of 19,000 lawsuits, a 25% increase from last year.

Citizens Cap: OIR is considering raising the current $700,000 replacement cost coverage cap in place for Citizens Property Insurance coverage in most of Florida. Deputy Insurance Commissioner Susanne Murphy said OIR is looking at data to determine whether there’s a “reasonable degree of competition” in the market to exceed the cap, like it did for Miami-Dade and Monroe counties, where the limit is $1 million. Our firm has done an informal survey and no one has reported they can’t place coverage for a home valued at more than $700,000. We encourage the insurance community to let us know if that is not the case.

Citizens Cap: OIR is considering raising the current $700,000 replacement cost coverage cap in place for Citizens Property Insurance coverage in most of Florida. Deputy Insurance Commissioner Susanne Murphy said OIR is looking at data to determine whether there’s a “reasonable degree of competition” in the market to exceed the cap, like it did for Miami-Dade and Monroe counties, where the limit is $1 million. Our firm has done an informal survey and no one has reported they can’t place coverage for a home valued at more than $700,000. We encourage the insurance community to let us know if that is not the case.

Reinsurance Challenges: I’d like to invite you to join us in Tallahassee on September 15 at 5pm for the FSU College of Business’ Brown & Brown Speaker Series at the Starry Conference Center (RBB 214). Yours truly, Steve Farmer of Brown & Brown, and Adam Schwebach of Gallagher Re will discuss “Reinsurance and the Current Challenges of the Florida Property Insurance Market”, moderated by Dr. Brad Karl, with a networking reception immediately following.

Reinsurance Challenges: I’d like to invite you to join us in Tallahassee on September 15 at 5pm for the FSU College of Business’ Brown & Brown Speaker Series at the Starry Conference Center (RBB 214). Yours truly, Steve Farmer of Brown & Brown, and Adam Schwebach of Gallagher Re will discuss “Reinsurance and the Current Challenges of the Florida Property Insurance Market”, moderated by Dr. Brad Karl, with a networking reception immediately following.

LMA Newsletter of 9-6-22