Latest OIR report encouraging

The Florida Office of Insurance Regulation (OIR) has released its latest twice-annual Property Insurance Stability Report and although the market is nowhere near being out of the woods yet, there are “emerging signals that the reforms signed into law are having a positive impact on Florida’s property insurance market,” according to the report. Yet high costs – including reinsurance – remain. Among the highlights:

The Florida Office of Insurance Regulation (OIR) has released its latest twice-annual Property Insurance Stability Report and although the market is nowhere near being out of the woods yet, there are “emerging signals that the reforms signed into law are having a positive impact on Florida’s property insurance market,” according to the report. Yet high costs – including reinsurance – remain. Among the highlights:

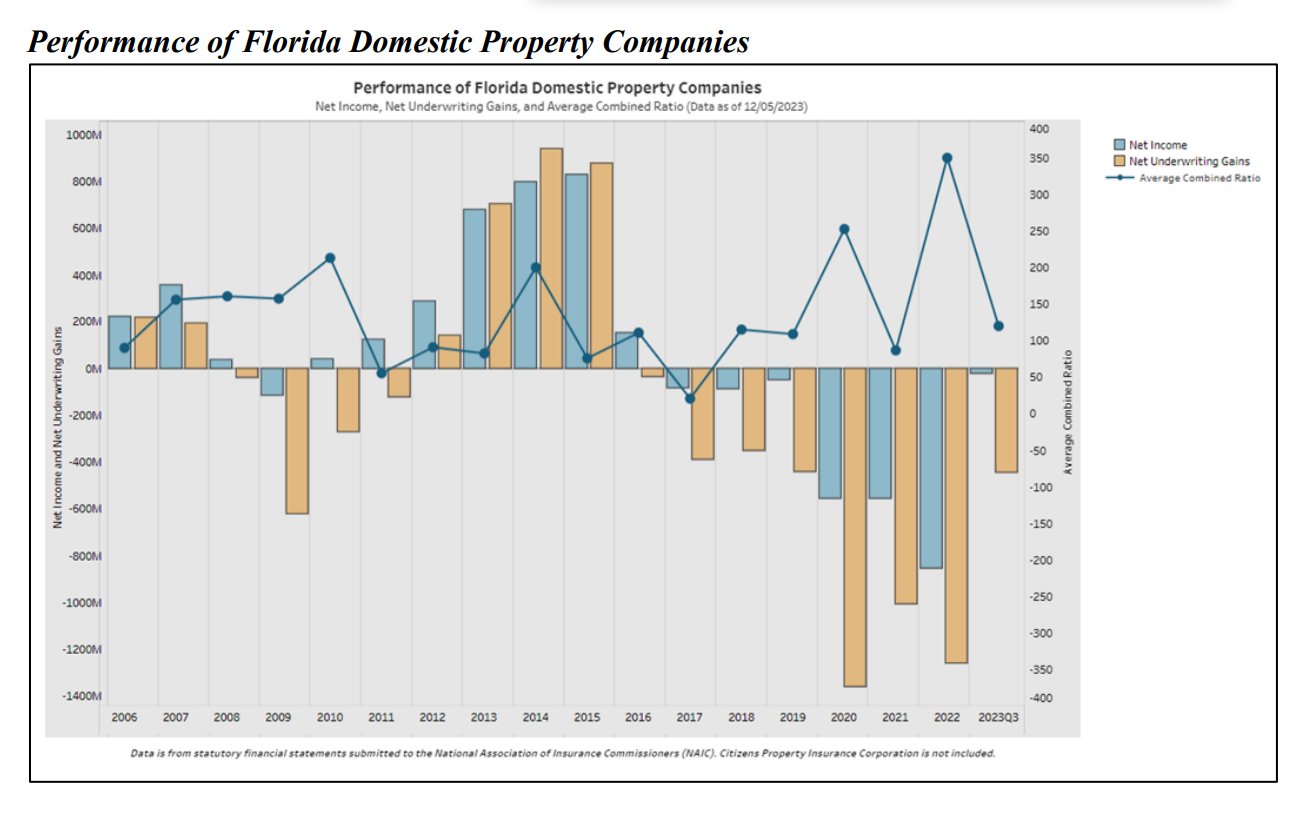

- After a promising 2023 Q1 start that showed positive Net Income for the first time in seven years, by Q3 of 2023 Net Income for the year was a negative $20 million (compared to the almost $900 million net income losses in 2022) and Net Underwriting Losses were about $75 million (compared to 2022’s $1.4 billion in losses). (See chart below)

- Adverse loss reserve development (cost of claims greater than reserves allotted) is growing worse. 2021 claims were $337 million more than originally estimated at the two-year look back. In 2022, claims were approximately $224M more than estimated after one year, and $772M at the two-year mark. “These numbers reflect the degree of uncertainty which exists in the property insurance market, which in turn impacts reinsurance capacity and reinsurance rates for insurers,” says the report.

- In 2022, Florida had just under 15% of the homeowners insurance claims in the country yet nearly 71% of the homeowners insurance lawsuits filed. That is a slight improvement from 2021 figures which showed Florida with 7% of the claims and 76% of the lawsuits – no doubt influenced by claims from 2022’s Hurricanes Ian and Nicole.

- Domestic Homeowners Defense Cost & Containment Expenses, which include litigation, fell slightly from 2021 to 2022, for the first time in many years.

- The number of lawsuits, as represented by Legal Service of Process (LSOP) filings, continues to decline from its high point in June 2021, when SB 76 reforms were signed into law.

- Notices of Intent to Litigate, which insurance companies must receive along with a demand at least 10 days before a lawsuit can be filed, fell dramatically from a monthly high of 8,345 in March 2023 to 4,064 in December 2023. So too for Civil Remedy Notices, required to be filed with DFS 60 days prior to filing suit.

- The amount of 2023 reinsurance coverage purchased by insurance companies has increased an average of 11% from 2022. However, the risk adjusted cost of that reinsurance has increased by 27% from 2022 figures.

- There were 32 insurance companies referred to OIR’s stability unit for enhanced monitoring from July 1, 2023, through December 15, 2023.

From Florida Office of Insurance Regulation, January 1, 2024. Click here to enlarge image

The report’s “Property Claims and Litigation Data Call” section (starting on page 10) reflects new annual data calls that began January 1, 2023. Mandated by the legislature, its purpose is to identify and understand the life cycle of a claim and claims trends to help detect and resolve emerging issues. Of the 180 companies submitting data filings:

- Total number of reported claims closed in 2022: 732,390

- Total number of litigated claims: 58,395

- Total number of non-litigated claims: 534,738

- Total cost of indemnity paid for claims closed in 2022: $11.2 billion

- Total loss adjustment expenses (LAE) paid for claims closed in 2022: $1.5 billion

- Average LAE paid across all perils for litigated claims: $9,934

- Average LAE paid across all perils for non-litigated claims: $1,576

The Tri-County area (Palm Beach, Broward, and Miami-Dade counties) had the highest percentage (27.5%) of litigated claims in the state.

Of the total 732,390 claims, the largest number (291,155) were from hurricane damage. The average hurricane indemnity for a claim closed within 61 days was $65,631 (litigated) vs. $11,854 (non-litigated). The average LAE was $11,621 (litigated) and $1,519 (non-litigated). The report includes figures on specific perils, claim-closing time periods, and average premiums charged by county. It notes that many Hurricane Ian claims will be reported in the 2023 closed claims report beginning this July.

The one unknown is the cost of reinsurance for 2024 June renewals. January reinsurance renewals reported a 3% increase. Fingers crossed for those that renew on June 1.

LMA Newsletter of 1-8-24